SafeMoon price bullish breakout challenged by market circumstances

- SafeMoon bulls break the downtrend firmly, triggering a strong rally.

- As global markets are again on the back foot, the bullish flag in Safemoon to be considered a firm sign.

- Expect Bulls to face some profit-taking at $0.00000400 at the 50% Fibonacci retracement level.

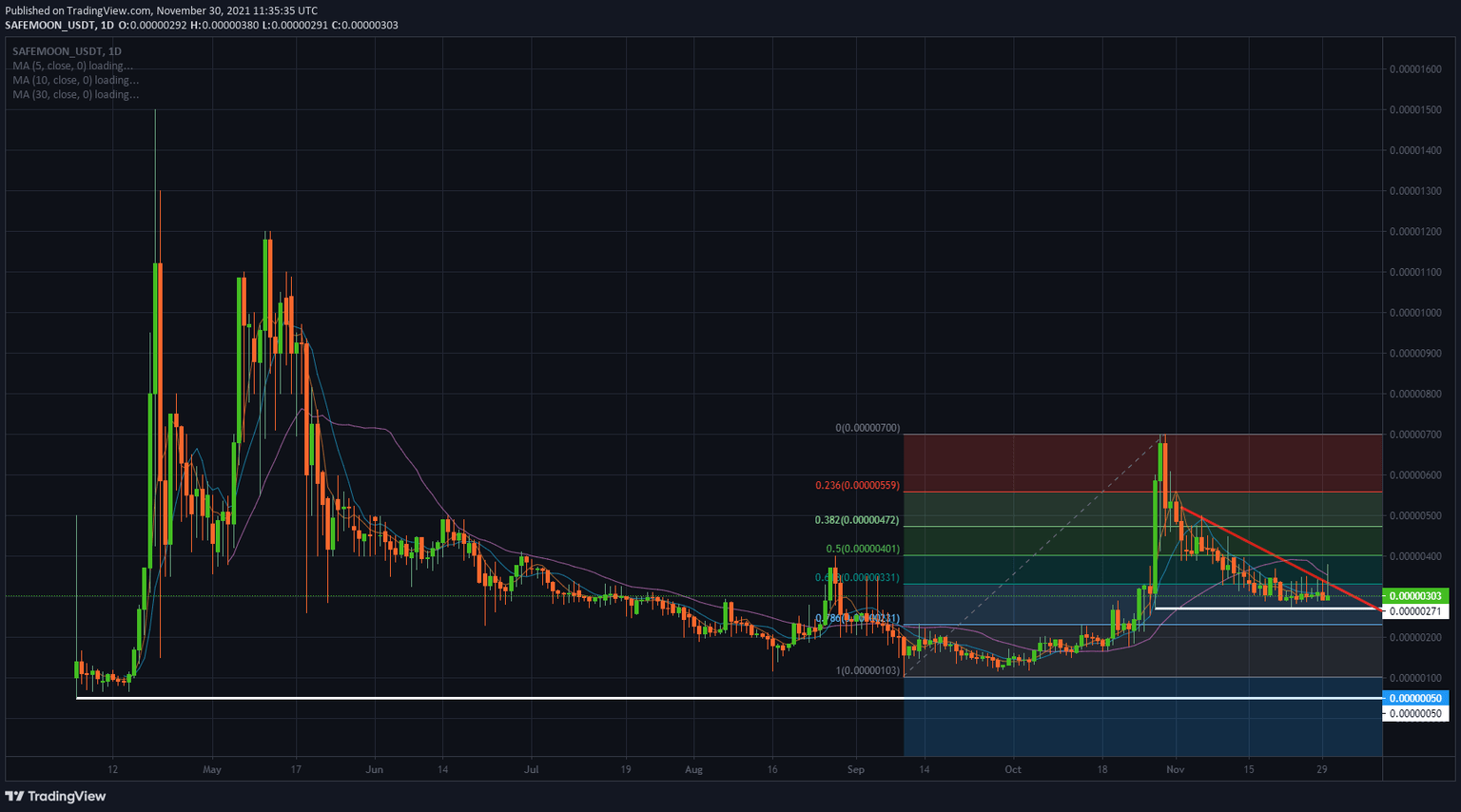

SafeMoon (SAFEMOON) price has been on the back foot for almost the full month of November. As concerns on Covid variants rattle markets, investors are looking for gems to invest in, which sparked a massive buy-side explosion in SafeMoon price this morning under challenging circumstances. As bulls have broken the downtrend, expect a reboot of the uptrend from September, targeting $0.00000700 as the final profit target, holding 116% profit.

SafeMoon bulls squeeze bears out preliminary of their short positions

SafeMoon price has been under siege of the bears throughout November, with a 50% devaluation at one point. It looked like SafeMoon price action would complete the bearish triangle, break $0.00000271 and trade even lower towards $0.00000103. Given the recent turn of events in global markets with sparks of concerns on the recovery story, this could well have been the case. Instead, investors are scouring the markets, looking for exciting assets that are trading at a discount.

With SafeMoon as one of those gems in cryptocurrencies, quoting at a significant discount, the bullish breakout comes as no surprise. And with current market sentiment as a headwind, the bullish sign could have been even more violent in its pop to the upside. Essential to see next is if bulls can keep their act together and close above that red descending trend line to keep the momentum going.

SAFEMOON/USD daily chart

The first target to the upside will be $0.00000400, the 50% Fibonacci retracement level between the low and high from September. If bulls can keep current sentiment going, only the 23.6% Fibonacci at %0.00000559 looks to be a potential problem before hitting $0.00000700 and completing the Fibonacci retracement. Should market turmoil persist, expect investors to pull their funds and see a quick nose dive in SafeMoon price to $0.00000100, the swing low from September.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.