SafeMoon price crashes by 18% as it officially files for Chapter 7 bankruptcy

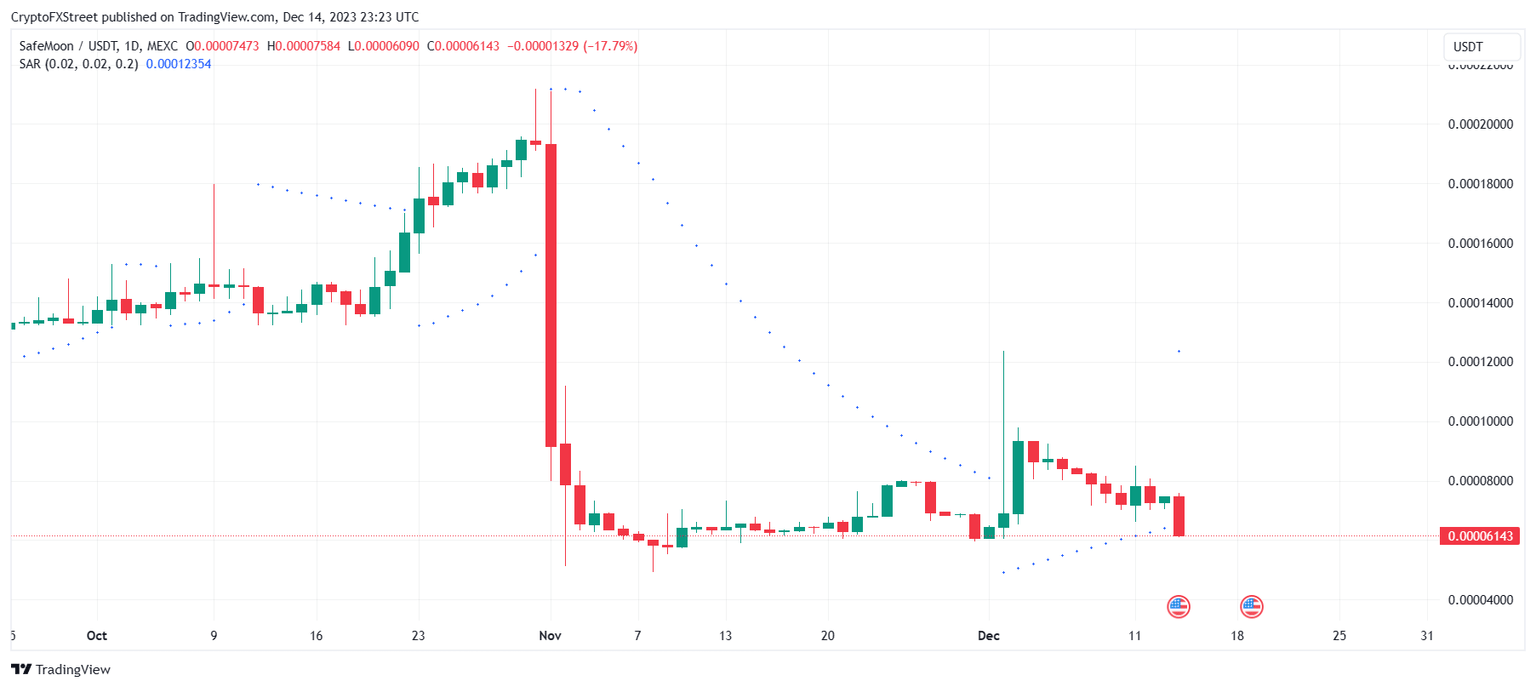

- SafeMoon price has been on a decline for the past week, falling from $0.000100 to $0.000061.

