The BTC-stock correlation at its peak – When will It end? The four top gainers in DeFi

The most important developments in the crypto world in 2021 were the entry of institutional investors like Tesla, Wall Street banks, and hedge funds into the space.

Institutional investors were not only a sign of mainstream acceptance, but also seemed to drive up prices. Cryptocurrency's market capitalization grew 185% in 2021, a boom year for the industry.

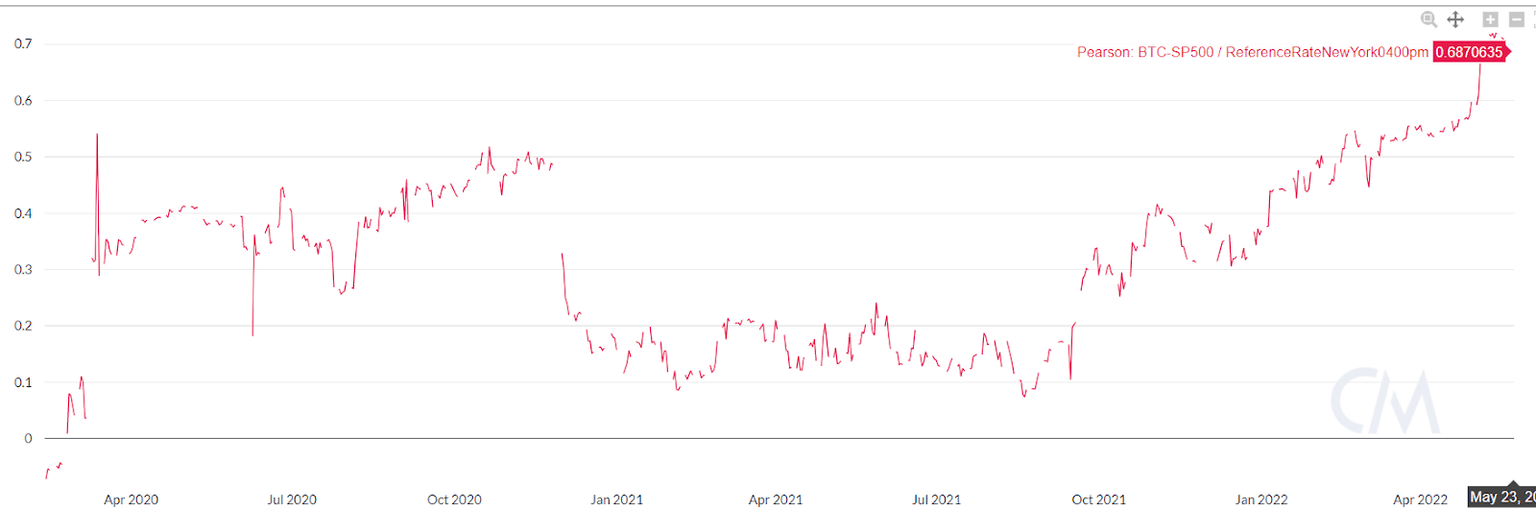

The latest crypto market crash has erased $1.25 trillion from the industry's all-time high market cap, raising the question: are institutional investors worsening the situation? Crypto markets have become increasingly correlated with the stock market, and institutional investors' presence has exacerbated that correlation. Crypto prices drop when stocks fail, which are in turn heavily affected by macroeconomic factors.

As a result, US inflation is at its highest level in decades, and prices are likely to stay high for quite some time.

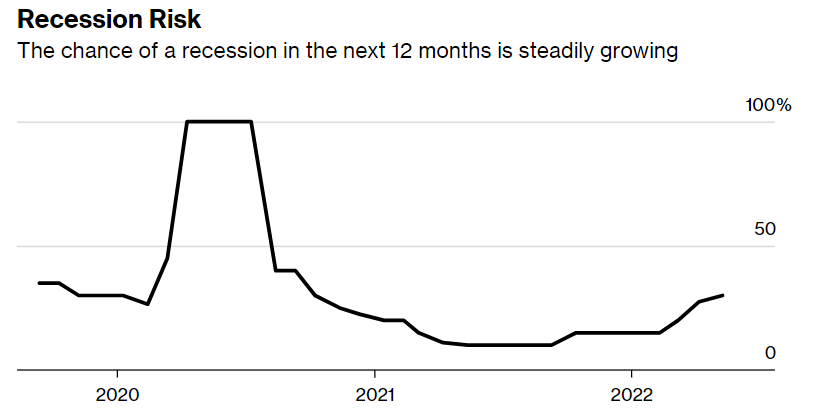

It appears that the Federal Reserve intends to cool inflation quickly with aggressive interest rate increases. The challenge is to cool the economy enough to temper price gains without tipping it into recession – no one really knows if this is possible.

