Solana integrates Chainlink, at risk of crashing below $30

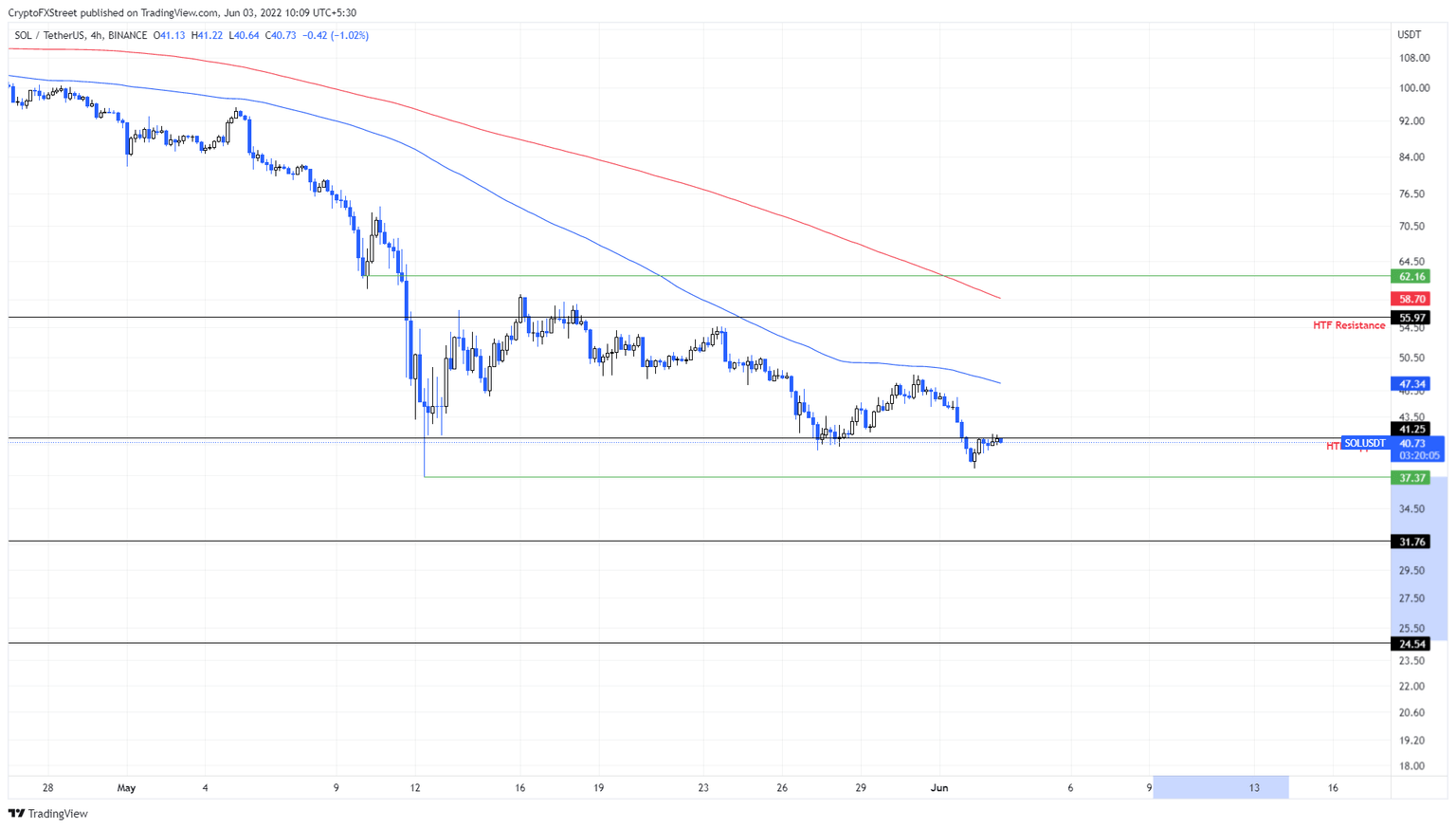

- Solana price is trying to recover above the $41.25 hurdle, after a failed rally.

- A rejection that pushes SOL to break down the $37.37 support floor could trigger a crash to $30.

- A four-hour candlestick close above $47.34 will invalidate the bearish thesis.

Solana price attempted a recovery rally after days of consolidation between a support and resistance level. This move was supposed to be the hail mary of bulls, but the buying pressure exhausted, leading to a lower high and correction that could exacerbate SOL’s condition.

Solana price at make or break point

Solana price action remain between the $41.25 support level and the $55.97 hurdle since May 13. Although there were a few sweeps of the range high and low, things remained in this area. The most recent retest of the $41.25 barrier led to a 20% ascent, which failed to push through the $47.34 200 four-hour Simple Moving Average (SMA).

As a result, SOL crashed 21% and shattered the $41.25 support floor, flipping things bearish. While a failure to recover above the said hurdle would pose threats to the gains of Solana price, investors need to pay close attention to the $37.37 level.

This support level is key in making or break the situation for SOL bulls. A breakdown of this foothold will confirm a bearish onslaught and knock Solana price further by 15% to retest the $31.59 barrier. In some cases, the bears might extend this downtrend to retest $30.

If the sellers continue to panic sell, a revisit of the $24.54 barrier seems plausible, denoting a total loss of 34%.

SOL/USDT 4-hour chart

While things are looking gloomy for Solana price, a four-hour candlestick close above the 200 four-hour SMA at $47.34 will create a higher high and invalidate the bearish thesis. This development could see SOL push to the next hurdle at $55.97.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.