Swipe Price Analysis: SXP rally interrupted raising the probability of 20% decline

- Swipe price reveals bearish topping pattern on the intra-day chart.

- Intra-day Relative Strength Index (RSI) forecasts trouble.

- Swipe price history forces traders to be prepared for wide-ranging fluctuations.

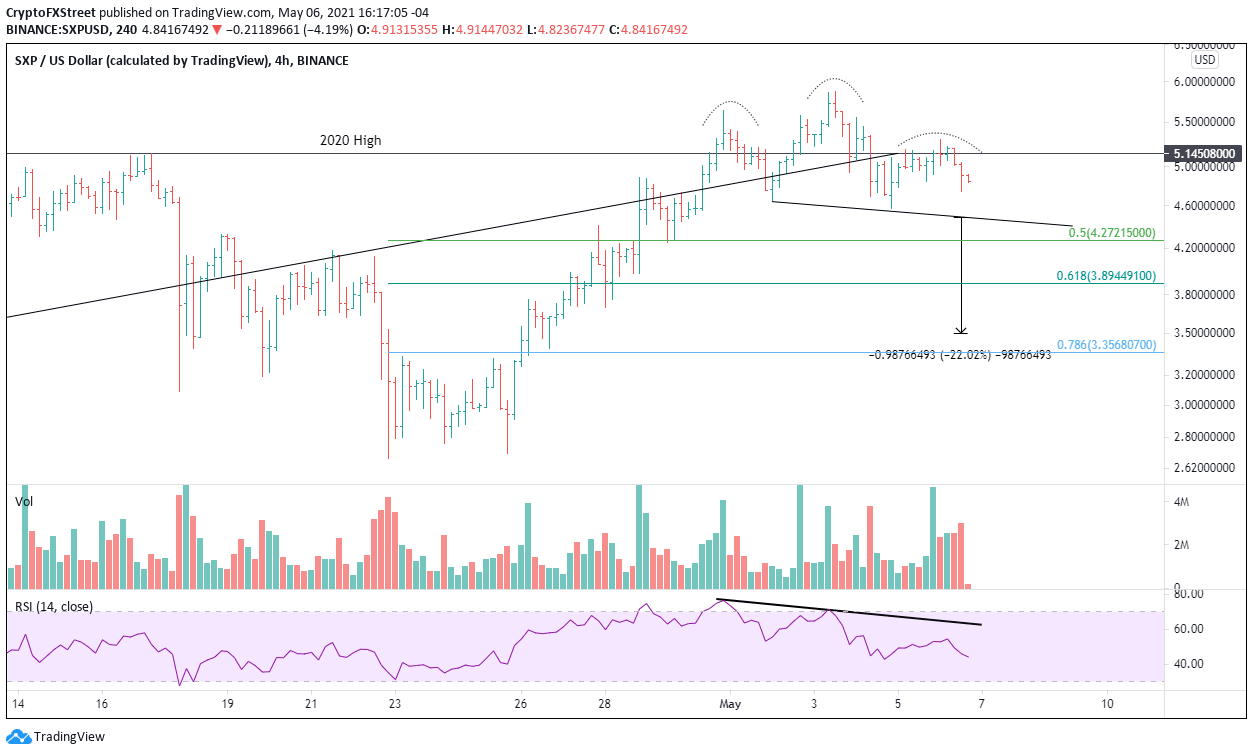

Swipe price action in May has been counter-productive for a bullish outlook, as three failed attempts above the August 2020 high have forged a head-and-shoulders top pattern that projects a noteworthy decline in the coming days.

Swipe price fails to secure trader commitment

A head-and-shoulders top pattern is one of the highest-ranked formations in performance and success rate, but it is more complex, combining trend lines, support or resistance lines and rounding.

The pattern has three well-defined peaks, either sharp or rounded, with the second peak always higher than the other two, commonly referred to as the head. The first peak is the left shoulder, and the third peak is the right shoulder. Both the left and right shoulders are lower than the head, but they do not need to be the same height. In fact, a higher peak for the left shoulder has been found to add to the post-breakout performance for the topping pattern.

During May, Swipe price has formed a bearish head-and-shoulders top pattern with the shoulders being roughly equidistant from each other and symmetrical. The measured move target of the pattern is $3.50, or a decline of 22% from the current position of the neckline and a drop of 28% from the price at the time of writing.

In between the neckline and the target is the 50% retracement level of the rally since April 22 at $4.27 and then the 61.8% Fibonacci retracement at $3.89. Both should offer some support for Swipe price. A failure to hold the target at $3.50 increases the likelihood of at least a test of the 78.6% retracement at $3.35 and even the April 22 low at $2.67.

SXP/USD 4-hour chart

The higher probability outcome for Swipe price is a resolution of the pattern to the downside, but if SXP rallies above the right shoulder high at $5.30, the head-and-shoulders top pattern is voided, and speculators need to be ready for a test of the all-time high at $5.87.

An extended rebound will carry Swipe price to the 138.2% extension of the 2020 bear market at $6.89.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.