Bloomberg estimates that US recession odds have risen to 30% in the next year, whereas Goldman Sachs predicts a 35% chance of one within the next two years, while Deutsche Bank is even more pessimistic.

Source: Bloomberg

Even the most pessimistic of observers were surprised at the US Q1 GDP figures released at the end of April, which not only showed the impact of inflation and currency fluctuations, but also underscored the Federal Reserve's challenging position.

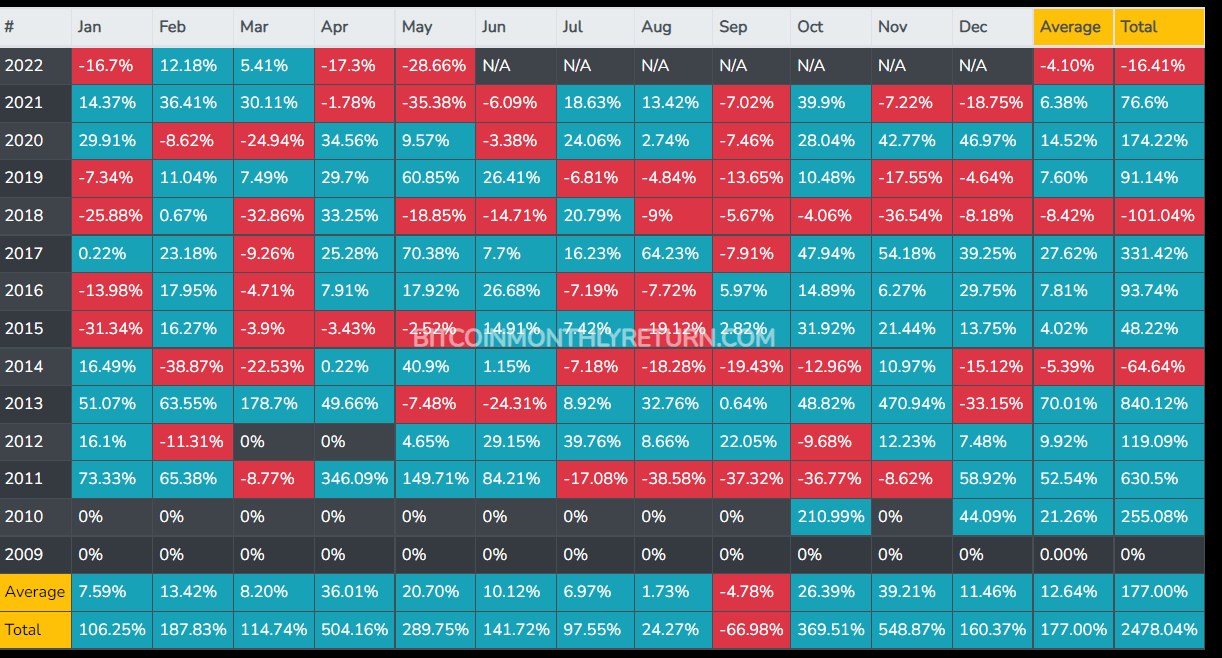

With sentiment and stocks declining, Bitcoin saw its worst April in history, dropping nearly 18%. So far in May, the flagship crypto has lost almost 29%. Several factors contributed to the negative performance, including growing uncertainty about the global economy, earnings disappointments, poor economic performance data, and concerns about the potential effects of aggressive rate hikes. A panic sell-off in the crypto market due to the Terra crash resulted in May's weakness as well.

