Shiba Inu Price Analysis: SHIB retraces Coinbase rip, as crypto market selling intensifies

- Shiba Inu price dropped 30% before finding support at the 50 four-hour simple moving average (SMA).

- Four-hour Relative Strength Index (RSI) has released the notable overbought condition in SHIB.

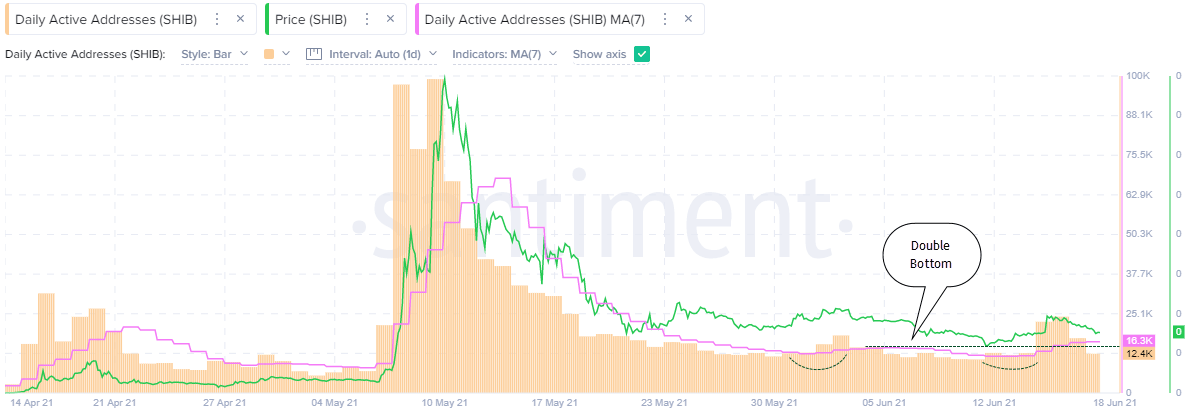

- Daily active addresses trigger a double-bottom pattern, suggesting renewed interest in the rookie cryptocurrency.

