Terra Price Prediction: LUNA aims for 25% upswing as signs of reversal pop up

- Terra price has witnessed a 30% correction since hitting its all-time high at $22.35.

- A bounce from the 61.8% Fibonacci retracement level at $15.68 could propel LUNA higher.

- A bearish scenario could come into play if the demand barrier at $15.68 breaks down.

Terra price seems poised for a quick upswing as it bounces off a crucial support barrier.

Terra price eyes a retest of all-time high

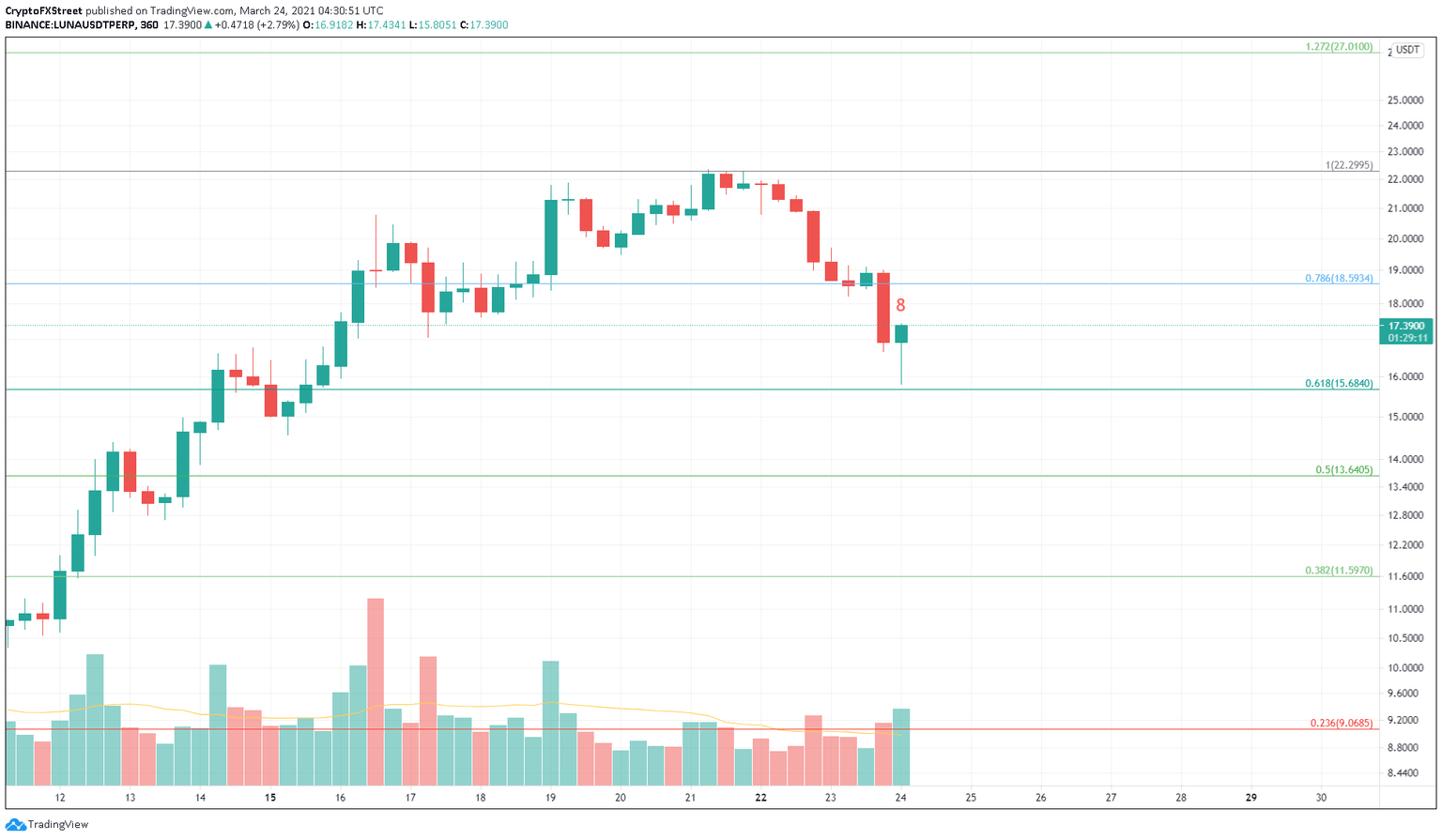

Terra price has been in a corrective phase that has resulted in a 30% drop toward the 61.8% Fibonacci retracement level. At the time of writing, LUNA was trading just above this point at $17.38, suggesting that a bounce is underway.

Adding credence to this bullish outlook is the Tom DeMark (TD) Sequential indicator, which indicates a potential end to this downtrend due to the formation of a red eight candlestick on the 6-hour chart.

If the current candlestick closes below $19.25, the indicator will generate a red nine candlestick, a buy signal for Terra price. In such a case, the setup forecasts a one-to-four candlestick upswing.

If this scenario were to play out, Terra price could first surge past the 78.6% Fibonacci retracement level at $8.59, which would serve as a secondary confirmation of the upswing.

Here, a persistence of bullish momentum could catapult the altcoin 20% to retest its all-time high at 22.35.

LUNA/USDT 6-hour chart

Regardless of the bullish signals, investors need to understand that a close above $19.25 would disrupt the TD Sequential indicator’s count, and thus a buy signal may never erupt.

If the bears manage to invoke a 6-hour candlestick close below $15.68, it will invalidate the bullish outlook. In this case, Terra price could drop 12% to the immediate demand barrier at $13.6, coinciding with the 50% Fibonacci retracement level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.