Solana memecoins in red: Popcat and Dogwifhat shed $140M as TRUMP’s token tumbles 80% from all-time high

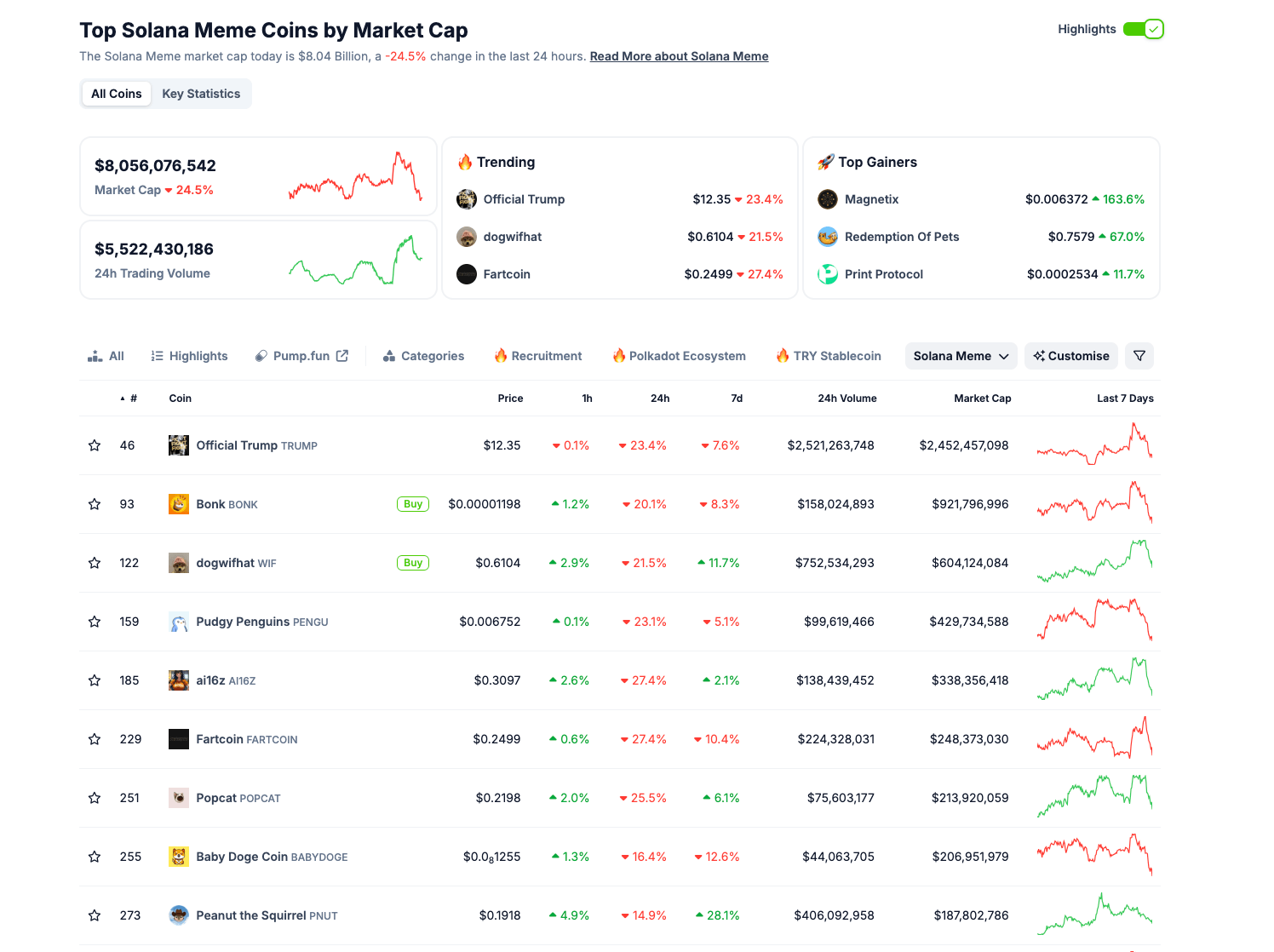

- Solana memecoin sector valuation hit $8.1 billion on Tuesday, tumbling 24.5%, double the 12% average crypto market loss.

- Popcat and Dogwifhat posted 25% and 21% losses, respectively, shedding $140 million in combined 24-hour valuation losses.

- Trump’s token valuation dropped to $2.5 billion, down 80% from its $12.8 billion all-time high.

Solana (SOL) memecoin sector valuation declined by $2 billion in 24 hours to hit $8.1 billion in early Asian trading on Tuesday.

Technical indicators highlight key levels to watch as Popcat (POPCAT), Dogwifhat (WIF) and Trump (TRUMP) emerge as the top losers.

