Terra's LUNA bound for profit-taking after hitting new all-time highs

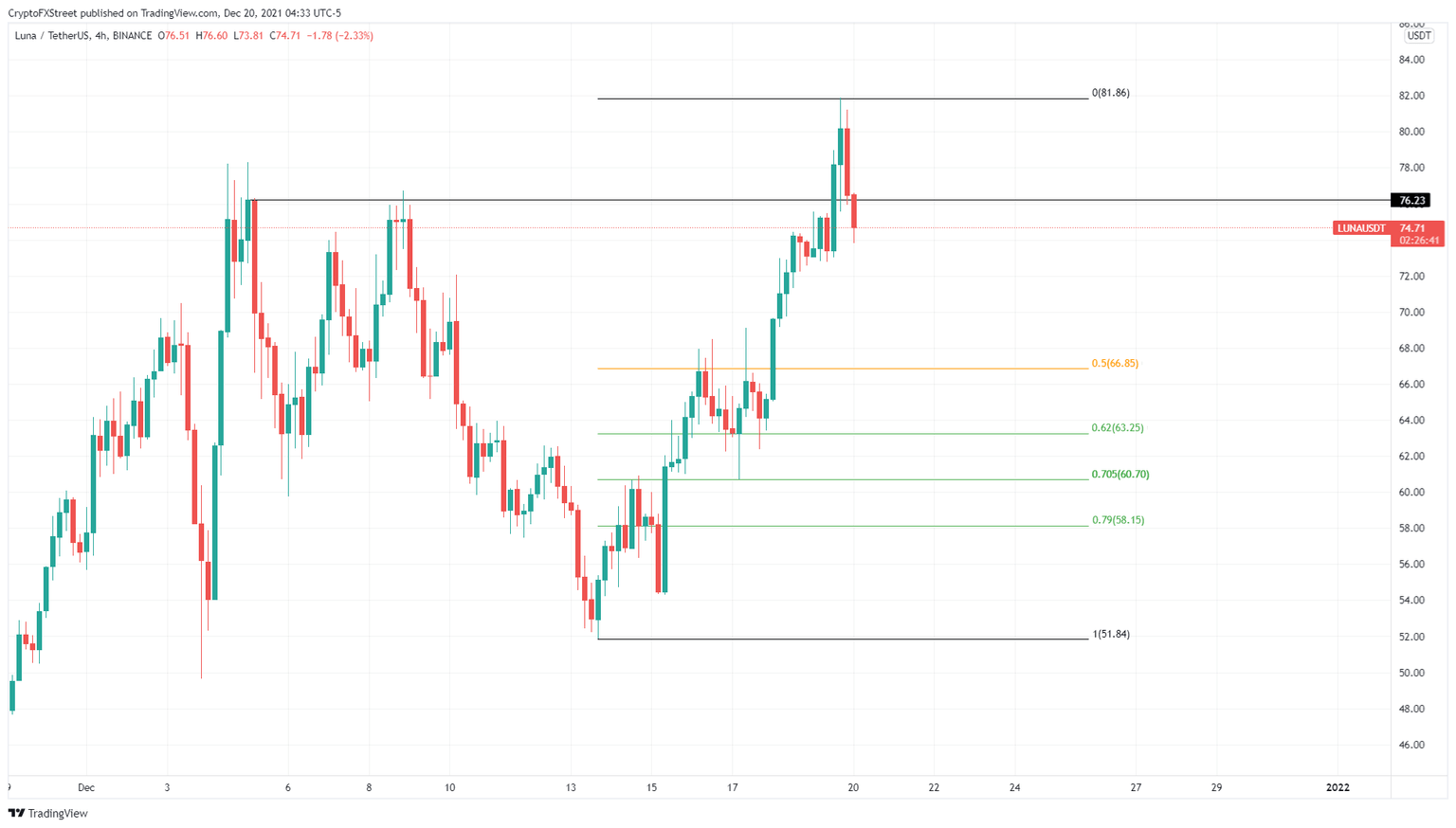

- Terra price is looking top-heavy and is likely to correct after it set a new high at $81.87.

- The retracement will result in LUNA shedding 15% of its market value.

- A swing high above $81.87 will invalidate the bearish thesis.

Terra price embarked on a massive uptrend on December 13 that pushed it to new highs. While this ascent was impressive, the uptrend will likely see a reversal as market participants book profits. This development will likely push LUNA lower to stable support levels.

Terra price in search of stable grounds

Terra price is experiencing a sell-off as investors rush to book profits after a new all-time high at $81.87. This record high resulted from a 57% advance that occurred over six days. As market participants offload their holdings, LUNA will continue its descent.

So far, Terra price has already pierced through the immediate support level at $76.23 and is hovering below it. A barrage of sell orders will likely drive LUNA to retest the 50% retracement level at $66.85, constituting a 10% retracement from the current position - $74.68.

While there is a chance for Terra price might form a base here, investors need to pay attention to the 62%, 70.5% and 79% retracement levels at $63.25, $60.70 and $58.15, respectively, to serve as a foothold, cushioning the incoming selling pressure.

LUNA/USDT 4-hour chart

While things look top-heavy for Terra price, a surge in buying pressure from sidelined investors could change the narrative. If LUNA bulls produce a swing high above the current all-time high at $81.87, it will set a new high and invalidate the bearish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.