SUSHI's rise and fall: What happened with SushiSwap and what to expect

- SUSHI owners had a tense weekend.

- The token dropped to $1.1 and recovered above $2.8 in less than two days.

- The token's price is driven by speculations and the whims of its creator.

SUSHI token has been the talk of the crypto town these days. The asset price topped at $11.17 on September 1 and hit bottom at $1.20 on September 6. At the time of writing, SUSHI/USD is changing hands at $2.78, while its total market value is registered at $190 million and an average daily trading volume of nearly $1 billion. It is most actively traded on Uniswap and Binance. The project is ranked 63d in the CoinMarketCap's rating. SUSHI has gained over 17% in the last 24 hours and lost over 10% on a week-on-week basis.

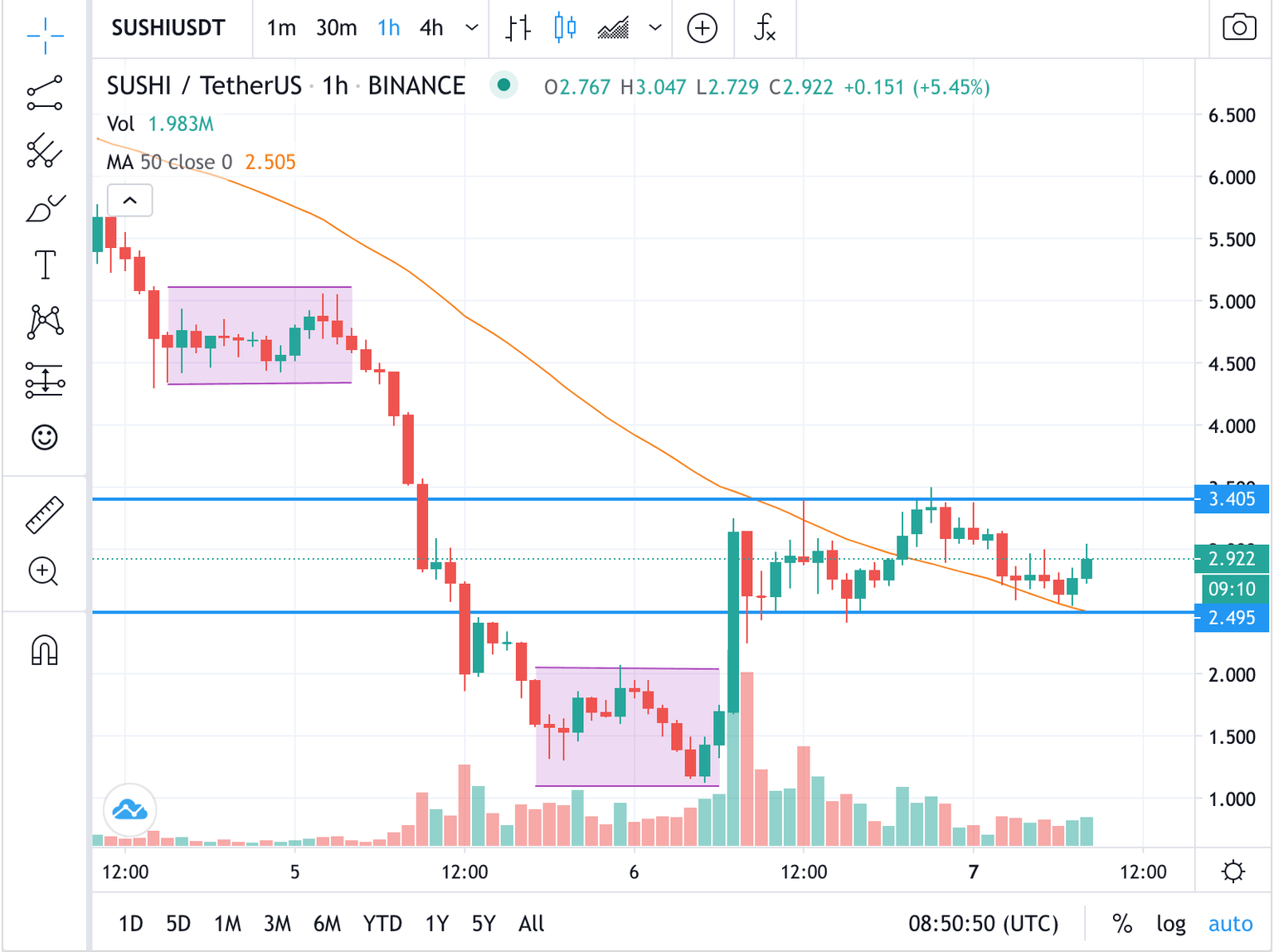

SUSHI/USDT: The technical picture

On the intraday chart, the price is moving inside the range limited by $2.50 on the downside and $3.40 in the upside. A sustainable move in either direction can create strong momentum and result in a new sharp movement. The lower boundary of the above-said channel is reinforced by 1-hour SMA50, which means it has the potential to slow down the bears for the time being. The next support comes at $2.00. This psychological barrier served as resistance on Saturday 6, right before the sharp rally.

On the other hand, a move above $3.4 will increase the bullish push and open up the way to the next local resistance created by the consolidation range of $4.3-$5.1

SUSHI/USDT 1-hour chart

Speculators rule the day

If you are looking for a detailed SUSHI technical analysis, I have some bad news for you. The token is a wild thing that lives by the law of the jungle. The SUSHI price is vulnerable to sharp and unpredictable ups and downs triggered by rumors and speculations. Basically, such a boom-bust nature is a hallmark of most of the DeFi tokens recently moved to life. However, SushiSwap protocol with its SUSHI token is one of the latest and most illustrative examples of how risky these assets can be.

Let's have a closer look at the course of events that has been fuelling the token's ups and downs.

SushiSwap, a fork of DeFi protocol Uniswap, offers a popular AMM model with a twist in the form of rewards for liquidity providers. The project was launched on August 28 and catapulted from nearly zero to over $11 in a matter of days amid strong speculative interest. Despite numerous warning about the high risks attributed to unaudited project controlled by its anonymous creator, Chef Nomi cryptocurrency traders poured money into the project in hopes to get high returns on their passive investments,

However, it was not long before SushiSwarp participants found out that the SUSHIs were not that tasty after all. Chef Nomi unexpectedly sold his tokens on Saturday, September 6, less than two weeks after the project launch. As he swapped his Sushi LP tokens for 37,400 ether (ETH) worth of $13 million, many DeFi market observers suspected him of an exit scam.

The token price crashed by 73%, $4.44 to $1.20 in less than 24 hours.

Later on, Chef Nomi explained that the Timelock admin control had been transferred to the CEO of FTX and apologized for spooking the community. Voila, the token jumped by over 100% in a matter of hours.

The project participants lost lots of money during this roller-coaster; however, the creator obviously became a millionaire by just copying and twisting the code of Uniswap. The fate of the project and its users remains unknown, though Chef Nomi is in good shape anyway.

Author

Tanya Abrosimova

Independent Analyst