Tether Bitcoin stash crosses 100,000, stablecoin giant holds 7.7 tons of physical Gold

- Tether’s Q1 attestation report reveals the stablecoin giant has shored up over 7.7 tons of physical Gold to back its issuance of XAU₮.

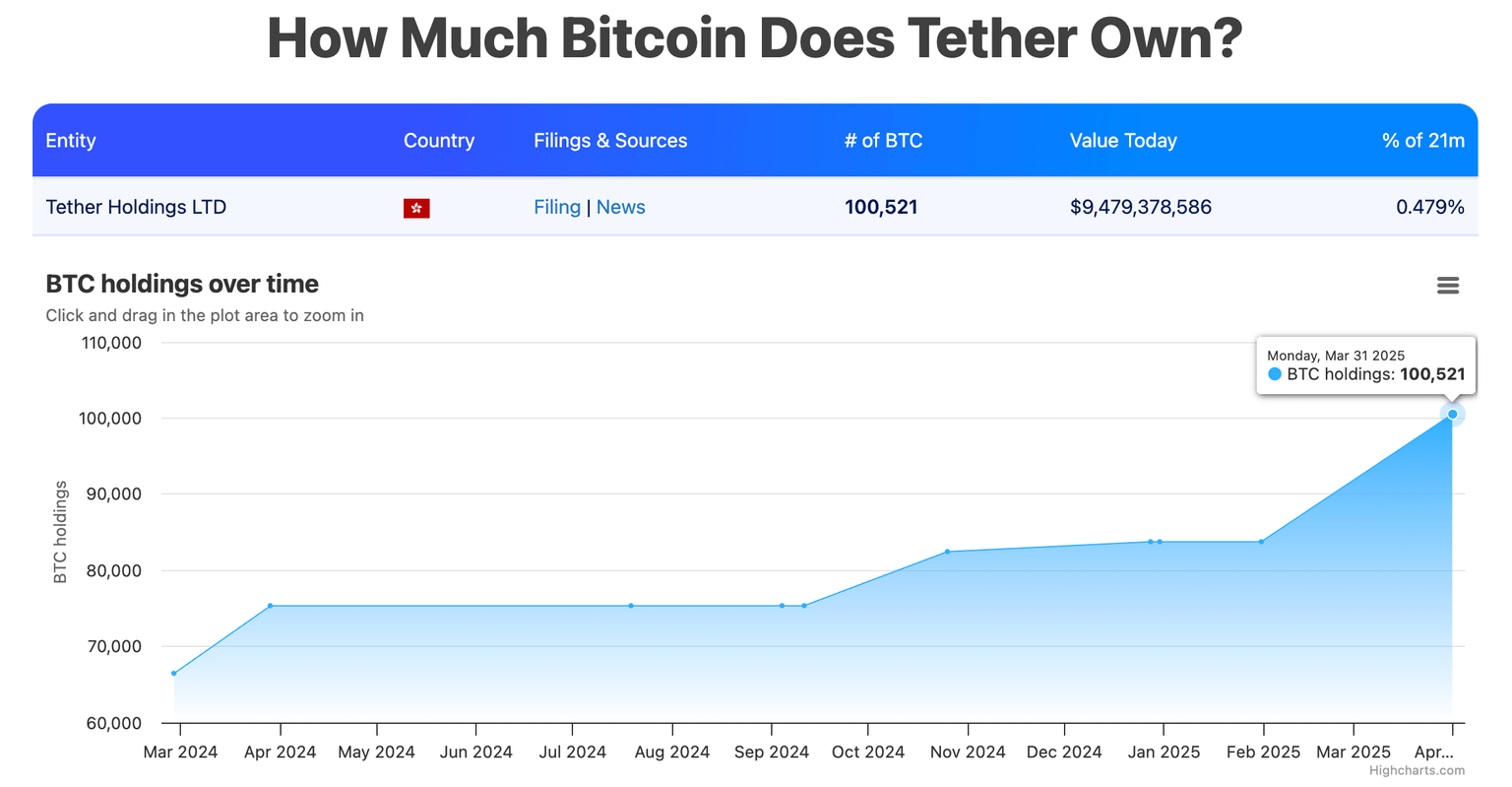

- Treasuries’ info shows that at the end of Q1, Tether held 100,521 Bitcoin tokens.

