Solana Price Forecast: SOL surges on record high Open Interest, Alpenglow vote

- Solana edges higher as capital inflows in SOL derivatives boost Open Interest to a record high.

- Sharp Technology to launch a $400 million Solana Digital Asset Treasury.

- Circle minted nearly $750 million USDC ahead of the Alpenglow upgrade.

Solana (SOL) upholds the recovery run above the $200 psychological level on Friday as record-high open interest sparks bullish sentiment. Even the institutional interest in high-performance blockchain continues to increase, underpinned by Sharp's $400 million Solana treasury and the $750 million USDC minted by Circle.

Furthermore, the voting process on the Alpenglow upgrade proposal fuels market sentiment.

Sharps Technology’s $400 million Solana ecosystem treasury, with an expansion $1 billion on the horizon

Solana continues to capture corporate interest as Sharp Technology, Inc., finalizes a $400 million investment with private partnerships to establish a Solana digital asset treasury. The private placement offering could result in proceeds of an additional $600 million if all the warrants are exercised, potentially reaching $1 billion treasury size.

Key subscribers included market leaders such as ParaFi, Pantera, FalconX, among others.

The native token of Solana, SOL, will be the key and dominant asset in the treasury, and the initial $50 million investment will be made at a 15% discount to the 30-day time-weighted average price, as outlined in the non-binding letter of intent between Sharps Technology and the Solana Foundation.

"Solana is capable of handling any tradable asset, everywhere in the world, and demand is only increasing," said Alice Zhang, Chief Investment Officer and Board Member of Sharps Technology.

Circle mints almost $750 million USDC ahead of Alpenglow upgrade

Solana’s community began voting on the upcoming Alpenglow upgrade (SIMD-0326), which will enable 150ms block finality, on August 27, with epoch 840. The voting process is expected to last nearly a week and will conclude with epoch 842.

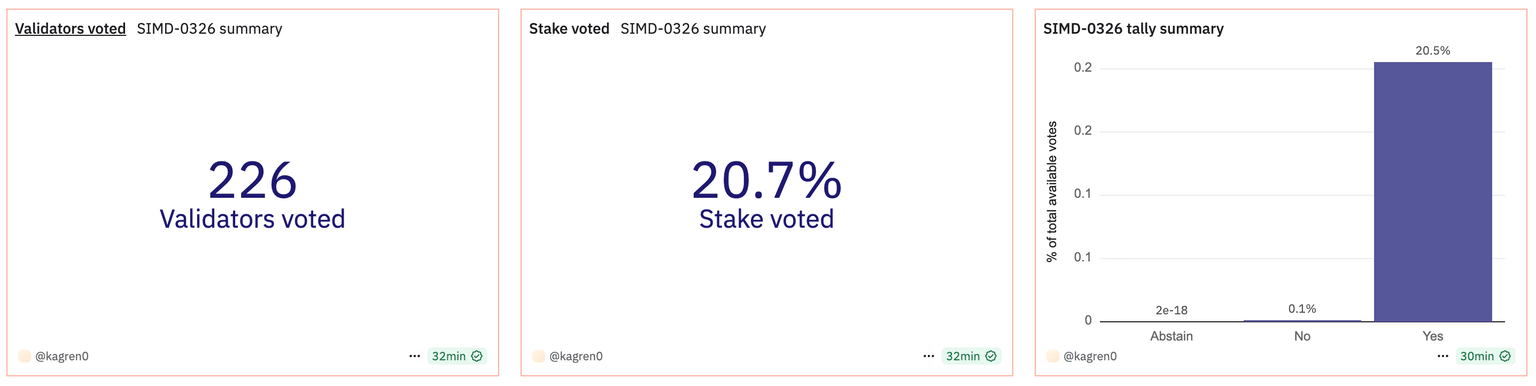

Dune Analytics data shows 226 validators have voted out, representing over 20% of the network’s stake. The majority of validators (20.5% of the network stake) support the Alpenglow upgrade.

Alpenglow voting status. Source: Dune Analytics

For approval, the voting requires 33% of validators to cast their ballots, out of which it will require 66% of "yes" votes. If approved, the Alpenglow upgrade will shift Solana’s Proof-of-History and TowerBFT systems to boost block finality to 150ms, improving from the currently required 12.8 seconds.

Amid the voting process, Circle fueled the liquidity on Solana by minting nearly $750 million of its stablecoin, USDC. With the newfound liquidity, the stablecoin market on Solana increased by over 4% in the last 24 hours, reaching $12.17 billion, with USDC dominating 71.6%.

Furthermore, DeFiLlama data shows the Total Value Locked (TVL) on Solana reached $11.815 billion, inching closer to its record high of $11.989 billion from January 23.

Solana DeFi metrics. Source: DeFiLlama

Solana’s recovery run targets a leg higher

SOL extends the recovery run underpinned by expanding TVL, corporate interest, and the launch of the US Government’s Gross Domestic Product (GDP) data on Solana’s Pyth Network. The high-performance blockchain’s native token holds above the $200 psychological level, with bulls targeting the $232 mark, aligning with the 78.6% Fibonacci level drawn from $295 on January 19 to $95 on April 7.

If Solana crosses above the $232 threshold, it could target its all-time high of $295, potentially flashing the $300 milestone on bullish radar.

CoinGlass data indicates that the SOL Open Interest (OI) has reached a record high of $13.68 billion, up from $12.39 billion on Thursday. This surge of over $1 billion in OI refers to increased interest among SOL traders.

Solana Open Interest. Source: Coinglass

The momentum indicators suggest a steady rise in bullish pressure on the daily chart. The Relative Strength Index (RSI) reads 62 as it rebounds from the halfway line, aiming for the overbought zone.

Additionally, the Moving Average Convergence Divergence (MACD) and its signal line continue to maintain a steady rise in the positive territory, reflecting an increase in bullish momentum.

SOL/USDT daily price chart.

Looking down, if SOL reverses below the $206 resistance-turned-support level, it could retest the 61.8% Fibonacci level at $191.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.