Terra Price Forecast: LUNA smashes through new highs amid Anchor Protocol successful debut

- Terra price hit a new all-time high at $21.85 thanks to Anchor's launch.

- The Anchor Protocol reached a market capitalization of $400 million almost instantly.

- The protocol offers a 20.7% APY on the Terra USD stablecoin.

Luna continues outperforming the market thanks to a successful launch of its newest protocol built on it, Anchor. The savings platform offers the highest stablecoin APY at 20% on the UST stablecoin built on Terra.

Terra price boosted by the success of Anchor

The Anchor Protocol launch was a total success, and developers have already deployed the UST savings dashboard with a 20% APY. Additionally, users can also use LUNA tokens for collateral to take loans in UST stablecoins.

On top of that, LUNA stakers will also receive ANC tokens every week for 2 years, increasing LUNA tokens' use case.

LUNA seems to have even more upside potential

Despite Terra price hitting new all-time highs, LUNA's social volume has decreased significantly since March 17, which means that a lot of the hype has worn out, but the price continues rising. It is often the case that significant spikes in the social volume are followed by corrections in the price, while low social volume indicates a good buying opportunity.

LUNA Social Volume

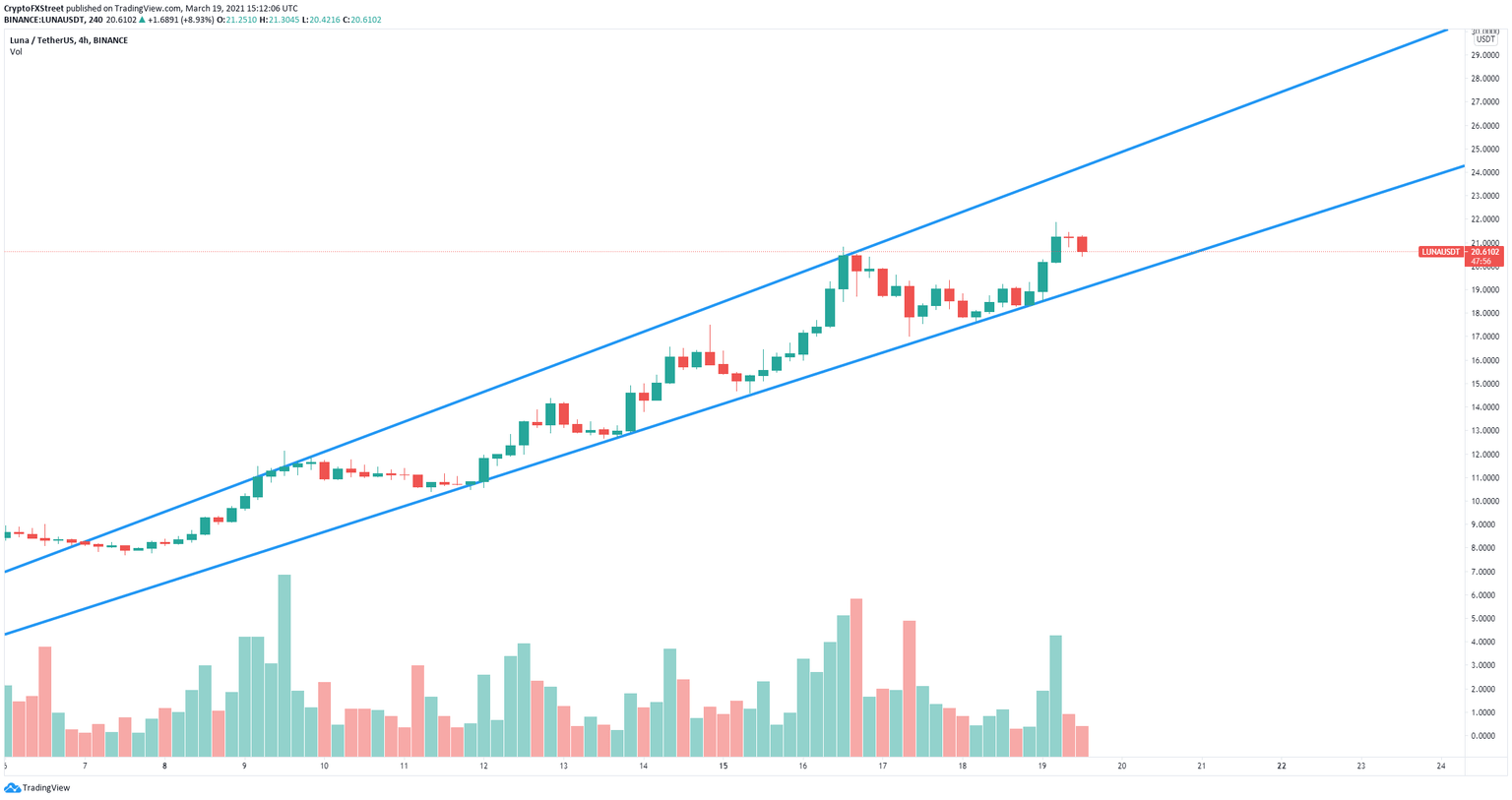

On the 4-hour chart, Terra formed an ascending broadening wedge pattern, and bulls held the lower trendline in the past 24 hours. A rebound from this point should drive Terra price towards a high of $24.6 at the upper boundary.

LUNA/USD 4-hour chart

However, a breakdown of the pattern can drive LUNA towards a low of $15. The key resistance support trendline is currently located at $19.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B16.07.32%2C%252019%2520Mar%2C%25202021%5D-637517635903510192.png&w=1536&q=95)