Sushi DAO faces subpoena from SEC, calls for $3 million USDT legal fund

- Sushi DAO CEO proposes to establish a legal fund in USDT to cover the attorney’s fees for core contributors.

- The Securities and Exchange Commission (SEC) served the DEX and its CEO Jared Grey with a subpoena for reasons unknown at the moment.

- SushiSwap price has fallen over 5% over the last hours to trade around $1.15.

The regulatory crackdown on the crypto market has been growing over the past few months, with the Securities and Exchange Commission (SEC) doubling down in its efforts. In line with the same, on March 21, Sushi became the next on the list to tangle with the regulatory body.

Sushi subpoenaed by SEC

In a blog post on March 21, Sushi DAO announced that the SEC issued a subpoena for the Decentralized Exchange (DEX) company. The subpoena also included the Chief Executive Officer (CEO) of Sushi, also known as the Head Chef, Jared Grey.

While the reason remains unknown at the moment, Sushi is already taking the necessary steps to deal with the situation. Sushi also stated that they were cooperating with the SEC and that there was no intention to comment publicly on the ongoing investigations.

In response to the subpoena, the CEO proposed establishing a legal defense fund to cover the legal costs that may occur. The proposal seeks $3 million from the Sushi DAO in the form of USDT. The Sushi DAO Legal Defense Fund would be used to provide coverage for the attorney fees and costs for just its core contributors.

This fund, per the proposal, will include money from three different sources. The CEO suggested that 50% of the fund would come from the Kanpai fees, another 35% from Grants and the remaining 15% from Sushi Time-Weighted Average Price selling.

The proposal also noted that if the funds deplete, the DAO will add another $1 million in USDT until the legal proceedings come to an end. The Securities and Exchange Commission provided no statement regarding the same.

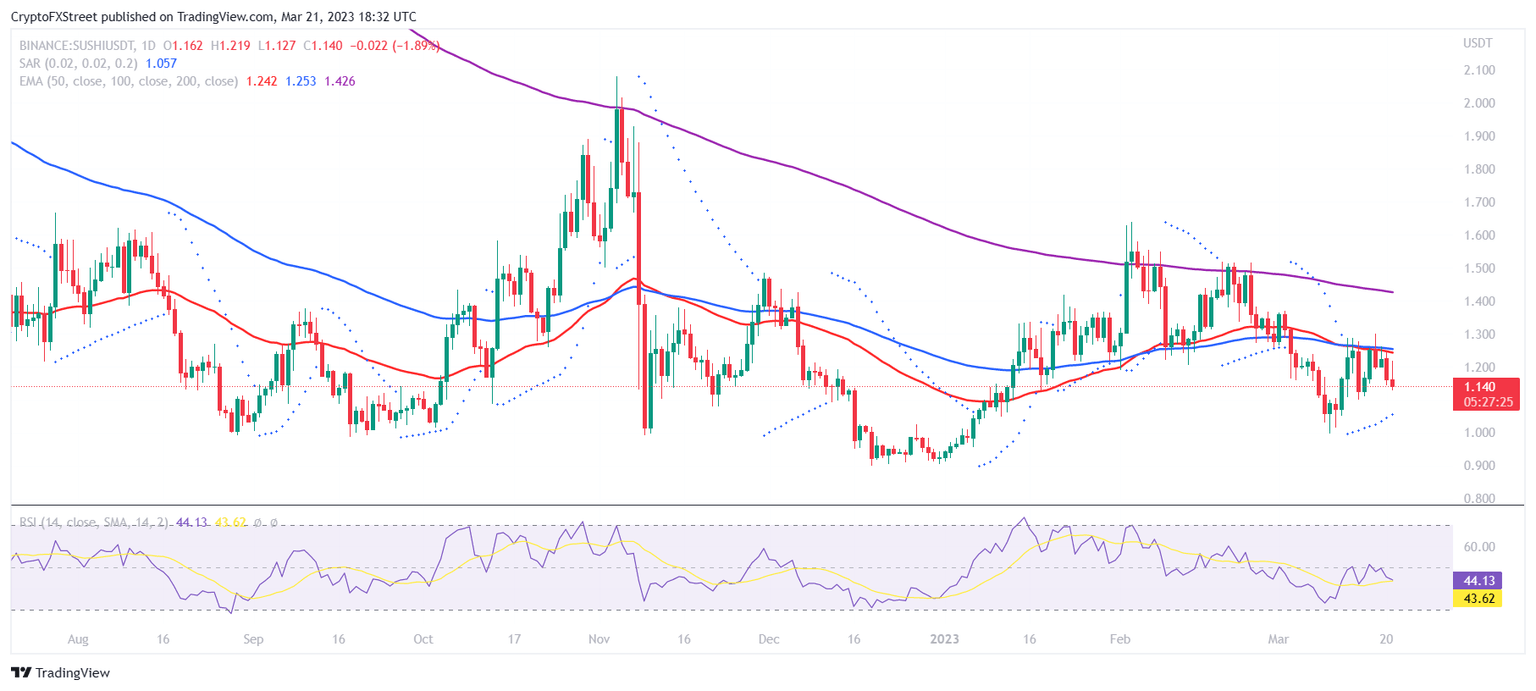

SUSHI/USDT 1-day chart

The SushiSwap price is trading at $1.140 at the time of writing, having retreated from a daily high of $1.219. SUSHI is also currently one of the only few coins that did not follow the broader market cues and failed to recover from the late February decline of 28.5%.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.