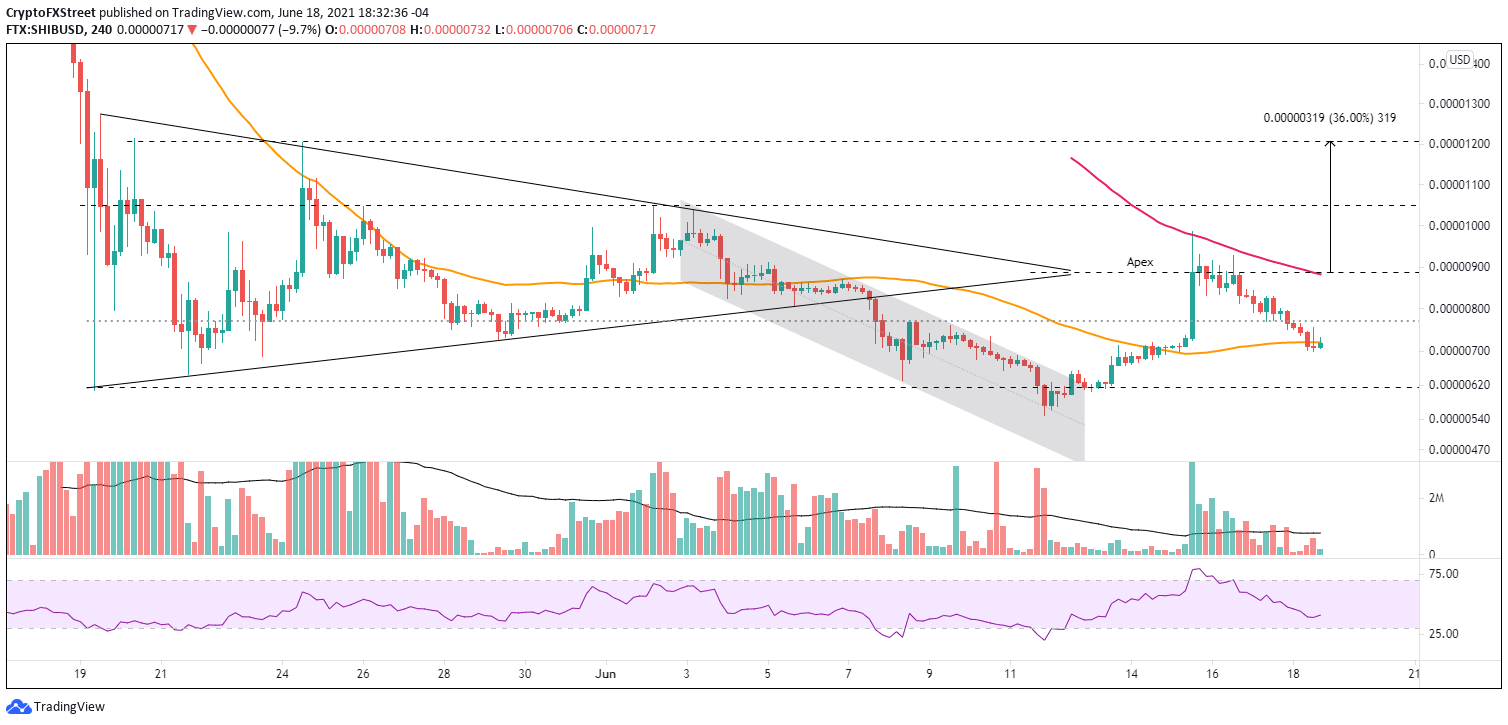

Shiba Inu price had been locked in a frustrating descending channel before the brief June 11 sweep below the May 19 low, effectively clearing the weak holders and pockets of anxiety. The initial rebound gained momentum on the Coinbase Pro listing news until two crucial resistance levels, articulated on the four-hour chart, halted the rally. Now, SHIB is trying to decide whether the rip was a new beginning or a one-hit-wonder.

Shiba Inu price needs to get up and fight back if investors are to prosper

From the June 11 low to the June 15 high, Shiba Inu price successfully tested the May 19 low of $0.00000607, shattered a descending channel, overcame notable resistance at $0.00000770, briefly surpassed the apex of a multi-week symmetrical triangle at $0.00000888 and tagged the 200 four-hour SMA at $0.00000978. Furthermore, SHIB climbed approximately 80%, thereby shaking off skepticism dictated by the previous bearish price structure.

Since the June 15 high, Shiba Inu price has declined almost 30%, leaving behind the symmetrical triangle apex and the important $0.00000770 level, before achieving support at the 50 four-hour SMA at $0.00000721. The pullback to the moving average has retraced the entire Coinbase rally, and it undermines a new bullish SHIB narrative. Still, it has confirmed the key resistance levels that may impede a complete turn from the price awkwardness that has reigned for the last month.

The overbought condition signaled by the four-hour RSI has been released, improving the momentum conditions for a new, spirited rally higher.

To start, Shiba Inu price needs a close above $0.00000770 and the intersection of the 200 four-hour SMA at $0.00000883 with the symmetrical triangle apex at $0.00000888. If successful, SHIB will be poised to test the June 2 high at $0.00001048, representing an 18% gain from the intersection.

Additional resistance for Shiba Inu price includes the May 20 high at $0.00001214, delivering a 36% gain from the intersection mentioned above.

SHIB/USD 4-hour chart

If SHIB fails to hold the 50 four-hour SMA at $0.00000721 on a closing basis, it would deal a blow to the new rally attempt and raise the probabilities that Shiba Inu price will revisit the May 19 low.

An improving on-chain metric for SHIB is the number of daily active addresses (DAA). Daily active addresses show the number of unique addresses involved in SHIB transactions daily. In addition, the metric indicates the daily level of crowd interaction or speculation with the digital asset. Higher readings indicate investor interest and the opposite with lower readings.

The 7-day average of the metric triggered a double bottom on June 16, hinting at a renewed interest in SHIB after being in the doldrums for the last month.

SHIB Daily Active Addresses (DAA) - Santiment

SHIB investors were primed following the announcement that one of the largest cryptocurrency exchanges would be listing the altcoin to trade. However, the instant euphoria has quickly faded, and now it is a struggle for Shiba Inu price to hold a key intra-day moving average. It demonstrates the weight of an unstable cryptocurrency market. Still, more importantly, it reflects the challenges of an experimental altcoin trying to make the turn higher after a significant decline and frustrating bottoming process.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.