Terra Price Prediction: LUNA sees new all-time highs ahead of Anchor Protocol release

- Terra Price has formed a new all-time high at $19.34 in the past 24 hours.

- The digital asset continues rising ahead of the release of Anchor's savings platform.

- LUNA faces short-term selling pressure after a massive upswing.

LUNA has done it once again, outperforming practically everyone in the cryptocurrency space with another 20% upswing to new all-time highs. It seems that investors are hyped for the upcoming release of Anchor Protocol, a savings platform offering low-volatile yields on top of Terra.

Terra price could see a healthy pullback before resuming uptrend

The Anchor savings protocol offers a high-yield on stablecoins and intends to become the reference interest rate in the cryptocurrency market. Some Anchor tokens will be airdropped to LUNA stakers, which is driving its price up.

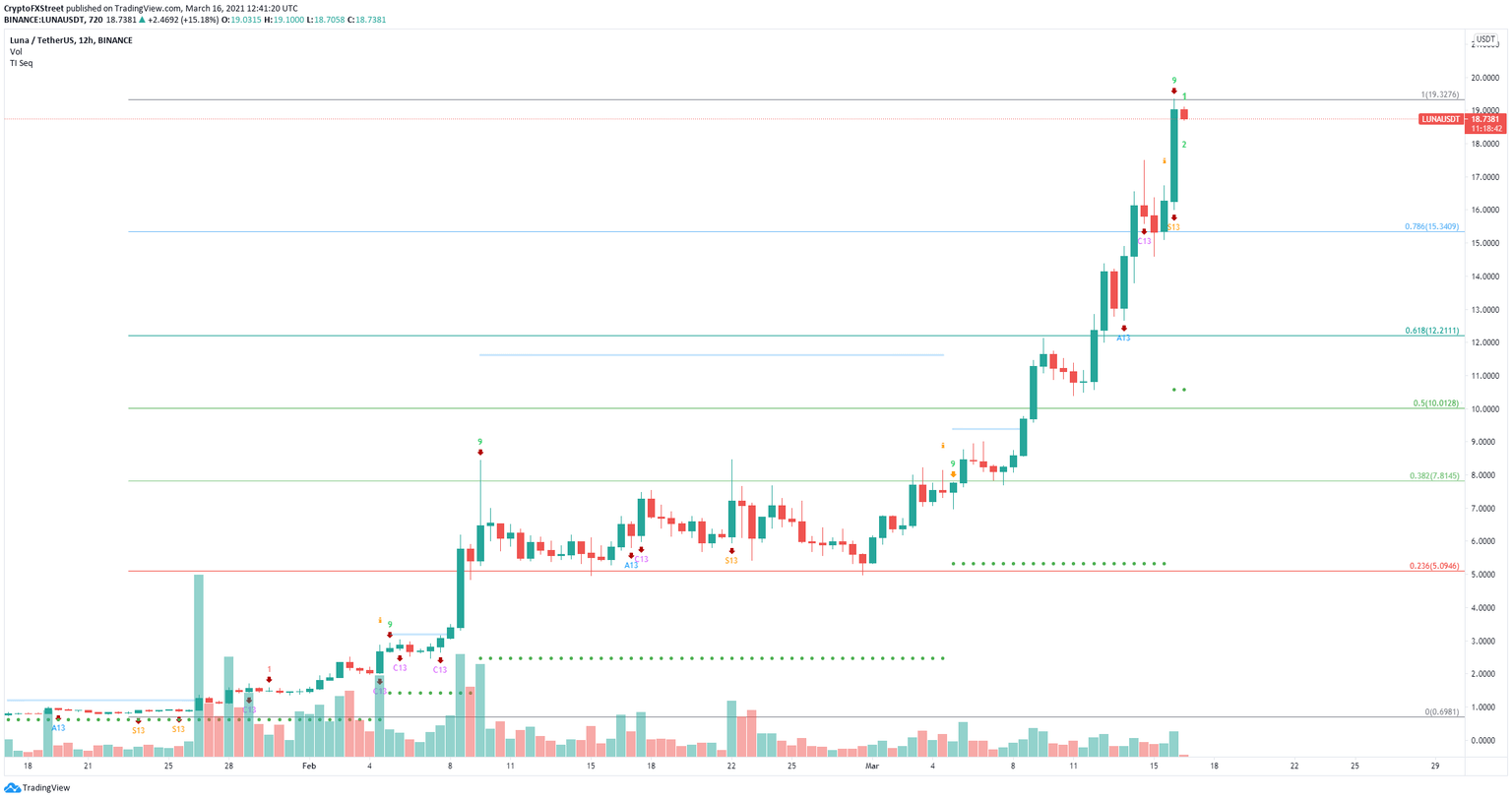

LUNA/USD 12-hour chart

On the 12-hour chart, the TD Sequential indicator has just presented a sell signal. The next potential price target for the bears will be $15.34 at the 78.6% Fibonacci retracement level if the signal is validated.

LUNA Social Volume

Furthermore, LUNA has experienced two significant spikes in social volume, which is also usually indicative of a potential upcoming correction like it happened on March 10 or February 9.

On the other hand, bulls can invalidate the sell signal by pushing LUNA above $19.34. The next psychological level is located at $20, but Terra price could extend as high as $24.39 at the 127.2% Fibonacci level.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B13.42.29%2C%252016%2520Mar%2C%25202021%5D-637514956365813133.png&w=1536&q=95)