Ripple's XRP surges 30% as crypto market stages recovery

- XRP investors have realized nearly $2 billion in profits in the past three days following Trump's tariff on Canada, Mexico and China.

- XRP's weighted sentiment and funding rates have plunged to significant low levels, indicating a potential bottom.

- XRP set to reclaim the $3.00 psychological level but faces a descending trendline resistance.

Ripple's XRP is up 30% in the early hours of Tuesday as bulls are looking to stage a recovery from the recent crypto market crash. While on-chain data shows prevailing bearish sentiment in the market, bulls could return to help the remittance-based token secure a move above the $3.00 psychological level.

XRP on-chain data reveals extent of recent market crash

Since the crypto market crash after Trump announced tariffs on Canada, Mexico and China, XRP investors have realized nearly $2 billion in profits in the past three days — one of the highest in its history.

XRP Network Realized Profit/Loss. Source: Santiment

The selling activity was dominated by whales across the long-term and short-term holders’ cohort, as indicated by spikes in the whale transaction count and Dormant Circulation.

XRP Whale Transaction Count (>$100K and >$1M). Source: Santiment

The high selling activity has sent XRP's Weighted Sentiment — which measures the overall average social volume relative to its negative/positive bias — to lows last seen in November.

XRP Weighted Sentiment. Source: Santiment

XRP Funding rates also plunged to lows last seen in August. Funding rates are periodic payments between traders to ensure crypto derivative contracts maintain parity with their underlying spot counterparts.

XRP Funding Rates. Source: Coinglass

It's important to note that prices often tend to go in the opposite direction when such high negative sentiments drive the crowd. This partly explains why XRP has staged a comeback, gaining over 30% in the past 24 hours.

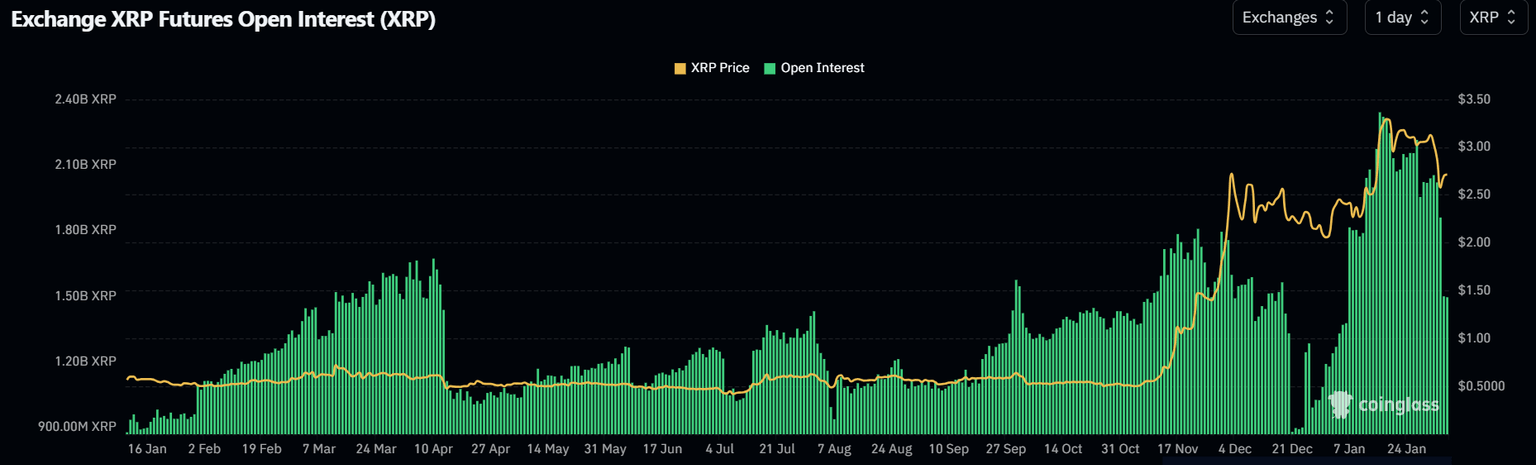

However, XRP bulls need to return to the market to strengthen the comeback as XRP's open interest has failed to rise with the market after plunging from 2.05 billion XRP to 1.50 billion XRP. The low interest rate shows a reluctance among investors to hold large positions in the remittance-based token.

XRP Open Interest. Source: Coinglass

XRP eyes recovery above $3.00 psychological level

XRP saw a sharp decline below the $2.00 psychological level on Monday, sparking $103 million in futures liquidations in the past 24 hours - its highest single-day futures liquidations in the current market cycle, per Coinglass data. The total amount of liquidated long and short positions accounted for $74.67 million and $28.28 million, respectively.

Following the general crypto market recovery, XRP is looking to reclaim the $3.00 psychological level. A successful move above this level could see the remittance-based token stage a move to tackle its seven-year high resistance of $3.40.

XRP/USDT daily chart

However, it faces a descending trendline resistance, extending from January 16. If XRP clears this resistance alongside the $3.40 level, it could rally to a new all-time high above $3.55.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are trending upward, with the latter crossing above its neutral level. This indicates rising bullish momentum.

A daily candlestick close below the $1.96 support level will invalidate the bullish thesis.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi

%2520%5B03.22.17%2C%252004%2520Feb%2C%25202025%5D-638742341217334189.png&w=1536&q=95)

%2520%5B03.35.51%2C%252004%2520Feb%2C%25202025%5D-638742341726695800.png&w=1536&q=95)

%2520%5B02.05.26%2C%252004%2520Feb%2C%25202025%5D-638742342172438574.png&w=1536&q=95)