Source: Bitcoinmonthlyreturn.com

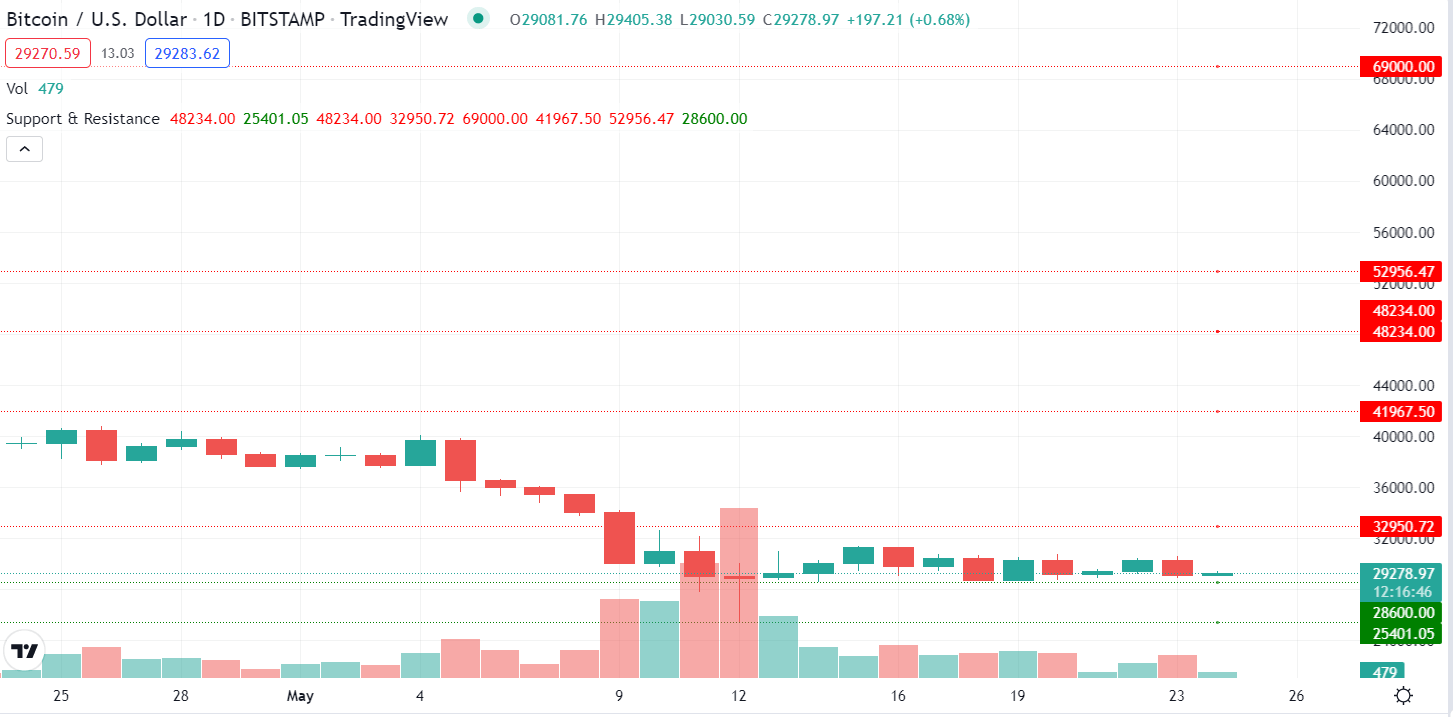

BTC is currently struggling to firmly hold its price above $30K, hovering around this level. The next resistance to the upside would come around $32,950.

Source: TradingView

Nevertheless, Bitcoin is an asset that should be immune from economic and monetary policy concerns. Why would it even be affected?

This is the result of institutional interest in BTC, which coincides clearly with the jump in correlation between BTC and the S&P 500. They view Bitcoin as a diversification asset rather than as a long-term investment vehicle, which explains why institutional flows into and out of the market have more of an impact on Bitcoin’s price than accumulation of long-term investors, making BTC's performance more reflective of the overall market.

Source: CoinMetrics

Is this going to last forever?

