SUI price outperforms top 100 cryptocurrencies, including Bitcoin

- SUI price gains another 20% as it crosses $3.70 on Friday, outperforming all top 100 ranked cryptocurrencies with 72% weekly gain.

- Sui's TVL has risen by 15.8% in the past 24 hours, reaching $1.8 billion.

- DeFi ecosystem collaborations with Babylon Labs and Lombard Protocol help to propel SUI market dominance.

SUI price outperformed the top 100 cryptocurrencies, including Bitcoin, on Friday, surging 72% weekly as DeFi expansion and trade war updates fuel market rally.

SUI outperforms top-100 cryptocurrencies

SUI emerged the standout performer among the top 100 cryptocurrencies on Friday, as global financial markets received a major boost from fresh updates in the US-China tariff trade war.

Following a turbulent month that saw US stocks shed more than $10 trillion in value, US President Donald Trump began to soften stance this week.

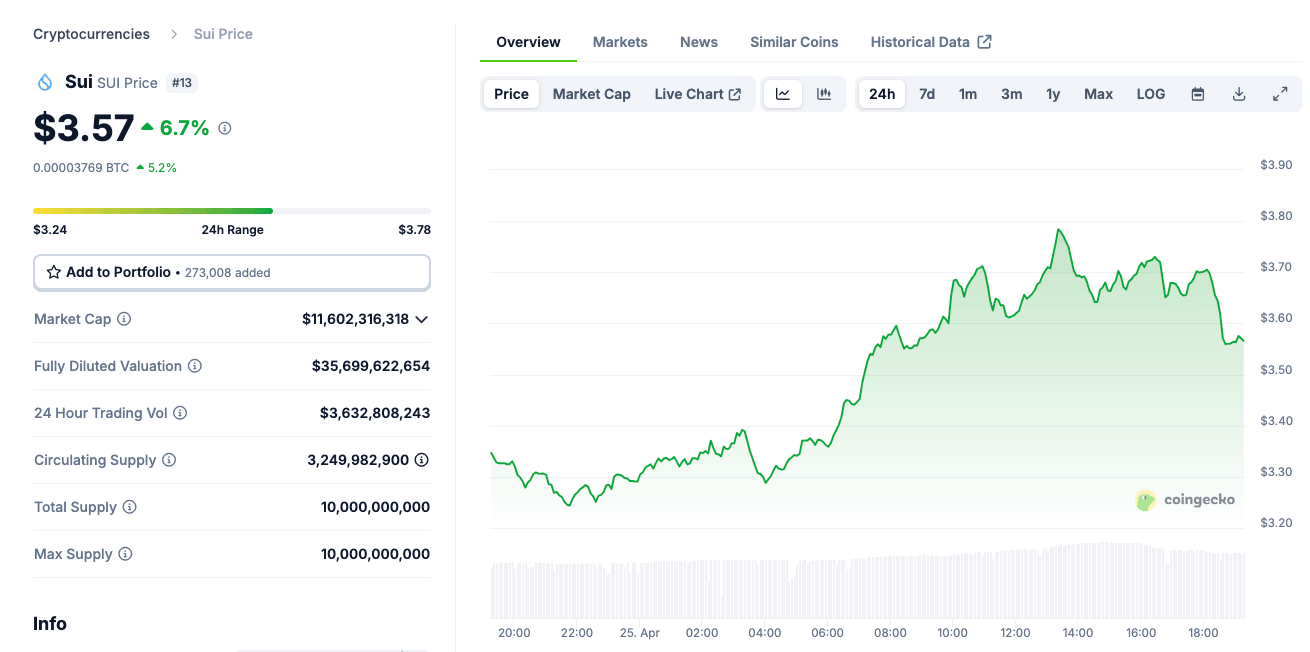

SUI outperforms top 100 cryptocurrencies, April 25 | Source: Coingecko

After Trump announced an official call with his Chinese opposite, XI Jinping, on Friday, it prompted bullish action across global financial markets, including cryptocurrencies.

Why is SUI price going up ?

While Bitcoin’s rise to a 60-day peak of $95,200 grabbed the headlines, Coingecko’s aggregate market data identifies SUI as the most in-demand crypto asset on Friday.

SUI price action, April 2025 | Source

SUI price rose by another 20% on Friday to reach a two-month peak above $3.70 before retracting toward $3.50 at press time.

While this brings SUI weekly gains to a whopping 72%, a closer look at the chart above also shows that the token is still attracting the most search interest on the day.

The increased media awareness could trigger more gains as traders actively look to FOMO in on the rally.

However, looking beyond the current price action, here are other key market indicators supporting the SUI rally.

Strategic partnerships propels SUI TVL to $1.8 billion

Sui's ecosystem has seen significant growth, contributing to increased investor confidence. Notably, partnerships with entities like Ant Digital Technologies have accelerated the adoption of real-world assets (RWAs) into Web3, enhancing SUI's utility.

Furthermore, the integration of Bitcoin staking into Sui’s DeFi ecosystem through collaborations with Babylon Labs and Lombard Protocol has opened new avenues for liquidity and user engagement.

These strategic moves have positioned Sui as a versatile platform catering to diverse sectors, including DeFi, gaming, NFTs and SocialFi. Consequently, SUI-hosted DeFi protocols and smart-contracts are currently attracting an unusual amount of deposits.

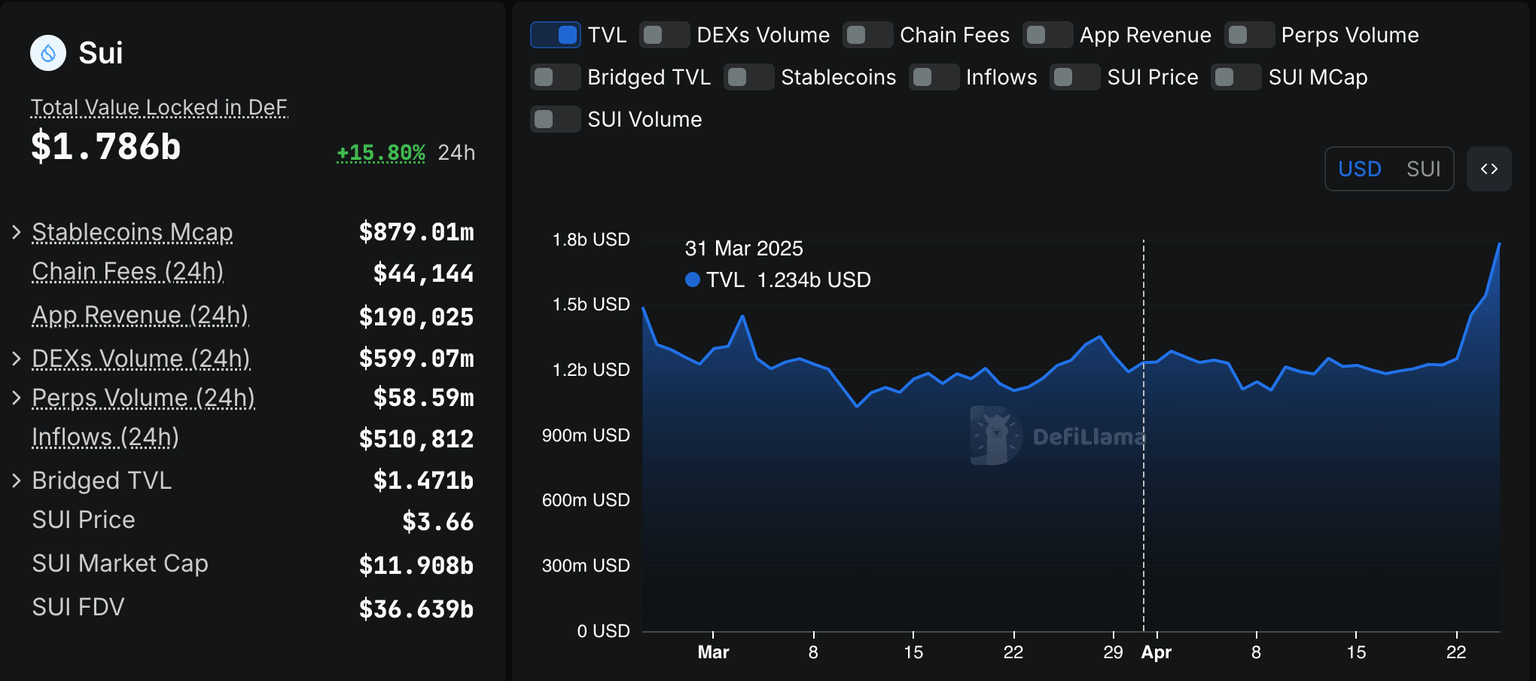

SUI Total Value Locked | Source: DeFillama

According to on-chain data culled from DeFilamma data, SUI Total Value Locked rose by another 16% in the last 24 hours to hit $1.8 billion.

Zooming out, this brings its total inflows for April to the $600 million mark.

When a cryptocurrency asset price rally coincides with a notable increase in TVL, it signals that the rally is being driven by organic demand for its services rather than speculative activity.

Looking ahead: Profit-taking risks loom

SUI price outperforming over the past week means that early traders are now in positions to take out profits and reinvest them in other altcoins like Bitcoin Cash (BCH) and Toncoin (TON), breaking out into early rally phases on Friday.

Beyond that, it is important to note that crypto had received capital inflows after trade war fears prompted investors to seek refuge in alternative assets with minimal exposure to global supply chains.

As the trade war with China moves toward a verdict, it now remains to be seen if investors will withdraw some of the $1.8 billion on-chain assets funnelled into yield-bearing protocols on SUI to reinvest in US stocks and money markets.

A rapid withdrawal could see SUI price lose organic support, potentially resulting in a rapid correction.

