Shiba Inu price retraces as SHIB bulls plan 22% ascent

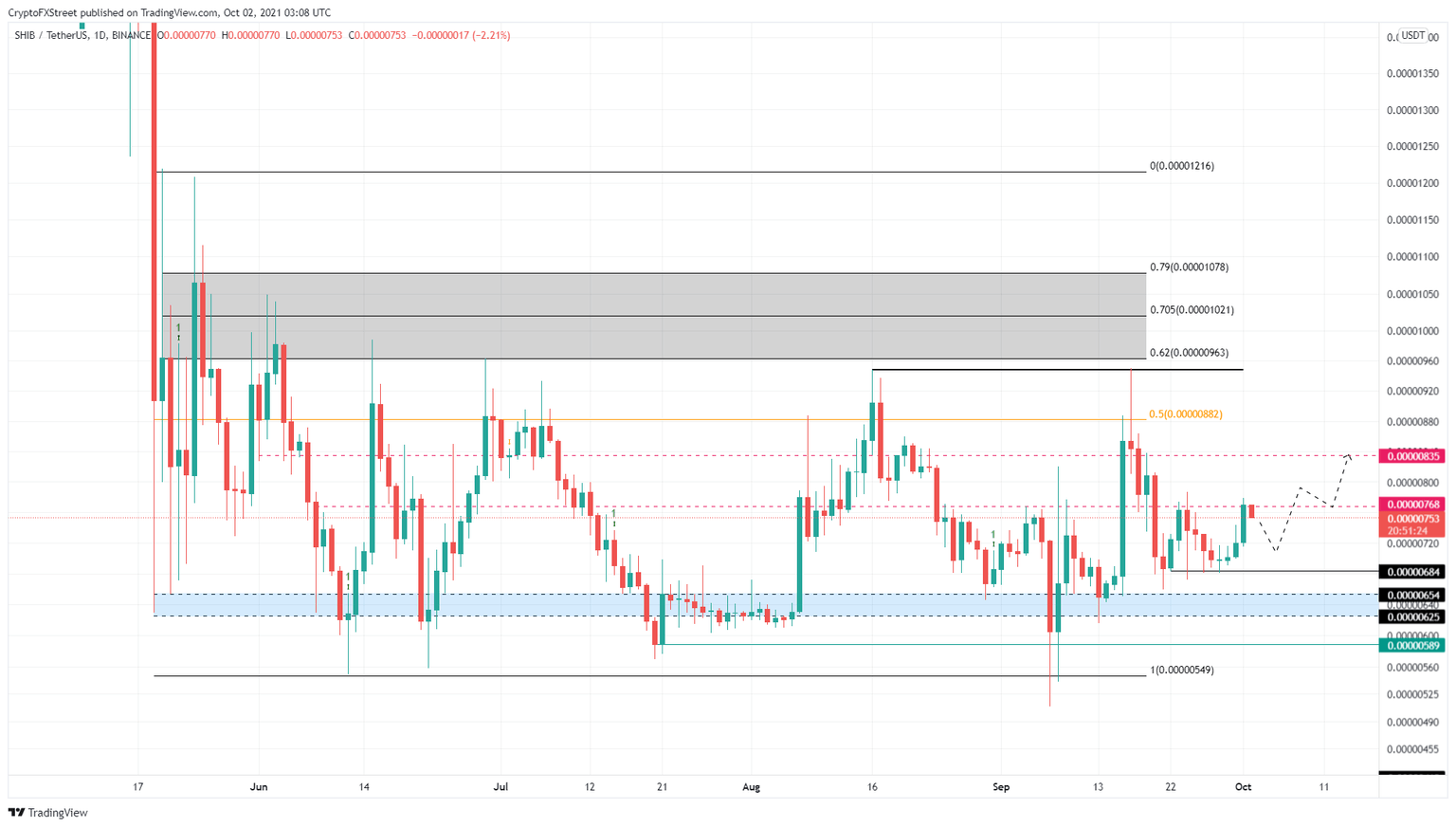

- Shiba Inu price rose 10% over the past three days and retested the $0.00000768 resistance level.

- The current retracement is likely to be followed by an 18% ascent to $0.00000835.

- In some cases, SHIB might retrace to the support area, ranging from $0.00000625 and $0.00000654.

Shiba Inu price has narrowed its consolidation within a bigger range over the past few days. However, the overall trend appears to be bullish due to the formation of consecutive higher lows.

Shiba Inu price faces momentary blockade

Shiba Inu price rose roughly 10% since September 28 as it encountered the $0.00000768 support level. The bulls failed to breach this resistance level and are currently leading to the start of a retracement.

If the overall market structure flips bullish like yesterday, investors can expect Shiba Inu price to slice through this barrier and continue heading higher. While this is an optimistic scenario, a likely outcome would be a pullback to $0.00000684.

This correction gives the buyers a chance to recuperate and restart the uptrend. Assuming the bulls make a comeback, market participants can expect SHIB to slice through $0.00000768 and make a run at $0.00000835.

This move would constitute a 22% ascent.

SHIB/USDT 1-day chart

On the other hand, if Shiba Inu price fails to hold above $0.00000684, it will lead to a retest of $0.00000654 or $0.00000625, where the buyers can have another go at the bull rally.

However, if neither of the support floors mentioned above fails to hold up, the dog-themed cryptocurrency will likely produce a decisive close below $0.00000625, invaliding the bullish thesis.

In such a case Shiba Inu price could venture lower and retest the range low at $0.00000549.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.