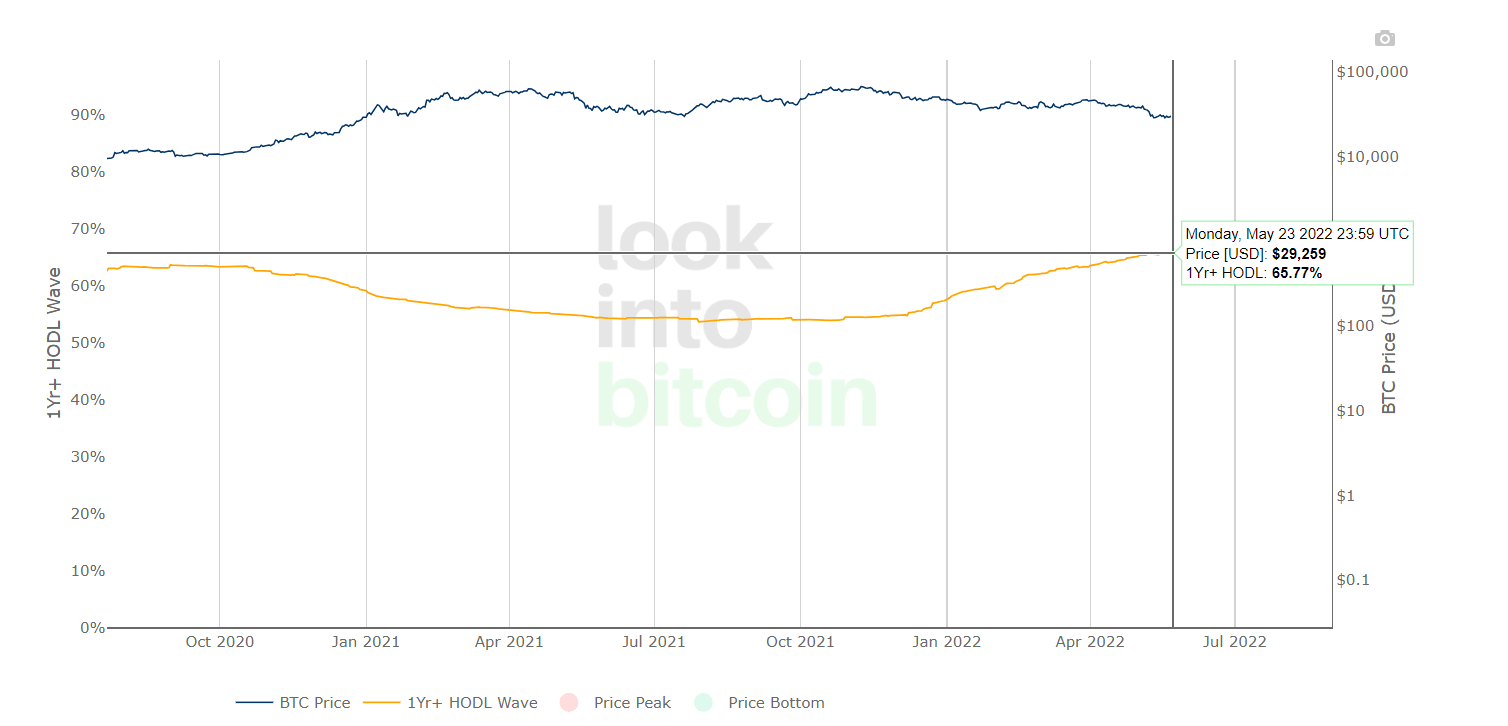

The increasing correlation with the S&P 500 indicates that Bitcoin's price is acting as a risk asset; however, its long-term accumulation is not only continuing, but also accelerating.

Source: Lookintobitcoin.com

In other words, investors are increasingly viewing Bitcoin as a reliable means to store value. It is expected that this growing group of participants will have a greater influence on BTC prices than institutional investors who continually move their funds in and out of the market. Eventually, we might see the correlation between BTC and stocks drop and Bitcoin finally regains its full power.

Top-performing Defi tokens

Although decentralized exchanges have been around for years now, their lack of liquidity made them unable to satisfy the needs of users. With the invention of the automated market maker (AMM) model in 2020, everything changed for DEXes throughout the crypto industry. The DeFi sector, which is currently valued at $18.84 billion, is expected to continue growing.

