Solana Price Prediction: Can Confidential Balances boost SOL amid Trump tariff tumult?

- Solana's $100 support shaky ahead of US President Donald Trump's reciprocal tariffs.

- Solana's Confidential Transfers feature morphs into Confidential Balances, encompassing privacy, fees, mint, and burn features.

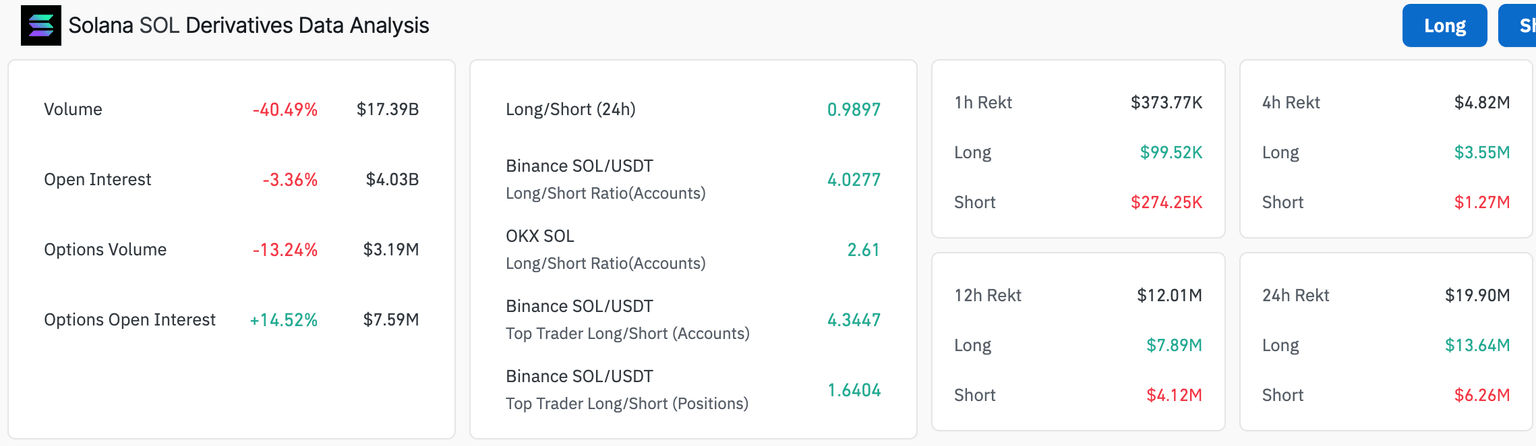

- Solana derivatives face $19.9 million in 24-hour liquidations as open interest falls 3.36% to $4.03 billion.

- A falling wedge pattern on the daily chart could trigger a 29.78% rebound in SOL if validated.

Solana (SOL) stabilizes and trades around $105 at the time of writing on Wednesday, clinging to the daily open, as macroeconomic factors bite global markets, including crypto. The smart contracts token recovered the previous day, reaching $112.50, but quickly reversed the gains in the American session alongside majors Bitcoin (BTC) and Ethereum (ETH) as United States President Donald Trump insisted that tariffs are good for the world's largest economy, escalating trade tensions, especially with China. Meanwhile, Solana's "Confidential Transfers" has transformed beyond privacy to cater to other features, including transfers, fees, mint, and burn.

How Confidential Balances elevate Solana ecosystem

According to an article published on the Helius blog, a network validator, Solana's Confidential Transfers feature has grown over ten years to include various layers of confidentiality without compromising regulatory compliance.

Confidential Transfers, launched by Solana's Token2022, made it possible for token issuers to 'obscure' token amounts. The process involved processes like deposit, application of confidential balance and transfer on the sender's side. On the other hand, the recipient would accept the tokens into their confidential balance before withdrawing (optional).

Helius’ post says, "All of these steps take advantage of homomorphic encryption and zero-knowledge proofs (ZKPs) behind the scenes so that, while sums are hidden, the system can still verify correctness."

However, Confidential Balances has transformed into an umbrella-like platform beyond confidential transfers, including a suite of extensions using cryptographic primitives to hide token transfer amounts, fees confidentiality and confidential mint and burn.

Solana developers currently have a Rust-based implementation in place and are working on JavaScript libraries, which are expected later in 2025. With this update, Confidential Balances will include native wallet integration, such as Phantom.

Solana’s early "Confidential Transfers" feature has evolved into "Confidential Balances," a suite of advanced privacy extensions covering confidential transfers, fees, minting, and burning, enabling asset issuers to conceal amount details without compromising compliance.…

— Wu Blockchain (@WuBlockchain) April 9, 2025

Solana's ecosystem could become more attractive to decentralized finance (DeFi) projects and institutional players with improved privacy features.

Despite the launch of Confidential Balances, Solana's price had minimal bullish impact as Trump’s tariff fears dominated sentiment. Leading investment banks like JP Morgan and Goldman Sachs have warned that the new tariff regime could weigh heavily on the economic growth outlook and see a stronger probability of a recession in the US.

