Sushiswap Price Prediction: Sushi aims for $15 as its network growth continues to expand

- Sushiswap price has just hit a new all-time high of $12.719 after a massive rally in 2021.

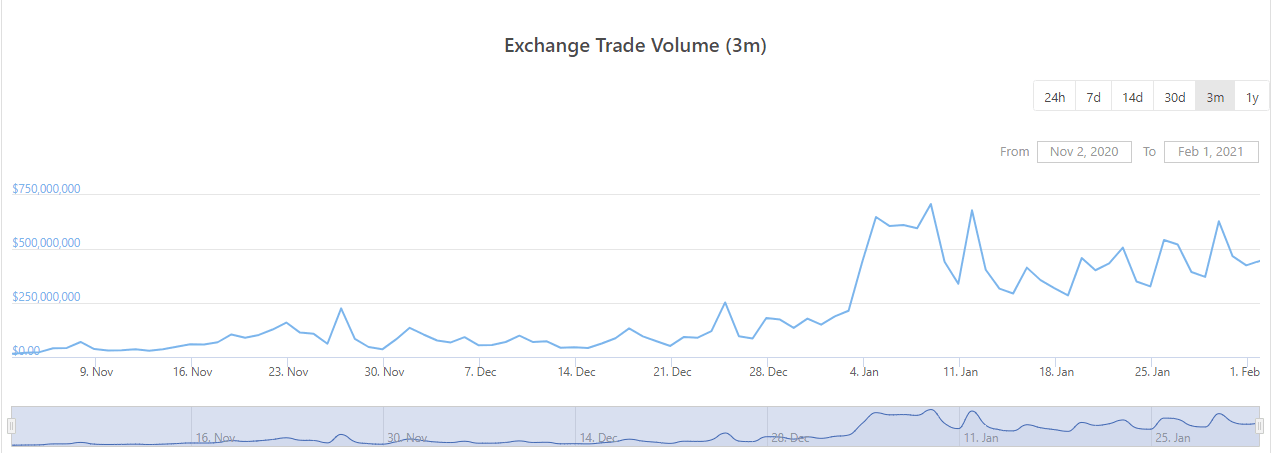

- The exchange has seen a massive increase in trading volume in the past month.

- Sushi stakers have been paid $6.1 million in fees in January.

Sushiswap price is up by 340% in January after seeing tremendous growth in 2021. The digital asset and exchange seems to be unstoppable and faces no barriers on the way up to $15. Several positive on-chain metrics suggest the digital asset could continue rising without any opposition.

Sushiswap price can hit $15 with no resistance ahead

One of the main factors behind Sushi’s impressive rally is the massive increase in trading volume the exchange has experienced in 2021. In January 1, Sushiswap had $187 million in trading volume over 24 hours. This number peaked at $708 million on January 8 and continues trending higher, currently at an average of $500 million.

SUSHI trade volume chart

The token itself has also seen a massive increase in trading volume from an average of $324 million on January 1 to $1.3 billion currently. The number of whales holding between 1,000,000 and 10,000,000 SUSHI coins has increased by four in the past week.

SUSHI Holders Distribution chart

Additionally, the SushiSwap exchange has paid xSUSHI stakers around $6.1 million in fees in January alone which is extremely significant and increases buying pressure.

SUSHI MVRV (30d) chart

However, the MVRV (30d) chart shows that Sushi is in the danger zone above 60% which often leads to significant correction periods. The digital asset is certainly overextended and has not experienced a notable pullback yet.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B20.57.32%2C%252001%2520Feb%2C%25202021%5D-637478066218749712.png&w=1536&q=95)

%2520%5B21.02.40%2C%252001%2520Feb%2C%25202021%5D-637478066267841632.png&w=1536&q=95)