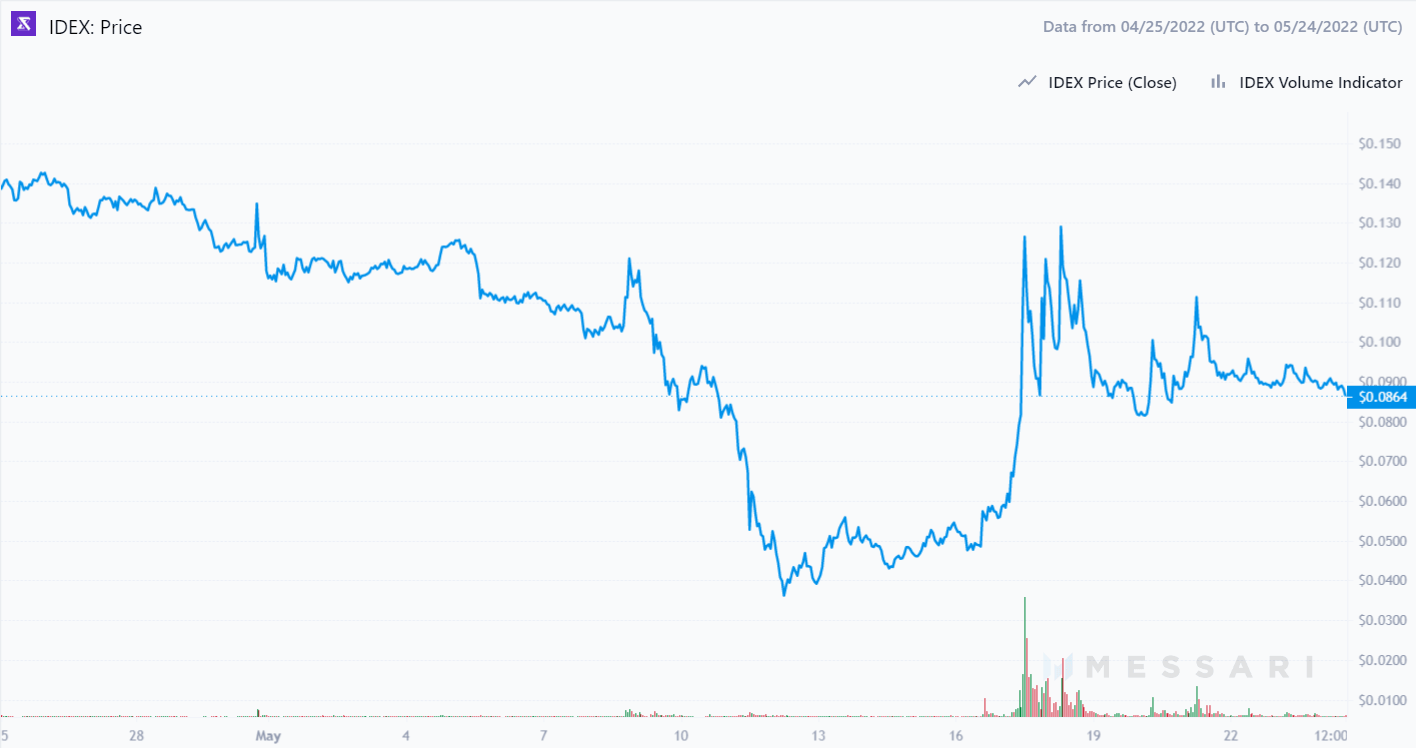

IDEX

The IDEX project is unique in that it functions as both an order book and an automated market maker (AMM). This platform claims to be the first to combine the features of a traditional order book with those of an automated market maker.

Source: Messari.io

IDEX token has been the best performing DeFi token gaining 54.3% against the greenback over the past seven days. Yet, it is still around 90% away from its all-time high hit in Sep, 2021, so we'll see if it can recover that far. As of writing, IDEX was trading at $0.0869 with a market cap of $56.40 million.