Liquidations in the derivatives market highlight the impact of Trump's reciprocal tariffs on Solana and other altcoins. As per Coinglass data, $19.9 million in long and short positions has been liquidated in the last 24 hours. A 3.36% decline in Solana's open interest to $4.03 billion indicates a growing risk-off sentiment.

Solana liquidations and open interest data | Source: Coinglass

Can Solana defend $100 support?

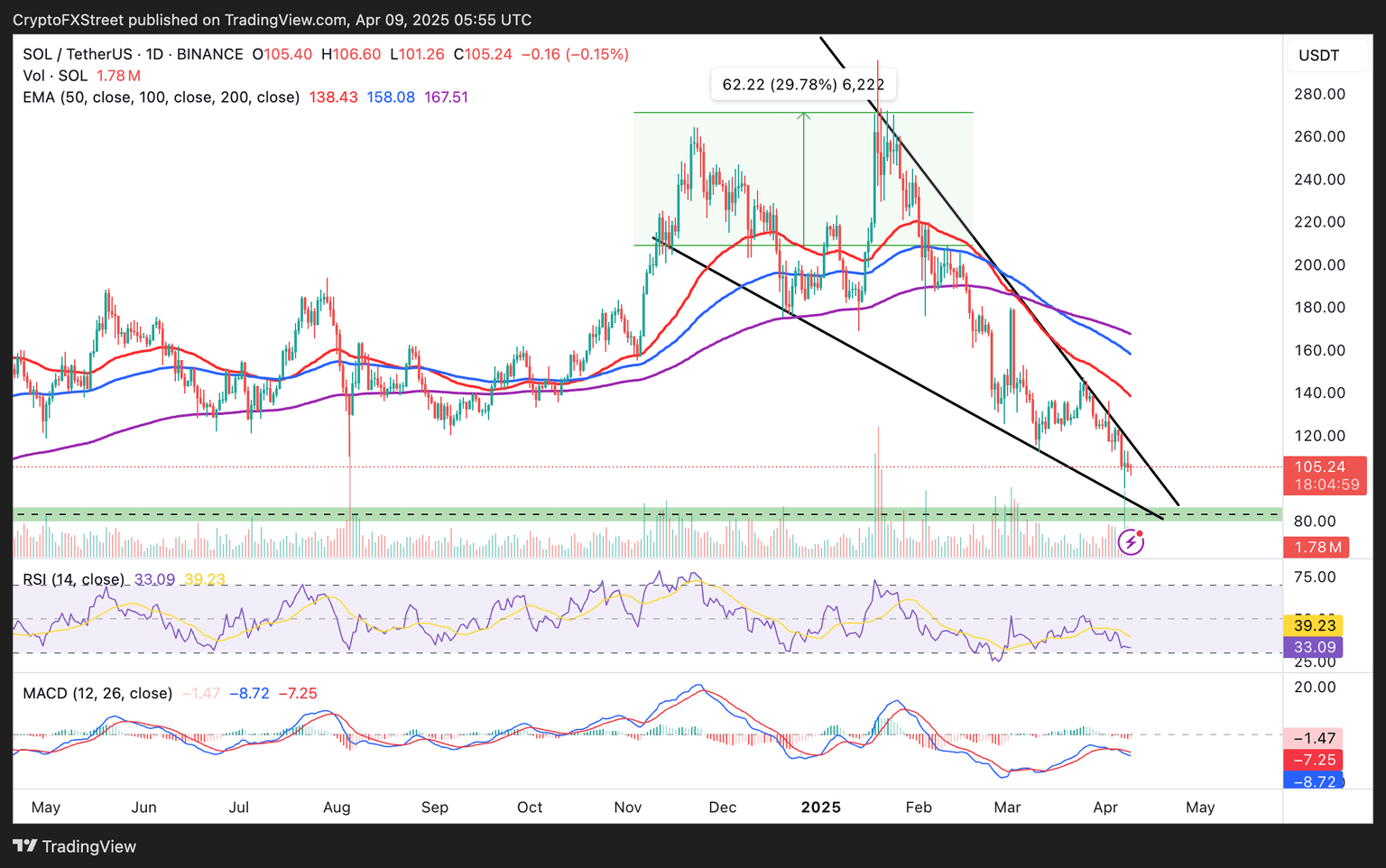

Solana's $100 level is a psychological support tested several times in 2024. With the 50-day Exponential Moving Average (EMA), the 100-day EMA and the 200-day EMA breached and acting as resistance, the probability of a smooth recovery is dwindling. If SOL slides below $100, the next crucial level holds at $75, where bulls could tap liquidity for a significant rebound.

XRP/USDT daily chart

A falling wedge pattern in the same daily chart hints at a possible 29.78% breakout (equal to the distance between the pattern's widest points), which could see SOL close in on $140 if volume surges and tariff-driven volatility declines.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren