SEC acknowledges Trump’s truth social Bitcoin and Ethereum ETF

The US Securities and Exchange Commission has accepted Trump Media’s application for a Bitcoin and Ethereum exchange-traded fund, starting the clock for the agency to approve or reject the proposed fund.

The ETF proposes offering investors exposure to Bitcoin and Ether through shares listed on NYSE Arca backed by the crypto assets, with 75% allocated to Bitcoin and 25% to Ether, according to the filing.

Foris DAX Trust Company, doing business as Crypto.com, will act as the custodian, and asset management firm Yorkville America Digital will act as the fund’s sponsor.

The filing comes amid a flood of other crypto ETF applications, and the SEC is reportedly exploring a simplified listing structure for crypto ETFs that would automate a significant portion of the approval process.

Truth Social crypto ETF tracks Bitcoin and Ether

Truth Social proposes that the net asset value of its ETF will be evaluated each day with the Bitcoin portion based on the CME CF Bitcoin reference rate, which is calculated by aggregating trade data from multiple major crypto exchanges.

The Ether in the fund will use the Ether CME CF reference rate to evaluate its value “unless otherwise determined by the Sponsor at its sole discretion.”

Truth Social first filed an S-1 form with the SEC for the dual crypto ETF on June 16.

Fidelity Solana ETF delayed again

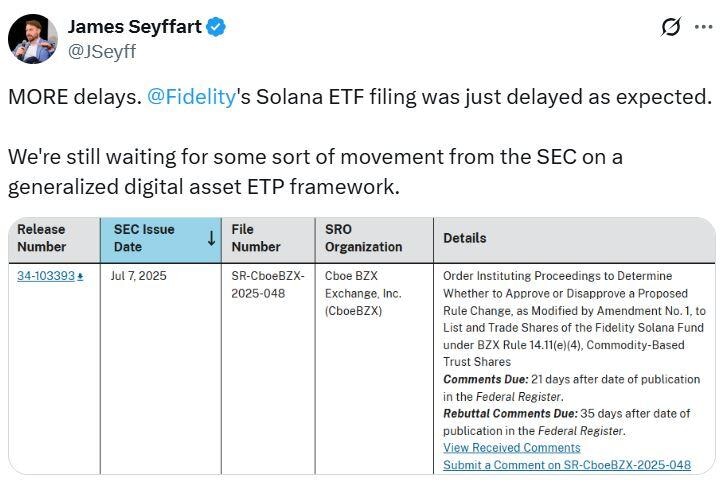

Meanwhile, the SEC has delayed making a decision on Fidelity’s proposed spot Solana ETF, opening up a new public comment window with responses requested within 21 days and rebuttals within 35 days.

Cboe BZX Exchange, a US securities exchange, first requested permission to list a proposed Fidelity ETF holding Solana in a March 25 filing.

In an X post on Monday, Bloomberg ETF analyst James Seyffart said it was “delayed as expected.”

Source: James Seyffart

“We’re still waiting for some sort of movement from the SEC on a generalized digital asset ETP framework,” he added.

Positive signs of SEC movement on crypto ETPs

Seyffart said in another X post on Monday that reports of the SEC asking issuers of SOL spot ETFs to amend and refile applications by the end of the month are another positive sign of “SEC movement” on potential new crypto exchange-traded products.

“Keep in mind that this would just be more amendments and more back and forth, NOT approvals, as I’ve seen some people hint. Pretty much any sort of interactions between SEC and issuers/exchanges should be viewed positively,” he added.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.