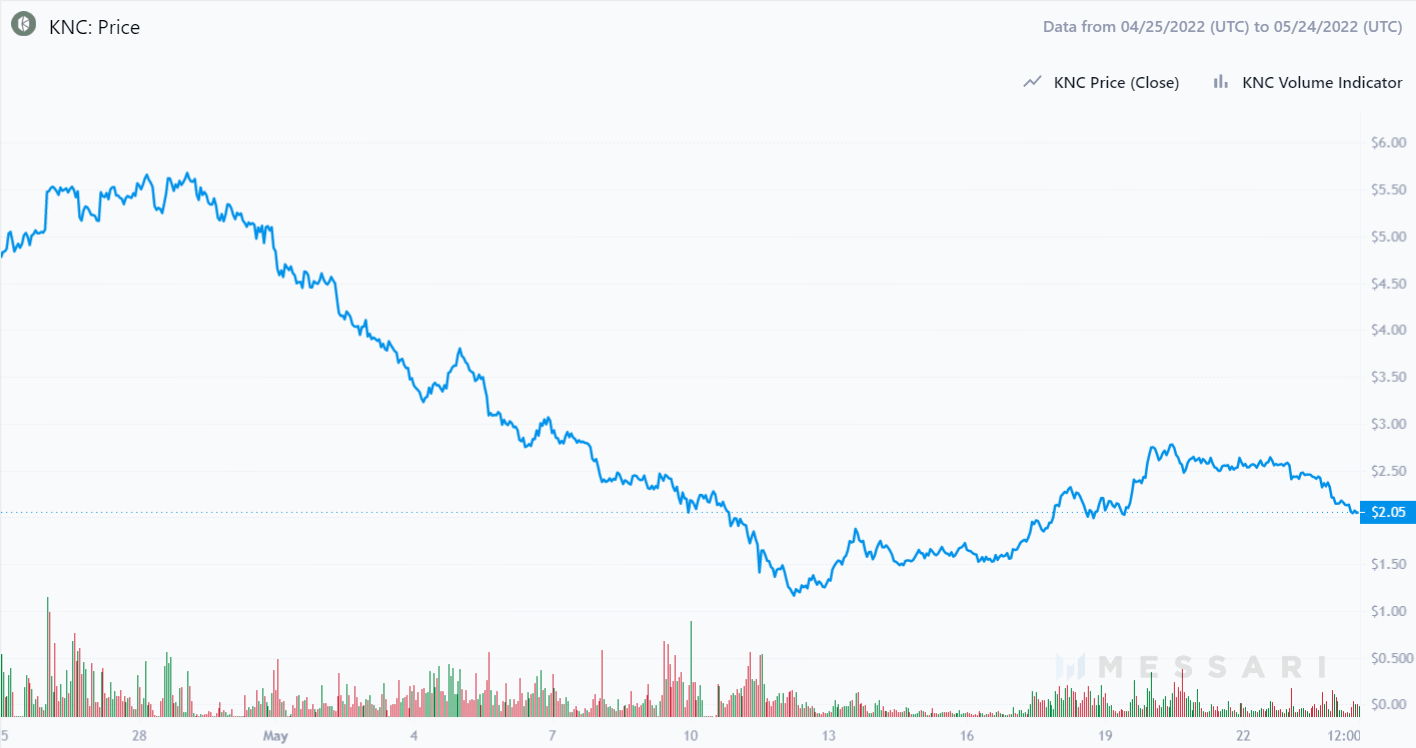

Kyber Network Crystal (KNC)

Kyber Network is a hub to aggregate liquidity from various sources in order to provide secure and instant transactions for any decentralized application (DApp). Kyber Network's primary goal is to provide easy access to liquidity pools with the best rates for DeFi DApps, decentralized exchanges (DEXs), and other users. All Kyber's transactions are on-chain, meaning any Ethereum block explorer can verify them.

Source: Messari.io

KNC, currently trading at $2.06, has gained 34.3% over the past seven days, making it DeFi's second biggest gainer. On Apr 29, 2022, the price reached its new all-time high of $5.70, but subsequently retreated 64.1% to current levels. As compared to last year, KNC has increased 42.1%.

