Stellar Price Prediction: XLM on its way to a 35% fall as technicals scream sell

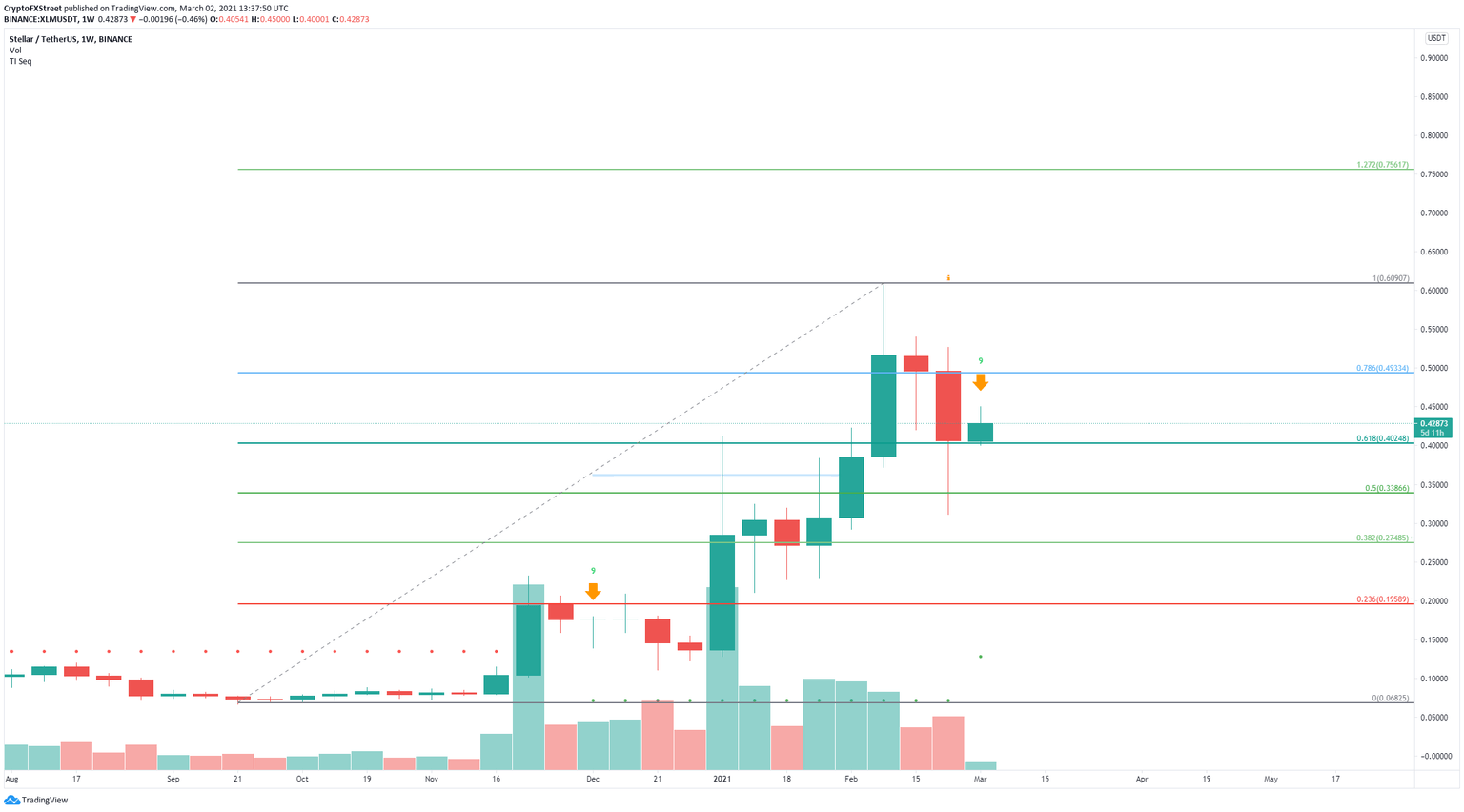

- A key indicator has presented a long-term sell signal for Stellar price.

- XLM must hold above a significant support level to avoid a massive 35% drop towards $0.27.

- Stellar doesn't have a lot of support on the way down.

Stellar had a massive 50% correction from a high of $0.606 on February 8 down to $0.311 on February 22. The digital asset seems to be poised for yet another leg down as technicals have turned against the bulls.

Stellar price will fall to $0.27 if it drops below this key level

On the weekly chart, the TD Sequential indicator has presented a sell signal. The most significant support level here is the 61.8% Fibonacci Retracement point at $0.40.

XLM/USD weekly chart

A breakdown below this key support level has the potential to push Stellar price down to $0.33, at the 50% Fibonacci level and as low as $0.27, at the 38.2% level. The last sell signal on December 2020 was confirmed and had a significant bearish continuation.

However, there is still hope for the bulls, which need to see a candlestick close above $0.49 to invalidate the bearish outlook. A breakout above this point could quickly drive Stellar price towards the high of $0.6.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.