Terra-based DeFi protocol anchor proposes cutting UST yield rates to 4%

The contributors of Terra-based decentralised finance (DeFi) protocol Anchor have proposed cutting terraUSD (UST) rates to an average of 4% from the current 19.5% as the broader Terra ecosystem seeks measures to protect UST’s peg with US dollars.

Also read: Is MicroStrategy facing possible bankruptcy on Bitcoin collapse?

“Decrease minimum interest rates to 3.5%, and maximum deposit rates to 5.5%, with a targeted interest rate of 4%,” the ongoing proposal describes.

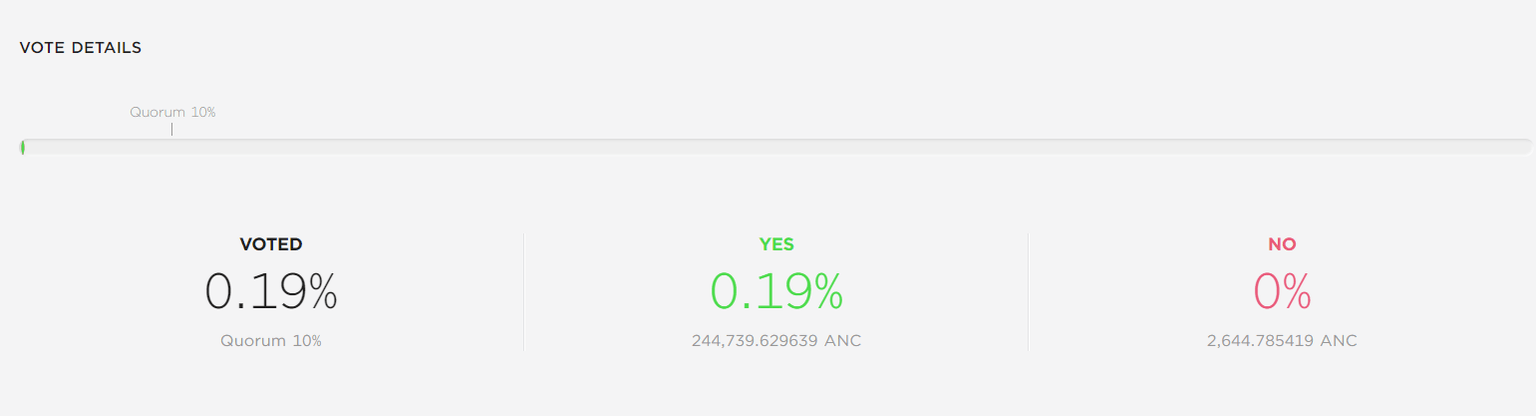

Some 244,000 anchor (ANC) tokens have been used to place votes on “yes” at writing time. ANC is Anchor Protocol's governance token that users can deposit or stake to create new governance polls, or vote on existing pools started by users that have staked ANC.

The ongoing Anchor proposal seeks to cut UST rates. (Anchor)

Anchor is a savings, lending and borrowing platform built on the Terra that serves that allows users to earn yields on UST deposits and take out loans against holdings. Critics have previously touted its “stable high interest rate” – as described on its website – as unsustainable due to the high amounts of money required to maintain those rates.

In the past few months, Anchor continued to operate as intended and became the biggest decentralized finance (DeFi) application on Terra. But UST’s recent depegging has made the protocol’s grandiose plans go awry.

UST fell to as low as 22 cents on Wednesday amid outflows from Anchor and LUNA’s rapid drop causing a downward spiral. The token has since recovered to 60 cents – still far off its $1 peg – but the long-term recovery remains unclear.

“A depegged UST cannot sustain 18% APY any longer,” wrote Anchor contributor Daniel Hong in a relevant forum post. “While some may argue higher interest rates help with less UST circulating supply, when the stablecoin have already lost trust from the public due to a 2-day depeg people would try to exit anyways.”

“One significant factor for today’s depeg was the release of Terra’s stability reserve into the Anchor reserve every time it was depleted, introducing newly minted UST that was not supposed to be there into circulation,” Hong wrote, explaining UST’s price plunge on Wednesday.

Hong, however, added the “fairly aggressive” change would be rolled back as and when deemed necessary, meaning the 4% interest rate may increase in the future should market conditions improve.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.