Sei Price Forecast: SEI rallies as Wyoming selects protocol for WYST stablecoin pilot

- Sei extends gains above $0.21, decoupling the token from the broader crypto market amid low sentiment and macroeconomic uncertainty.

- The Wyoming Stable Token Commission selects Sei Network as a candidate blockchain for the WYST, the first fiat-backed stablecoin issued by a US state.

- Geopolitical tensions and potential profit-taking could cap Sei's rally, targeting highs around $0.26.

Sei (SEI) price is edging higher, trading at around $0.21 at the time of writing on Friday. The token, designed for Decentralized Finance (DeFi), high-frequency trading, and real-time digital exchanges, is up over 10% on the day and has sustained a 16% surge in the past 24 hours.

Sentiment surrounding Sei soared on Thursday after the announcement of the protocol's selection as a candidate for the Wyoming Stable Tokens (WYST), a stablecoin issued by the state of Wyoming.

Sei ranks above competition for stablecoin adoption

The Wyoming Stable Token Commission has selected two blockchains, including Sei and Aptos, for the final round of piloting of the WYST stablecoin. Sei, with a score of 30, ranked slightly below Aptos (32) and above other competitors, including Avalanche (27), Sui (26), Base (25), Algorand (21) and Ripple's XRP Ledger (XRPL). The commission considered, among other things, blockchain performance, user base, security, uptime and the core infrastructure.

WYST is a fiat-backed stablecoin and one of the first government-based pilots adopting blockchain technology. According to an X post, the stablecoin "will be deployed using LayerZero," a technology that supports communication and data transfer across blockchains.

The Wyoming Stable Token Commission was established in March 2023 and was tasked with issuing WYST. According to the official website, WYST is redeemable at a one-to-one (1:) ratio with the US Dollar (USD).

"We are excited to announce that the Wyoming Stable Token Commission has entered a critical testing phase, marking a significant step toward launching the first state-issued stable token in the U.S. This milestone underscores Wyoming's commitment to innovation in digital assets," the Wyoming Stable Commission said in a statement.

Sei's selection as a blockchain candidate for WYST comes after the advancement of the Guidance and Establishing Innovation for US Stablecoins (GENIUS) bill from the US Senate to the House, pending deliberation ahead of the final vote.

The adoption of the stablecoin bill as the law would mark a significant milestone in regulating the fast-growing sector, with the potential to boost institutional adoption, innovation and transparency.

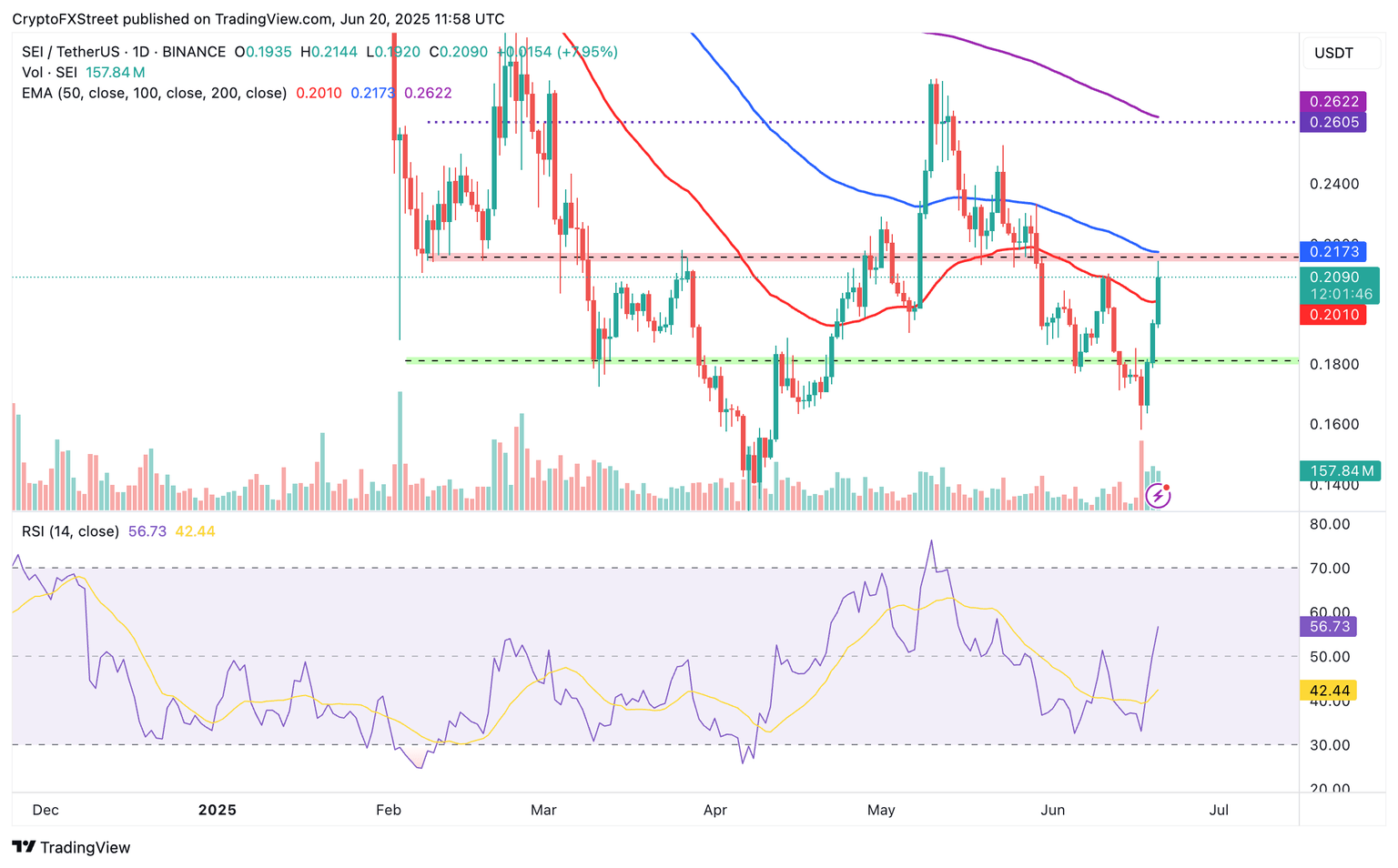

Technical outlook: Sei eyes $0.26 backed by strong sentiment

Sei's price stabilized at $0.15 support earlier this week after a sharp, nearly 43% drop from its May peak of $0.27. The uptick that followed built on bullish momentum and a spike in interest in the token fueled by the stablecoin adoption news.

Sei extended the uptrend, reaching intraday highs of $0.21 while reclaiming the position above the 50-day Exponential Moving Average (EMA), currently at $0.20.

The Relative Strength Index's (RSI) sharp climb above the midline from near oversold territory indicates a strong bullish grip.

Should the RSI approach the overbought area, the path of least resistance would remain firmly upward, increasing the chances of Sei paring losses with resistance at $0.26.

SEI/USDT daily chart

Despite the bullish outlook, traders should temper expectations, especially with the 100-day EMA resistance around $0.21. Failure to breach this hurdle could destabilize the bullish structure, possibly reflecting a lull sentiment in the broader crypto market and potential profit-taking.

Other key levels to keep in mind while trading Sei are the 50-day EMA at $0.20, which is likely to absorb sell-side pressure, and the demand area at $0.18, tested as support in early June.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren