Stellar Price Prediction: XLM/USD awaits a bull pennant confirmation to conquer $1

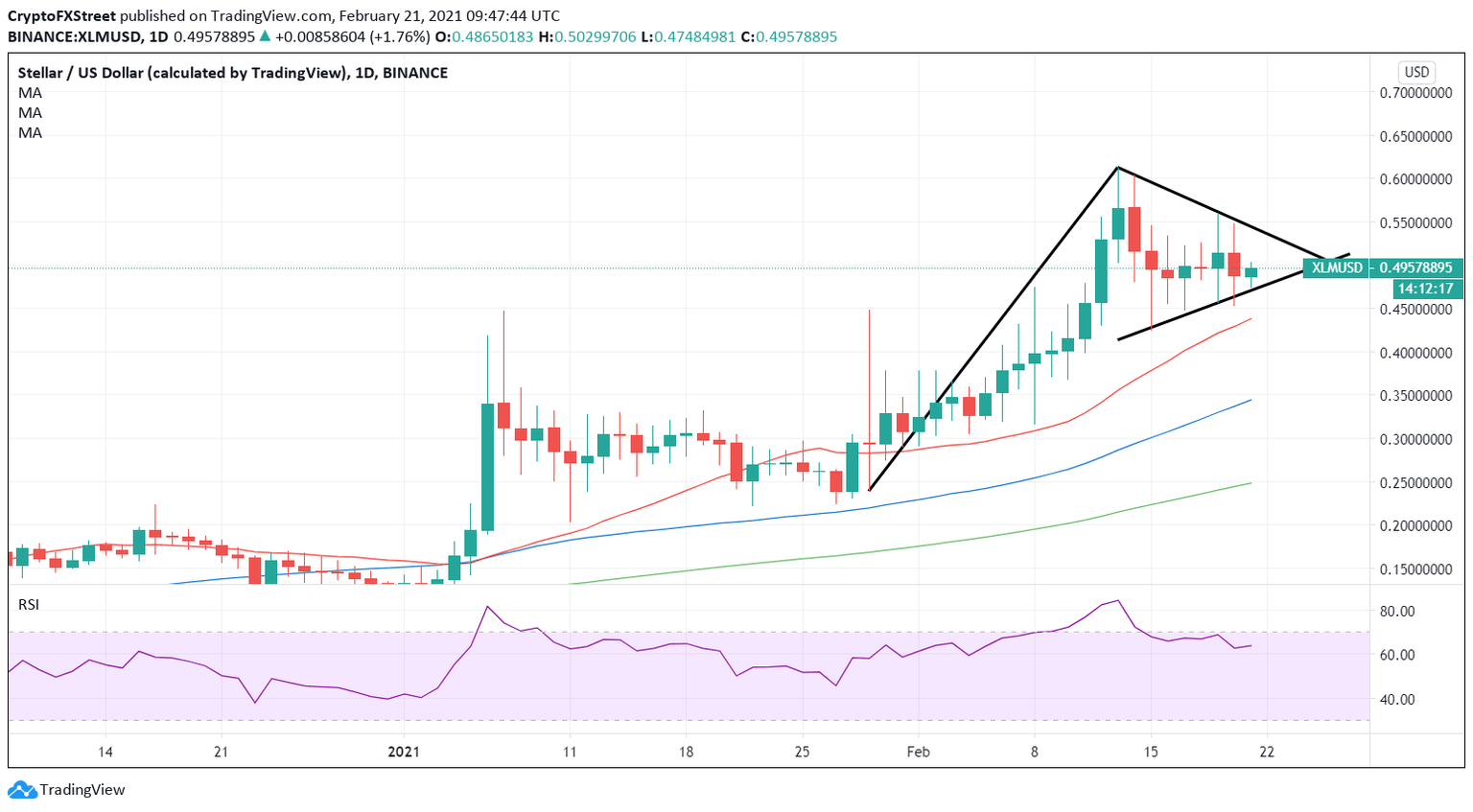

- XLM/USD spots a potential bull pennant on the daily chart.

- RSI points north while within the bullish region.

- Upside appears more compelling for Stellar Lumens.

Stellar Lumens (XLM/USD) trades within last week’s range on Sunday, as the bulls await a strong impetus for the next move northwards.

The all-time highs at $0.6123 are back on the buyers’ radars, with the short-term technical setup also backing the case for the additional upside.

XLM/USD attempting another run to record highs and beyond

XLM/USD: Daily chart

XLM/USD is eyeing a daily closing above the falling trendline resistance at $0.5425 in order to validate a bull pennant formation.

Adding credence to the upside bias, the 14-day relative strength index (RSI) edges higher above the 50 level.

The bulls will target the $1 psychological level if the record high is taken out.

On the flip side, if the price closes below the rising trendline support at $0.4740 on the daily candlestick, it could lead to the pattern failure, exposing the bullish 21-daily moving average (DMA) at $0.4384.

Further south the upward-sloping 50-DMA at $0.3452 could likely be the last resort for the XLM bulls.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.