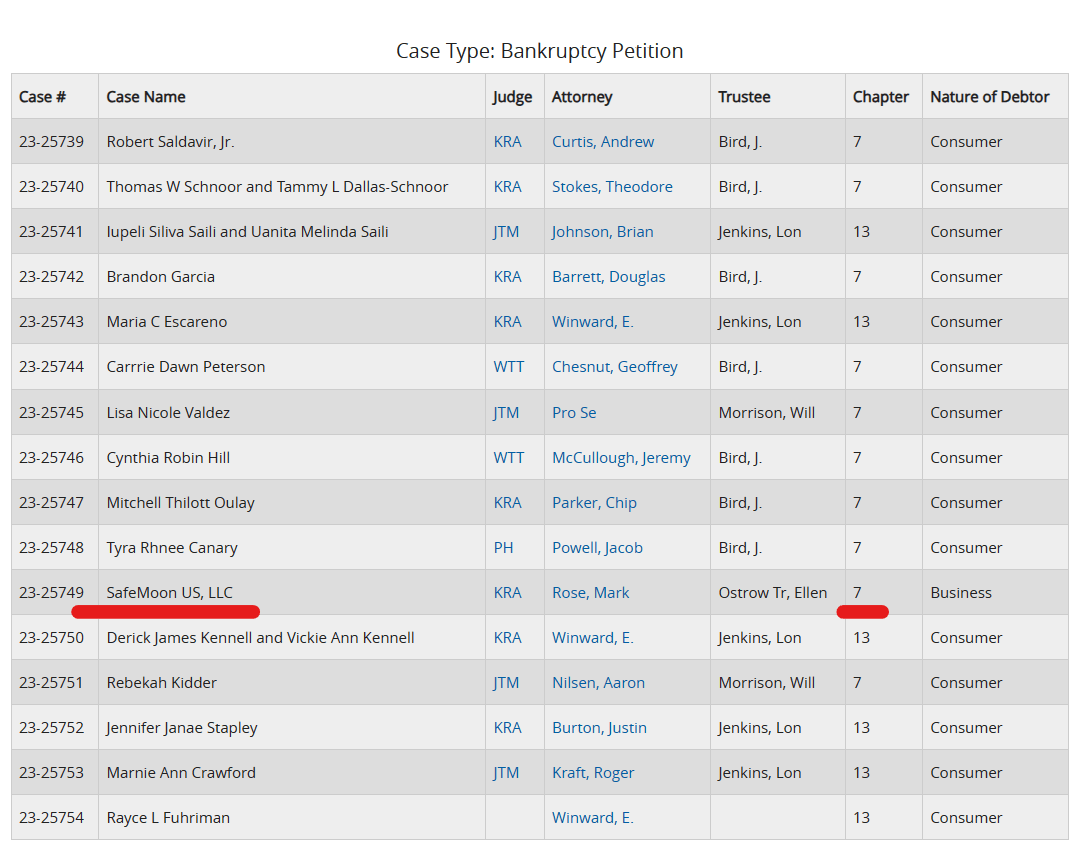

- The bankruptcy was confirmed after SafeMoon LLC's name popped up on the US court website.

- Earlier this year, SafeMoon's CEO and CTO were arrested by US DOJ for defrauding their customers.

SafeMoon price took the brunt on Friday after the company seemingly collapsed and filed for bankruptcy. The filing came a little over a month and a half after the US Department of Justice arrested key members of the company for defrauding their customers for millions of dollars.

SafeMoon goes bankrupt

SafeMoon began trending in the early hours of Friday after reports of an internal message discussing bankruptcy began making the rounds. Per the message, the Chief Restructuring Officer, Kenneth Ehrler, noted that SafeMoon had been facing a number of operational and financial challenges.

The message further stated that as a result of these challenges, the company could not continue its business operations and would be filing for Chapter 7 bankruptcy. This was confirmed on Friday after SafeMoon appeared on the filings page of the United States Bankruptcy Court District of Utah website.

SafeMoon bankruptcy

While an official announcement is awaited, the crypto market bid goodbye to the company, stating that this was bound to occur as the company was operating on stolen funds.

Earlier in November, SafeMoon Chief Executive Officer (CEO) John Karony and Chief Technology Officer (CTO) Thomas Smith were arrested by the US Department of Justice. The founder at the time was at large but was later arrested and charged with defrauding their customers by spending investors' funds for personal use.

This impacted the price considerably back then, marking the single largest decline of the year, which is now followed by the crash observed in the past 24 hours.

SafeMoon price crashes, again

SafeMoon price at the time of writing was down by 17.79%, trading at $0.000061. The crash added to the downtrend noted in the past week, which brought the coin down from $0.000080.

The plunge registered in the last 24 hours is the second biggest single-day decline.

SFM/USD 1-day chart

SFM first went down by nearly 52% in one day after the US DOJ and Securities and Exchange Commission (SEC) announced charges against the company and arrested its key executives.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.