SKALE Network among top-10 staked pools after Coinbase listing, technicals hint at 150% breakout

- SKALE Network’s native token went live on Coinbase after the recent listing announcement.

- The elastic network for Ethereum scaling, SKL, has risen to the top-10 cryptocurrency assets staked by value.

- SKALE price shows a continuation of its uptrend as it breaches past the ascending broadening wedge while on-chain metrics concur.

SKALE Network has seen considerable growth in the last two weeks as it was listed on Coinbase and climbed the top-10 list on StakingRewards. Now, SKL could continue its bull run to another critical supply barrier.

SKL climbs the top-10 list on StakingRewards

Coinbase’s recent listing announcement included altcoins like MATIC, SKL, and SUSHI. Since the listing news, SKL market value has surged by 68% to where it is currently trading.

While this development was occurring on one side, market participants staking on the SKALE network have pushed the blockchain to take over long-standing stablecoin DAI in terms of cryptocurrency assets staked.

At the time of writing, SKALE Network is the ninth-largest cryptocurrency based on the total value staked.

The sudden growth paints a bullish picture for the SKALE Network, at least on a fundamental level. Hence, further adoption of this scaling-focussed blockchain could positively impact Skale Network price.

SKALE Network price could catapult again

SKALE Network price has surged a whopping 500% in under two weeks. SKL is currently trading around the $1 mark, suggesting a continuation of this rally.

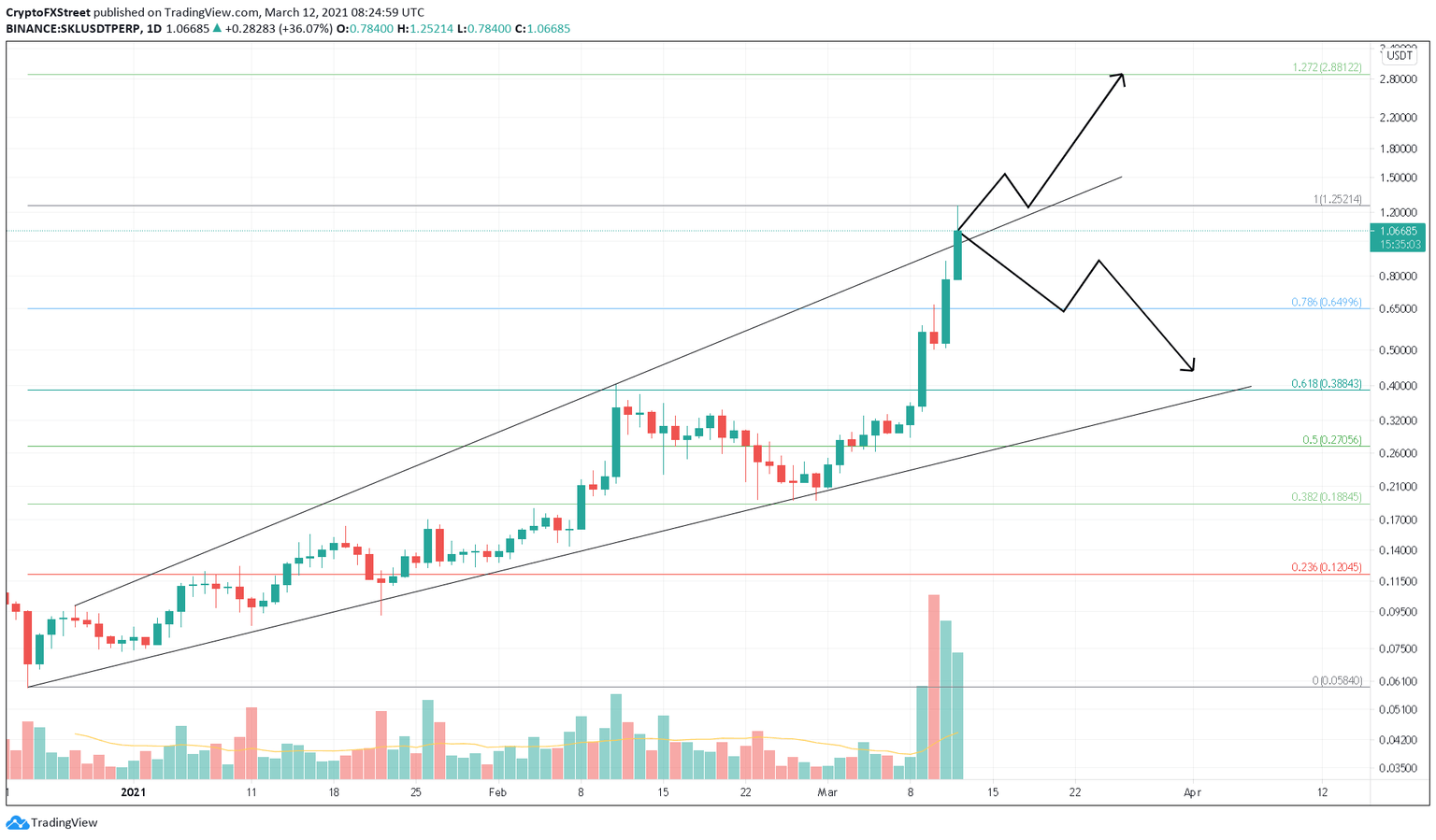

Since late-December 2020, SKL has been creating higher highs and higher lows. An ascending broadening wedge seems to form if the swing points are connected using trendlines.

Due to the recent spike in buying pressure, SKALE Network price has sliced through the setup’s upper trendline.

While this is bullish, a decisive daily candlestick close above $1.25 will confirm the buyer’s intention. In such a case, SKL could surge another 150% towards a key supply barrier at $2.88, which coincides with the 127.2% Fibonacci retracement level.

SKLUSDT 1-day chart

Supporting SKALE Network’s bullish thesis so far is the relation between exchange deposits and on-chain adoption. In the last three months, the exchange deposits have been only 15.29% of its total address activity, suggesting that users aren’t rushing to book profits.

Although only a small increase, the exchange deposits for SKALE have increased by 25% since March 11, which could provide an opportunity for sellers to momentarily take control. Therefore, SKALE Network price has to shatter the supply barrier at $1.25 if it aims to continue its bull run.

SKALE daily active deposits, addresses chart

On the flip side, if the number of SKL tokens transferred to exchanges continues to rise while daily active addresses topple, it may indicate that a correction is underway. A failure to close above the rising wedge’s upper trendline could see a spike in downward pressure.

In such a case, SKALE Network price might drop more than 30% to the immediate demand barrier at $0.64 or the 78.6% Fibonacci retracement level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.