SUI price forecast today: Bull traders eye $4.20 resistance after major breakout

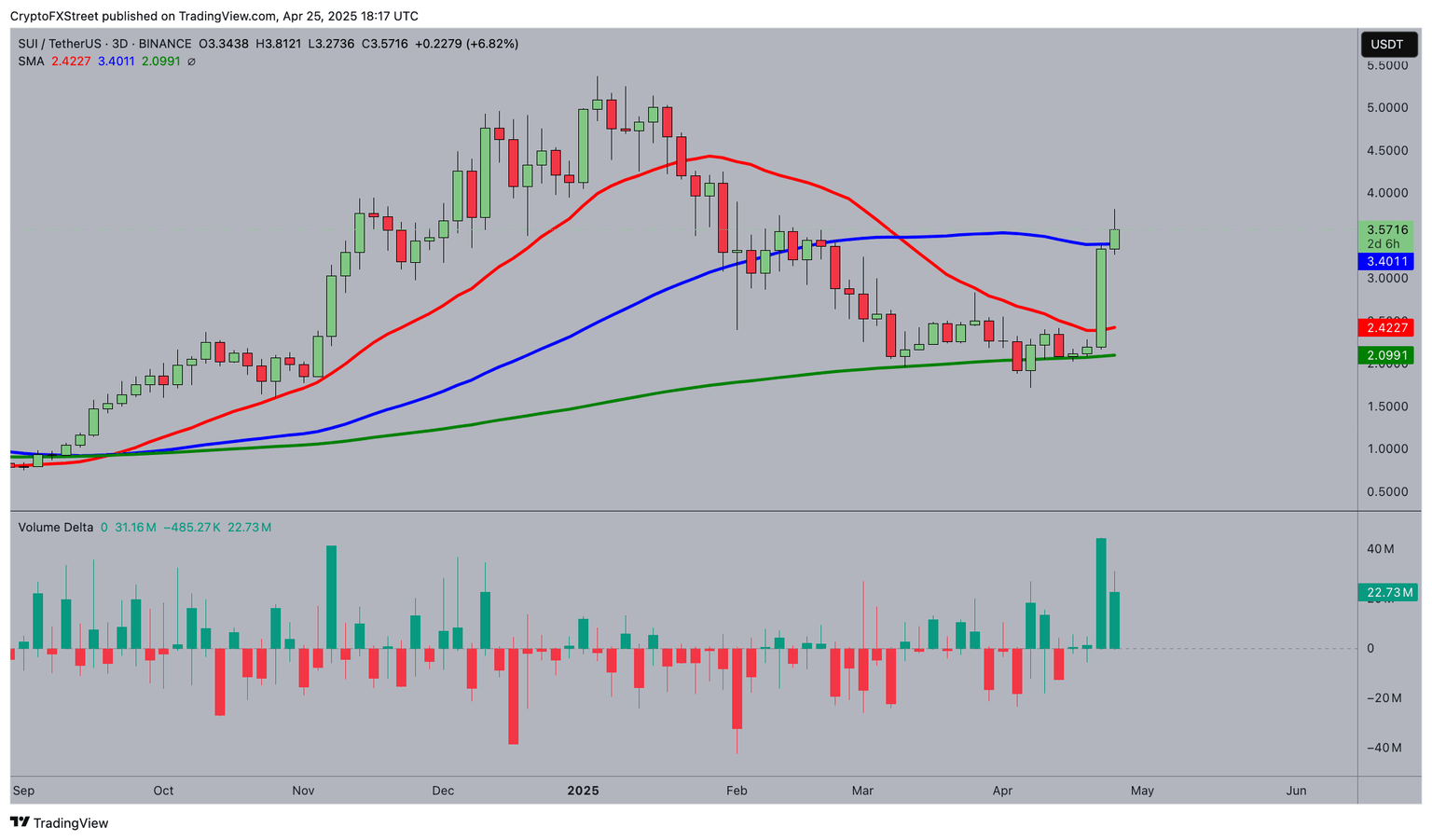

SUI price extended its rally to $3.70 on Friday, climbing over 20% as technical indicators on the three-day chart show short-term bullish signals.

The clean breakout above the blue 100-day Simple Moving Average (SMA) at $3.40, combined with the strong Volume Delta surge to 31.16 million, points to a robust bullish breakout with a short-term target at $4.20.

SUI Price Forecast Today

Buyers decisively reclaimed the 200-day SMA at $2.09 and the 50-day SMA at $2.42 over the past sessions, signaling a major trend reversal confirmed by higher volume accumulation.

More so, the slope of the 50-day SMA is starting to flatten, suggesting early bullish momentum recovery after months of downtrend. The 100-day SMA now flipping into key support cluster hints that the $4.20 level could be the next target.

On the contrary, failure to maintain above $3.40 would expose SUI price to a pullback toward $3.00, where the 50-day SMA could cushion further declines.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.