Solana Price Prediction: SOL could retrace 18% before heading higher

- Solana price might pull back as MRI flashes a sell signal on the 12-hour chart.

- The demand zone extending from $91.51 to $96.27 is likely to reduce the selling pressure.

- A decisive close above $130.16 will invalidate the bearish thesis.

Solana price shows a massive uptrend coming to a temporary pause after setting up new all-time highs. The downswing could exacerbate if an intermediate demand barrier fails to cushion the incoming selling pressure.

Solana price to retrace before a run-up

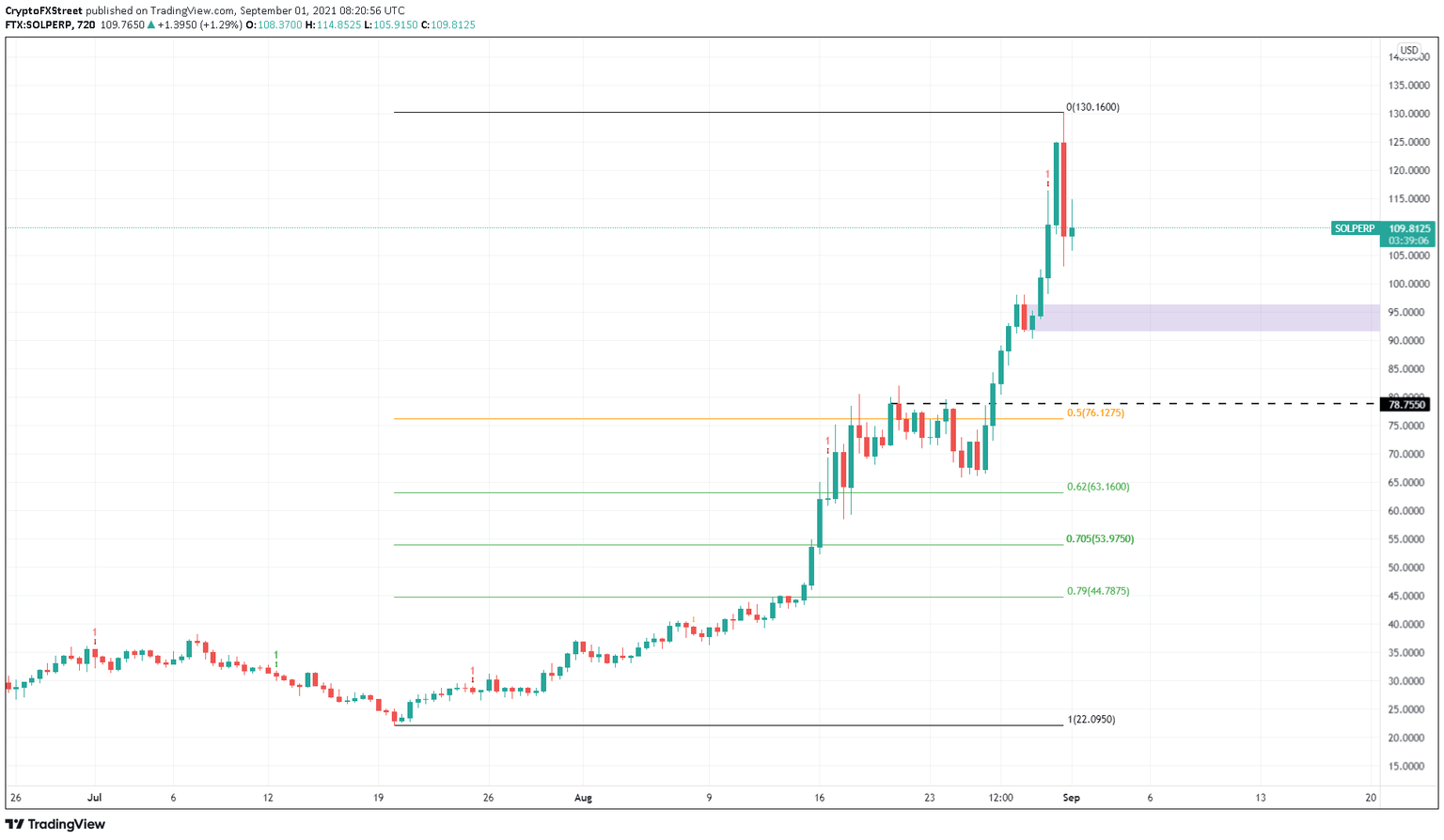

Solana price saw its price more than triple over the past 17 days as it set up a new all-time high at $130.16. This impressive and exponential rally ignored the Momentum Reversal Indicator (MRI), but the recent sell signal that flashed in the form of a red ‘one’ candlestick seems to be playing a role.

This technical setup forecasts a one-to-four candlestick correction. Although SOL initially ignored this warning signal and set up a new all-time high at $130.16, it eventually began its correction phase and is currently trading at $111.80.

If the investors continue to book profit, Solana price will test the demand zone stretching from $91.51 to $96.27. If the buyers make a comeback around this barrier, a reversal is more than likely to occur here.

However, there is a chance SOL might briefly dip below $91.51 before restarting the upswing. In total, this retracement would represent an 18% downswing.

SOL/USDT 12-hour chart

Regardless of the sell signal, altcoins like ADA, SOL and AVAX are rebelling against the trend that the big crypto is setting. Therefore, there is a high chance Solana price might not stick to the norm but restart an uptrend that retests the current all-time high at $130.16.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.