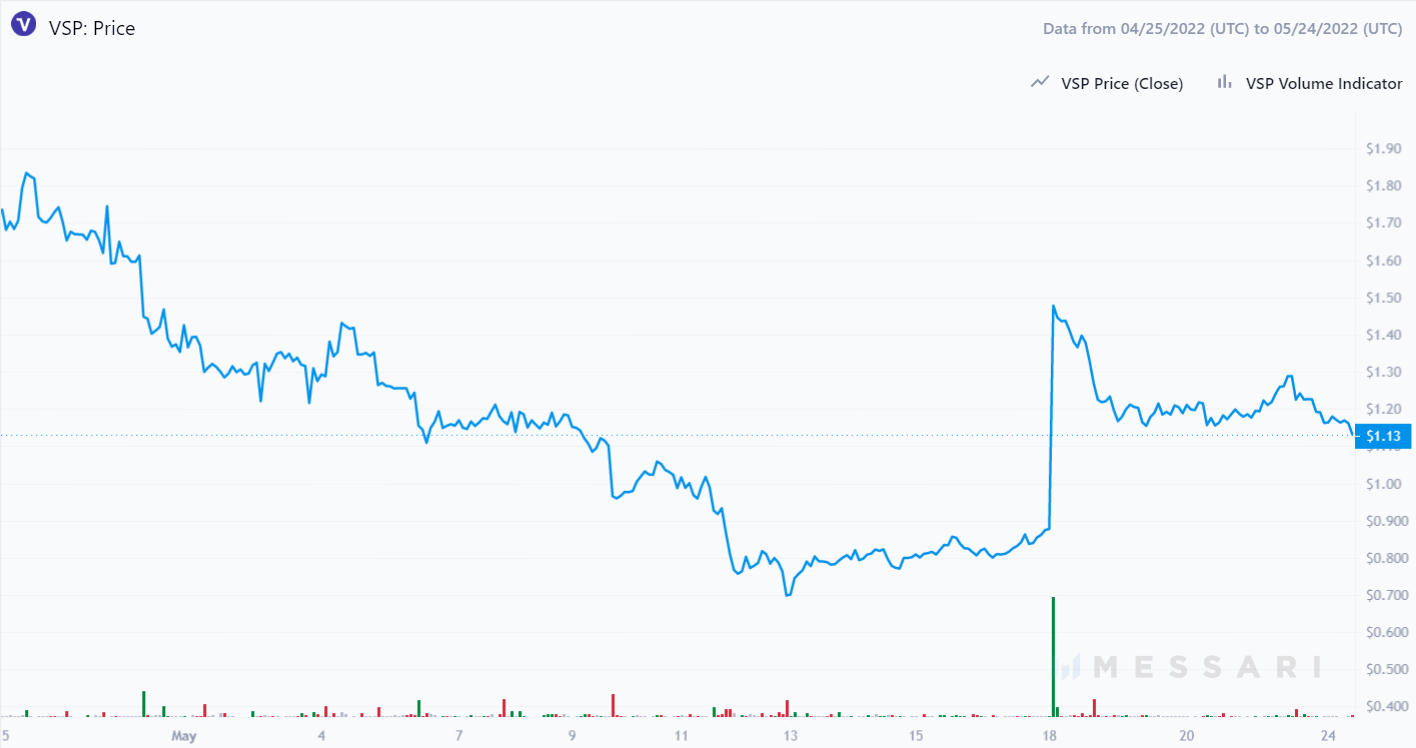

Vesper (VSP)

The Vesper platform works as a "metalayer" for DeFi, routing deposits to the highest yielding opportunities within the pool's risk tolerance. It is non-custodial, and products are automatically compounded.

VSP has been the third biggest DeFi gainer over the past week, posting a 42.4% gain.

Source: Messari.io

It has, however, fallen from its ATH of $79.51 on March 26, 2021 to an all-time low of $0.703362 not so long ago – on May 12, 2022. The coin has recovered 65.7% since its record low, but be aware of its extreme volatility. VSP had a market capitalization of $9.99 million at the time of writing and was trading at $1.13.