Solana memecoins sector valuation drops below $10 billion amid double-speed sell-offs

For mixed reasons, the Solana (SOL) ecosystem has dominated crypto media headlines in recent weeks.

On the positive side, United States President Donald Trump's announcement on Sunday of the inclusion of SOL in a crypto strategic reserve and the CME Group's decision to list SOL futures ETF on the world's largest institutional trading platform improved market sentiment last week.

However, Solana’s gains were due to FXT estates' 11.2 billion SOL payouts to creditors, which flooded the market supply from Saturday, the scheduled date.

Solana memecoins sector performance | Source: Coingecko

While the native SOL token price decline of 20% in the last 24 hours confirms an overwhelming negative, the bearish impact reverberated across the Solana ecosystem, particularly memecoins.

When news of US President Trump’s confirming tariffs on Canada and Mexico broke on Tuesday, the Solana memecoin sector valuation hit $8.1 billion in 24 hours, tumbling 24.5%, double the 12% average crypto market losses on the day.

Will Solana memecoins recover in March 2025 as Trump’s tariff woes trigger 24.5% losses?

Popcat, Dogwifhat and TRUMP, all of the top 10 ranked Solana meme tokens, had posted more than 10% losses at the time of writing, confirming the impact of the cascading market sell-offs.

Technical analysis indicators highlight key levels POPCAT, WIF and TRUMP traders could watch as the Solana memecoin ecosystem makes a false start to March 2025.

POPCAT Price Forecast: Short traders eyeing $0.18 reverse if bulls fail to reclaim $0.25

Market momentum leans bearish, with POPCAT trading at $0.22 after breaking below the midline of its Keltner Channel at $0.25.

The POPCAT price rejection from this level has left the token vulnerable to further downside, with the lower Keltner band at $0.18 now the immediate support. If sellers maintain control, a breach below $0.18 could accelerate losses toward $0.15.

The MACD histogram has flipped into negative territory, with the MACD line crossing below its signal line. This bearish crossover indicates that downward momentum is building, reinforcing the probability of a continued decline.

However, if bulls can stabilize the price above $0.21 and initiate a relief rally, a move back toward $0.25 remains possible.

Volume data shows a surge in sell-side pressure, confirming the bearish bias.

For bulls to regain control, they must drive POPCAT back above $0.25 to negate the current downward trajectory.

A decisive close above this level could shift the momentum back in favor of buyers, potentially pushing the price toward $0.32.

Until then, the risk of a slide to $0.18 remains the dominant scenario.

Dogwifhat Price Forecast: Bears targeting $0.50 breakdown as bearish momentum builds

Dogwifhat price leans bearish, currently trading at $0.61 after being rejected from the Donchian Channel midline at $0.650.

The Parabolic SAR trend indicator reinforces the downward pressure, which remains above WIF’s current price, signaling a continued bearish bias.

If sellers maintain control, a breakdown below the lower Donchian band at $0.52 could accelerate losses toward the psychological $0.50 level.

The Bull-Bear Power (BBP) indicator confirms weakening bullish momentum, printing a negative reading of -0.047. This suggests that sellers remain dominant, making a bearish continuation more likely unless bulls reclaim key levels.

A decisive daily close above $0.65 would be necessary to negate the current downtrend and open a path toward $0.80. However, without strong buying pressure, the likelihood of a deeper pullback remains high.

As volume remains low and sellers dictate price action, WIF risks further downside unless a strong bid emerges to reclaim resistance levels.

If bearish sentiment prevails, a move toward $0.50 remains the dominant scenario in the short term.

TRUMP Price Forecast: $10 breakdown ahead as valuation down 80% from all-time high

Trump’s token valuation has plunged to $2.5 billion, an 80% decline from its $12.8 billion all-time high.

TRUMP price is leaning bearish, currently trading at $12.40 after breaking below the middle Bollinger Band at $13.84.

The rejection from the upper band at $16.89 signals increased downside risk, with the lower band at $10.80 now a potential support. A sustained breakdown below this level could send TRUMP toward the psychological $10 level, where buyers may attempt to defend.

TRUMP/USDT 12-hour chart

The 12-hour RSI sits at 40.56, trending downward after failing to reclaim the neutral 50 mark. This indicates increasing bearish momentum. A bounce from these levels may see the price retest the middle Bollinger Band, but failure to reclaim it would reinforce bearish dominance.

If TRUMP price holds above $10.80 and the RSI stabilizes, a relief rally toward $14 could emerge.

However, without stronger buying volume, the broader downtrend remains intact, leaving TRUMP vulnerable to further losses toward $10.

(This story was corrected on March 4 at 08:01 GMT to say that TRUMP's RSI indicates increasing bearish momentum, not weakening bullish momentum.)

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.