SafeMoon price support failed to hold increasing risk of 30% drop

- Safemoon price has fallen below a primary support zone, pointing to lower prices.

- Restest of the breakout lower failed to recover Safemoon above support.

- 30% drop ahead for SafeMoon going into the weekend.

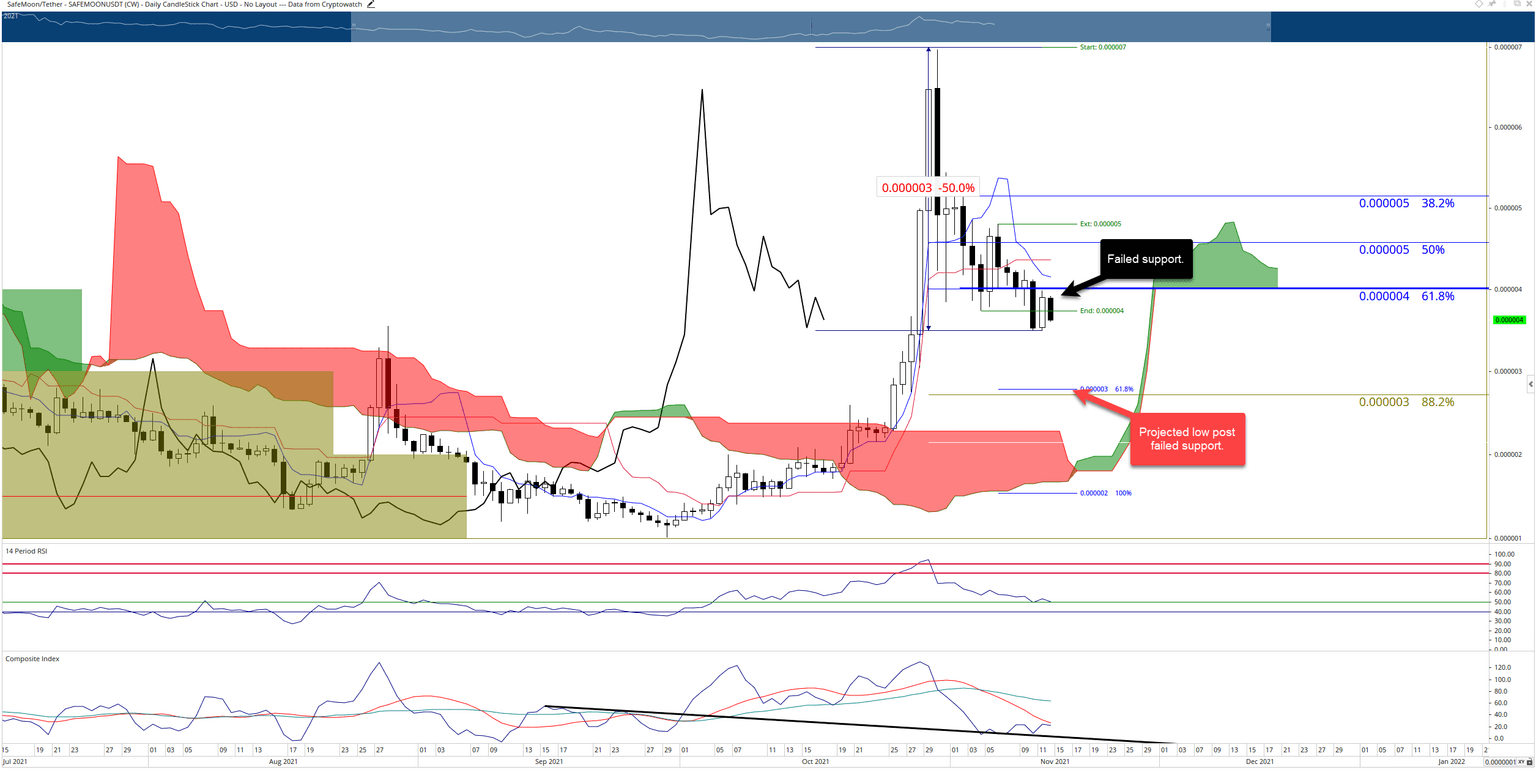

SafeMoon price has not been forgiving to any late entry buyers. After reaching a new six-month high of $0.0000070 on October 29th, SafeMoon has had a steady sell-off with little to no reprieve for the bulls. SafeMoon is currently down nearly 50% from the October highs – and will probably move even lower.

SafeMoon price eyes a steep drop going into the weekend; little support exists between $0.0000039 and 0.0000028

SafeMoon price had one tough support level for sellers to break through at 0.0000039 – which contains the weekly Tenkan-Sen (thick, blue ray) and the 61.8% Fibonacci retracement. For seven straight trading sessions, bears assaulted that support level and were finally able to crash through it during Wednesday’s sell-off. A retest of that breakout happened on Thursday, but that’s where it halted. So further downside pressure is now likely.

After failed support, the projected target low is a confluence zone of the 61.8 Fibonacci expansion and 88.2% Fibonacci retracement levels at $0.000028. That would represent a 30% drop from the Friday open. However, some support may come in at $0.0000030 as it is a robust psychological number and the top of a high volume node.

SafeMoon/USDT Daily Ichimoku Chart

There is a Kumo Twist that occurs on November 17th that may save SafeMoon from any extended sell-offs. If SafeMoon price continues to trend lower near November 17th, that could trigger a bullish corrective move. Kumo Twists are often points of reversal for price action, especially if an instrument is trending into the date of the Kumo Twist. Any bullish response around November 17th will likely see a retest of the original support – now turned resistance – at $0.0000039.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.