Shibarium transactions surpass milestone, exceed 105 million

- Shibarium total transactions exceeded 105.95 million as of December 14.

- The massive surge in transactions can be attributed to SRC-20 minting activities.

- SHIB yielded nearly 3% weekly gains for holders, Shiba Inu price rallied on Thursday.

Shiba Inu, one of the largest dog-themed meme coins in the crypto ecosystem, recently surpassed a key milestone. Shibarium, Shiba Inu’s scaling solution, has recorded a total of 105.95 million transactions as of Thursday.

Also read: XRP price rally to $0.74 likely as crypto market recovers post FOMC meeting

Shiba Inu’s scaling solution hits milestone in transaction count

According to data from Shibarium.io, the total transactions on Shibarium have surpassed 105.95 million. The total transaction count has crossed 105,955,656. A total of 1.3 million wallet addresses have interacted with Shibarium.

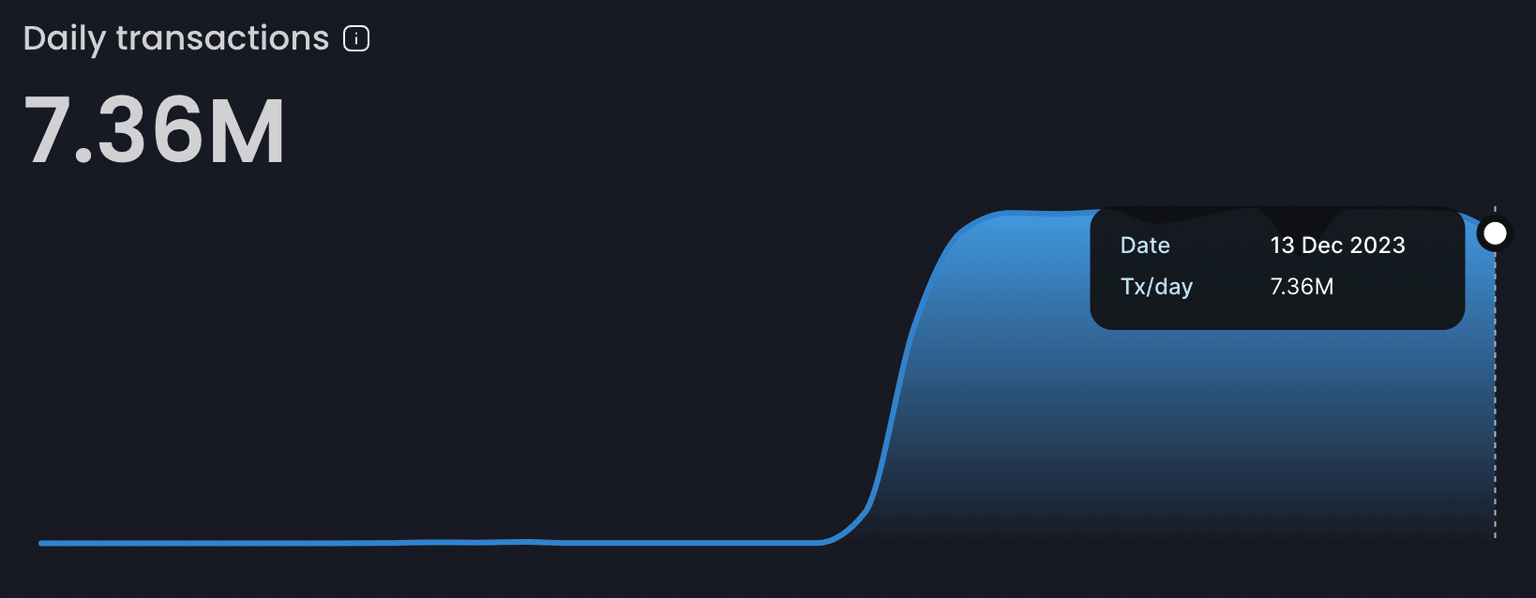

The daily transaction count hit 7.36 million, as on December 14. These metrics point to a rising adoption of Shiba Inu ecosystem tokens, SHIB and BONE among crypto market participants.

Daily transactions on Shibarium. Source: Shibariumscan.io

The massive surge in transactions can be attributed to SRC-20 minting activities. This supports inscriptions and ordinals on Shibarium, similar to BRC-20 in Bitcoin. WOOF is one of the first SRC-20 projects on Shibarium.

According to on-chain data from crypto intelligence tracker Santiment, there was a spike in whale transactions valued at $100,000 and higher on December 13, the number exceeded 38. There is an uptick in active addresses and volume in SHIB, as seen on Santiment.

Shiba Inu whale transaction count, volume, active addresses. Source: Santiment

Shiba Inu’s supply on exchanges has hit its lowest level in six months, another metric supporting SHIB price gains.

Shiba Inu supply on exchanges. Source: Santiment

At the time of writing, SHIB price is $0.00000995 and the meme coin has yielded nearly 3% weekly gains for holders.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B18.38.37%2C%252014%2520Dec%2C%25202023%5D-638381570867433508.png&w=1536&q=95)

%2520%5B18.37.45%2C%252014%2520Dec%2C%25202023%5D-638381572890345290.png&w=1536&q=95)