- Tether co-founder notes that USD-backed stablecoins currently dominate, other currencies could soon compete in the sector.

Tether, a stablecoin giant and the seventh-largest holder of US Treasury bills, published its attestation report for the first quarter on Monday. The stablecoin firm noted the US Dollar’s (USD) dominance in the stablecoin sector and dropped the statistics on its physical Gold reserves.

Stablecoin circulation and market capitalization are considered representative of crypto user adoption as they function as a fiat on- and off-ramp for traders and new market participants across most countries where crypto is not recognized as “legal tender.”

Tether’s Bitcoin and physical Gold stash is growing

Stablecoin issuer Tether generated nearly $14 billion in profits in 2024. A report from Pirate Wires identifies Tether as the most highly profitable firm in the world, per employee, generating nearly $93 million in profit per employee in 2024.

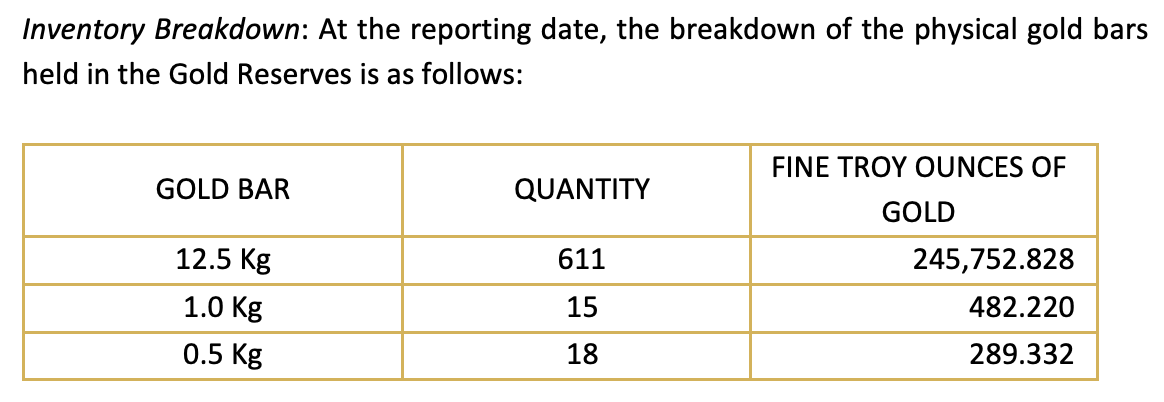

Tether is relevant for crypto traders for its stablecoin issuance, demand and physical reserves of the US Dollar and Gold. The Q1 attestation report shows that the giant holds over 7.7 tons of physical Gold.

Tether’s Gold Inventory | Source: Q1 attestation report

Data from Bitbo Treasuries reveals over 100,500 BTC holdings by Thether at the end of the first quarter.

Tether’s Bitcoin holdings | Source: Bitbo Treasuries

Rising profitability of Tether and larger volume of reserves could contribute to higher confidence from retail traders and institutional investors acquiring USDT. The firm recently unveiled plans to foray into Real World Asset tokenization (RWA) and stablecoins backed by other currencies (other than the USD) and physical assets like Gold.

Tether co-founder says stablecoins help preserve US Dollar dominance

The US Dollar is currently the dominant fiat currency backing stablecoins circulated by Tether.

Co-founder Reeve Collins told Cointelegraph,

“The stablecoin definitely helps preserve the Dollar dominance, especially in the crypto space. The Dollar is kind of the reserve currency of crypto. But now there are other currencies coming into play. But more importantly, it's not currencies. It's other types of backing.”

The stablecoin giant’s co-founder believes assets used to back stablecoins other than the USDT may soon catch up by offering a higher yield to users.

Collins shared her thoughts on funds backed by higher-yield generating assets (relative to US Treasury bills) like money market funds.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.