Shiba Inu price recovers after brutal sell-off, as SHIB eyes 28% advance

- Shiba Inu price showed strength as it bounced off a crucial support level at $0.00000549.

- SHIB looks ready to advance roughly 28% from its current position.

- A decisive close below the $0.00000549 support level will invalidate the bullish thesis.

Shiba Inu price saw a massive buying pressure that sliced through a stiff resistance level. Although the uptrend failed to sustain itself, the September 8 daily candlestick closed on a positive note.

As cryptocurrency slowly recovers after the September 7 crash, SHIB looks ready to do the same.

Shiba Inu price takes a jab at rallying

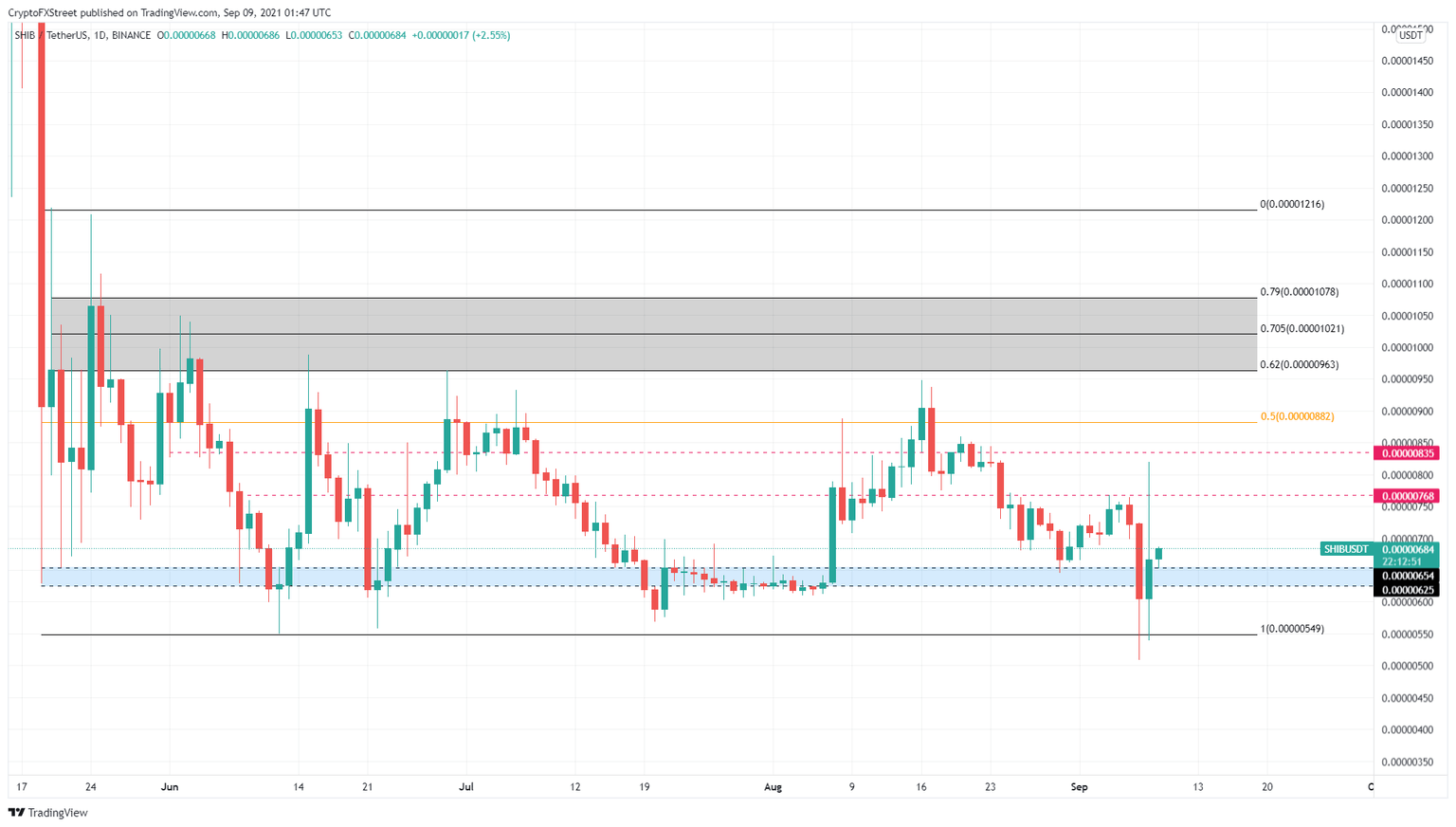

Shiba Inu price dipped below the range low of $0.00000549 on September 8 but recovered swiftly. At one point in time, SHIB rose roughly 35%, but the inability of the buyers to sustain this movement pushed it lower. Regardless, Shiba Inu price still shows promise of an ascent.

If the uptrend continues, the meme coin needs to slice through the $0.00000768 and $0.00000835 ceilings. Doing so will open the path up to the middle point of the trading range at $0.00000882, coinciding with the 50% Fibonacci retracement level. This move would constitute a 28% upswing.

If the buying pressure continues to pour in, Shiba Inu price will take a jab at the high probability reversal zone ranging from $0.00000963 to $0.00001080.

SHIB/USDT 1-day chart

While things seem to be going well for Shiba Inu price, a failure to go higher will indicate a problem. If the buyers fail to keep the asset above the support zone, ranging from $0.00000625 to $0.00000654, it will reveal that the sellers are still in control.

However, a decisive close below the range low at $0.00000549 will invalidate the bullish thesis and open the path for further descent.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.