Ripple Soars as Bitcoin and Altcoins Drift

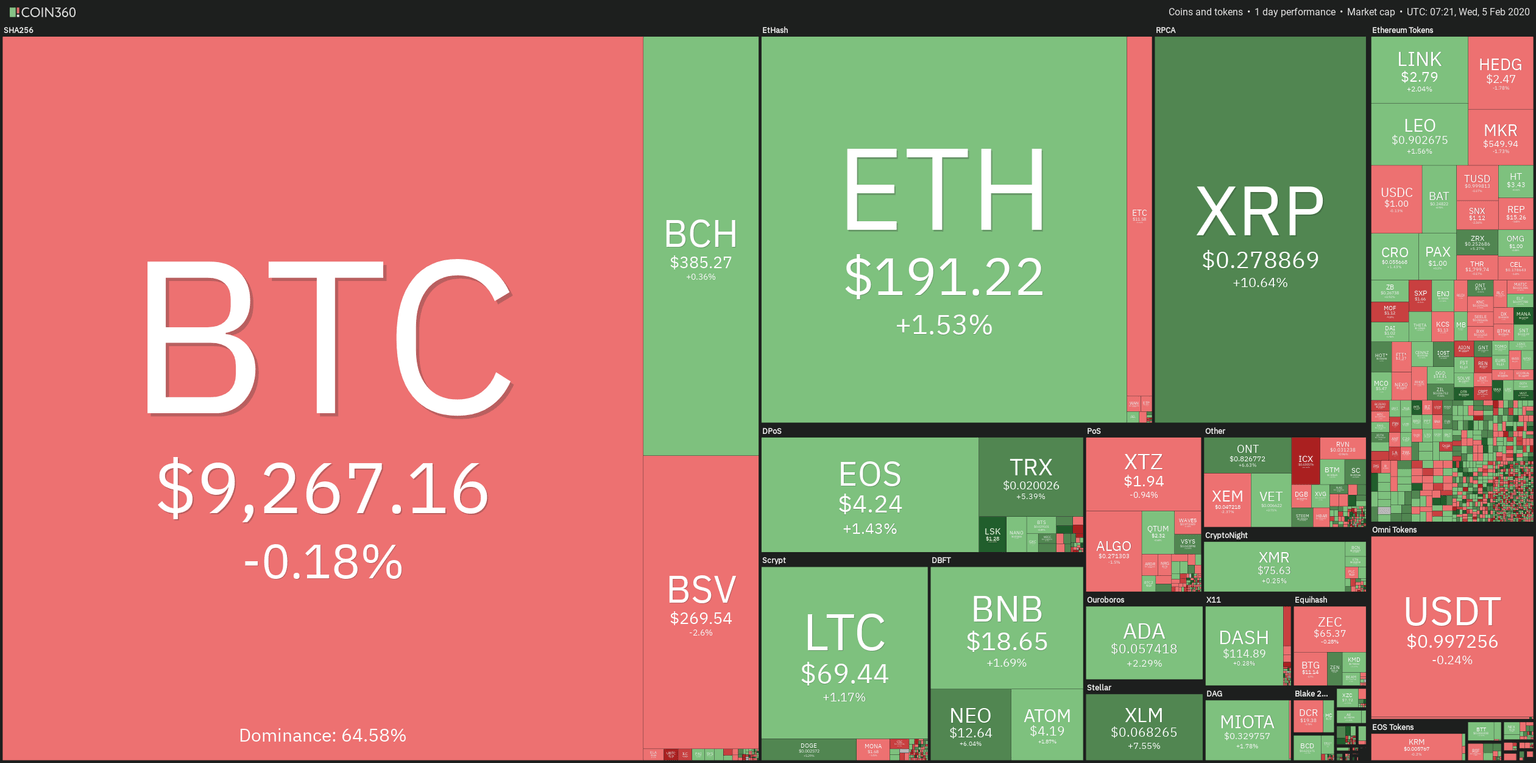

The last 24 hours have seen Ripple (+10%) soar over $0.277, setting its highest price in months whereas Bitcoin(-0.18%) is still looking for buyers with its dominance down to 64.6 percent. Ethereum (+1.52%) is a bit more bullish, and NEO (+5.78%), Stellar Lumens (+7.26%, DogeCoin (+6.49%), and Lisk (+15.5%) were joining Ripple's party.

The Ethereum tokens had a mixed day, with LINK (+1.92%), LEO (+1.56%) and CRO ( +1.51$) recovering, HEDG (-1.87%) and MKR (-1.83%) and REP (-3.87%) shedding off some gains.