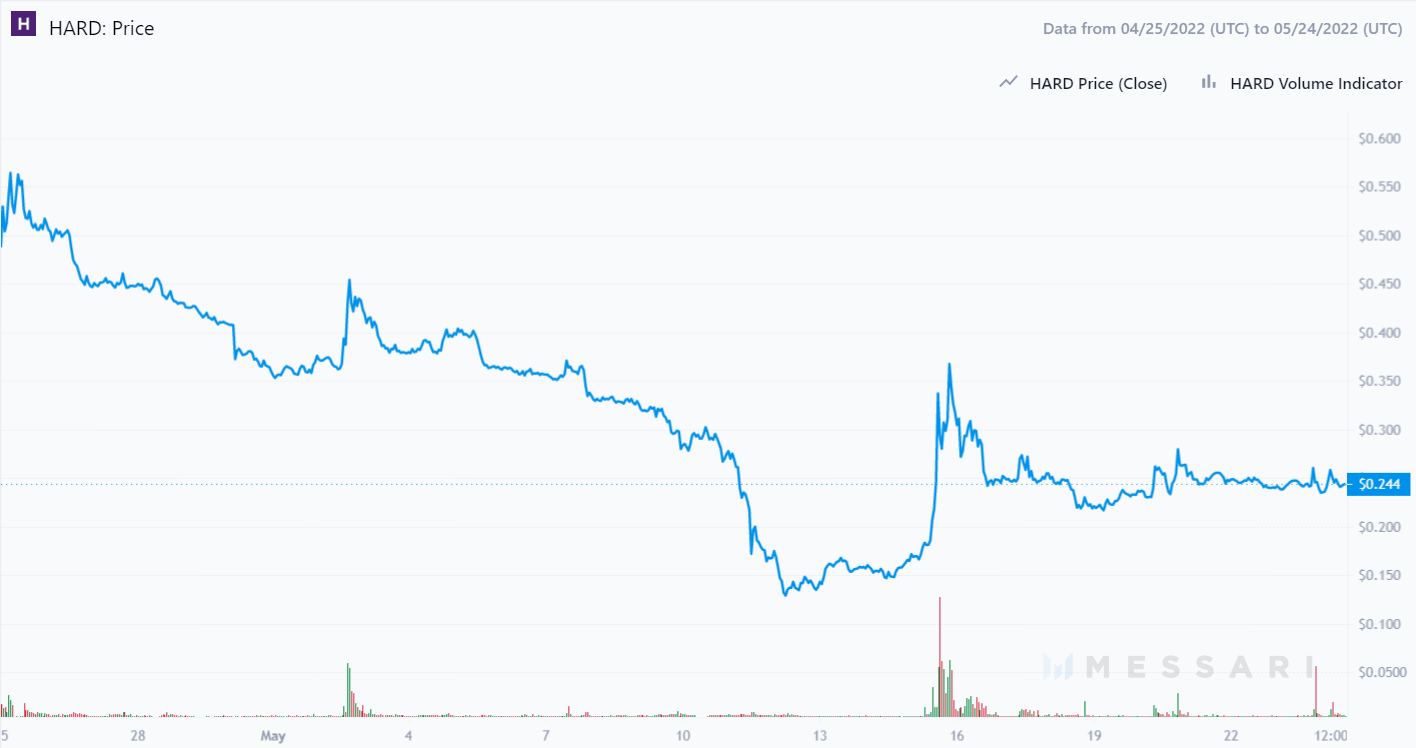

Kava Lend (HARD)

Kava Lend is a cross-chain money market that facilitates borrowing and lending across blockchain networks. By placing their funds on the Kava Lend Protocol, lenders can earn a yield, while borrowers can use collateral to receive funds.

At the time of writing, HARD, the native token of Kava Lend, was trading at $0.244292, with a market cap of $29,626,795.

Source: Messari.io

Final thoughts

The crypto world is one brimming with possibilities, and it is unlikely to stagnate, however only the strongest projects will survive. The most unpleasant part of this are the high-profile scam projects that may seem most trustworthy. It is even more frustrating that no one can tell you for sure what project to trust. Don't take my or anyone else's word for it. Whenever I share my analysis, it is never with the purpose of giving investment advice. Don't put your life savings at risk. If you're still inclined to go for it after doing some due diligence, don't invest more than you can afford to lose. Things are extremely uncertain these days, so you can never be sure.

Author

Mike Ermolaev

Independent Analyst

Mike Ermolaev is the founder of Outset PR. The agency helps tech companies, especially blockchain and Web3 projects, get the desired recognition thanks to its wealth of media connections.