Solana price to retest $125 if SOL can shatter this supply zone

- Solana price faces a $104.68 to $108.13 supply zone after rallying 15%.

- Clearing this hurdle will open the path for SOL to rally another 15% and retest $126.48.

- A rejection at the supply zone is likely to lead to a correction to $93.12.

Solana price experienced a quick run-up over the past two days. While this move was obvious, it failed to set up a higher high on a daily chart. Despite the recent shortcomings, SOL has a chance to prove itself by clearing a crucial hurdle and triggering another rally.

Solana price at a decisive point

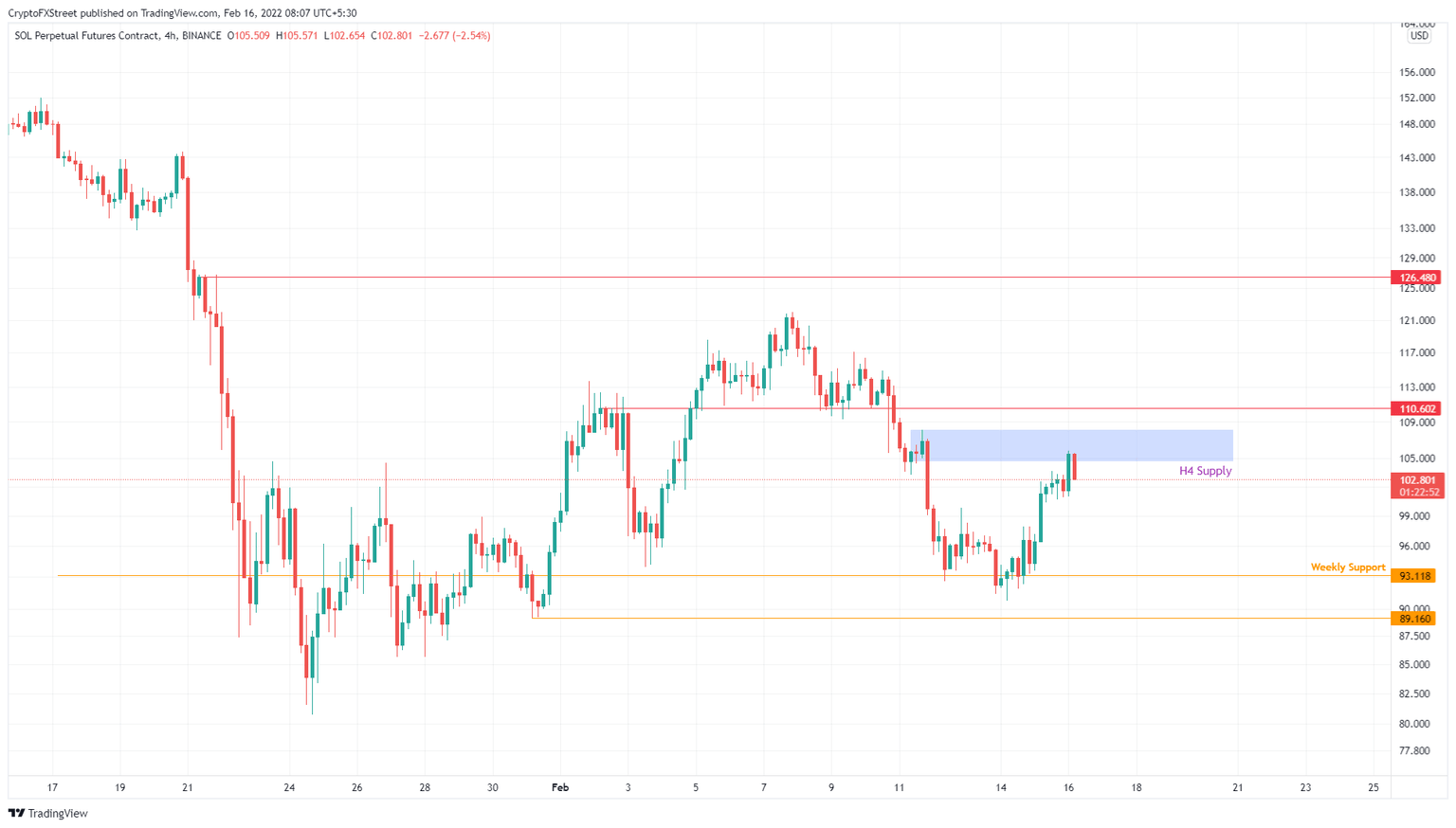

Solana price rallied 15% after stabilizing around the weekly support at $93.12. This upswing set a swing high at $105.82 as SOL pierced the four-hour supply zone, extending from $104.68 to $108.13.

A resurgence in buying pressure that pushes SOL to produce a four-hour candlestick close above $108.13 will flip this hurdle into a foothold and suggest that the bulls want to move higher. In this case, Solana price is likely to make a run at the $126.48 hurdle, bringing the run-up to 15%

This uptrend, however, relies solely on the fact that Solana price can slice through the said supply zone. Failing to move past this hurdle is likely to lead to a rejection that will push SOL lower.

SOL/USDT 4-hour chart

Assuming Solana price fails to muster up the momentum to slice through the four-hour supply zone, ranging from $104.68 to $108.13, it will indicate weakness among buyers.

A reduced bullish momentum combined with profit-taking could be the key to pushing SOL lower to tag the weekly support level at $93.12. Here, Solana price can form a base and give the uptrend another go.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.