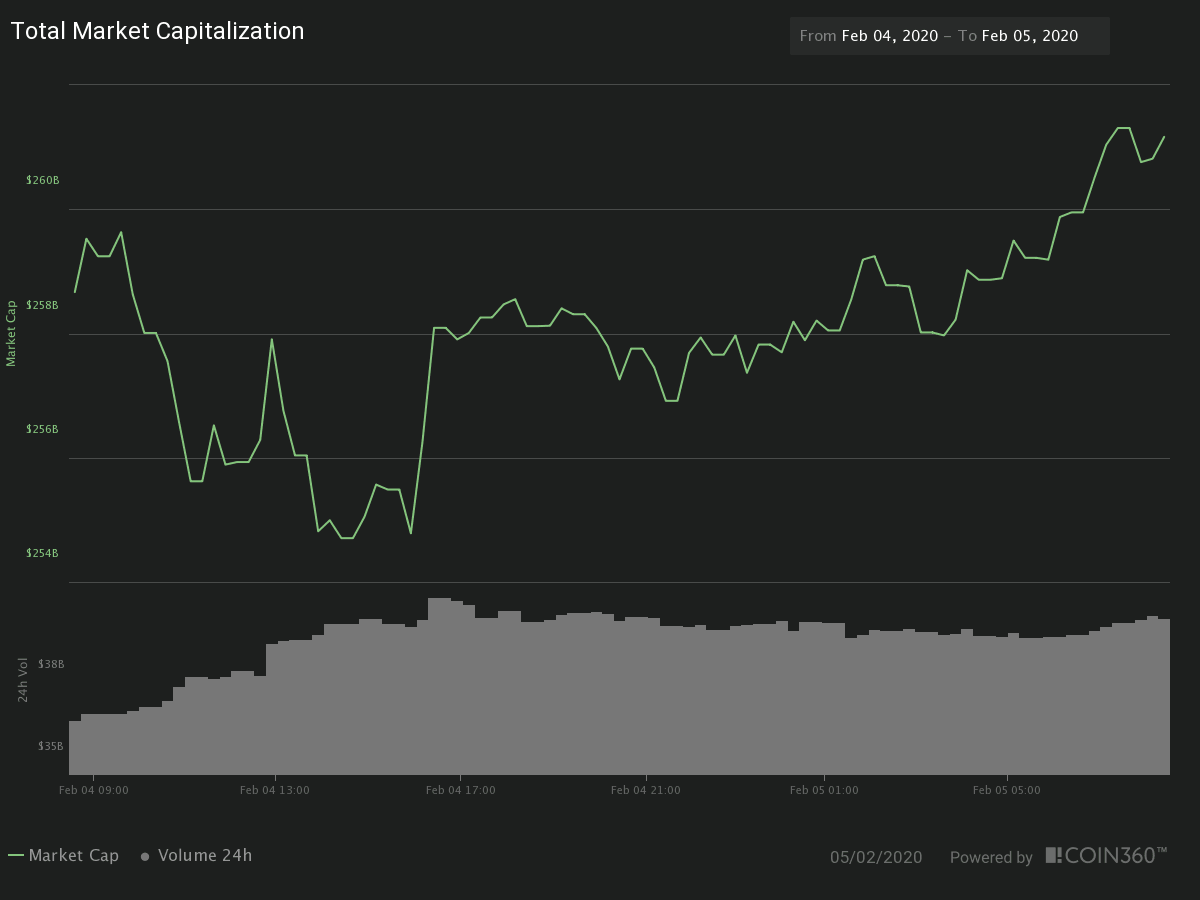

The crypto sector Market cap is currently $261.165 billion, up by 0.5 percent from yesterday, while the traded volume in the last 24 hours was $40.2 billion, up 12.65 percent from yesterday's value.

Hot News

Ripple is having a great time. Yesterday, BitMEX launched a new perpetual swap contract tied to XREP (XRPUSD) that moved its traded volume to the highest places and its price rocketing. But, maybe it's not just fireworks. Also last Tuesday, Ripple announced its partnership with International Money Express Inc (Intermex), a leading remittance services firm that is primarily focused in the Caribean and Latin America. "The partnership will enable Intermex to leverage RippleNet for faster, transparent cross-border remittance services between the United States and Mexico," - said Ripple's press release.

Intercontinental Exchange (ICE), which owns the New York Stock Exchange (NYSE) and the Bitcoin Futures trading Bakkt, has made a formal offer to buy eBay for $30 billion, as reported by the Wall Street Journal.

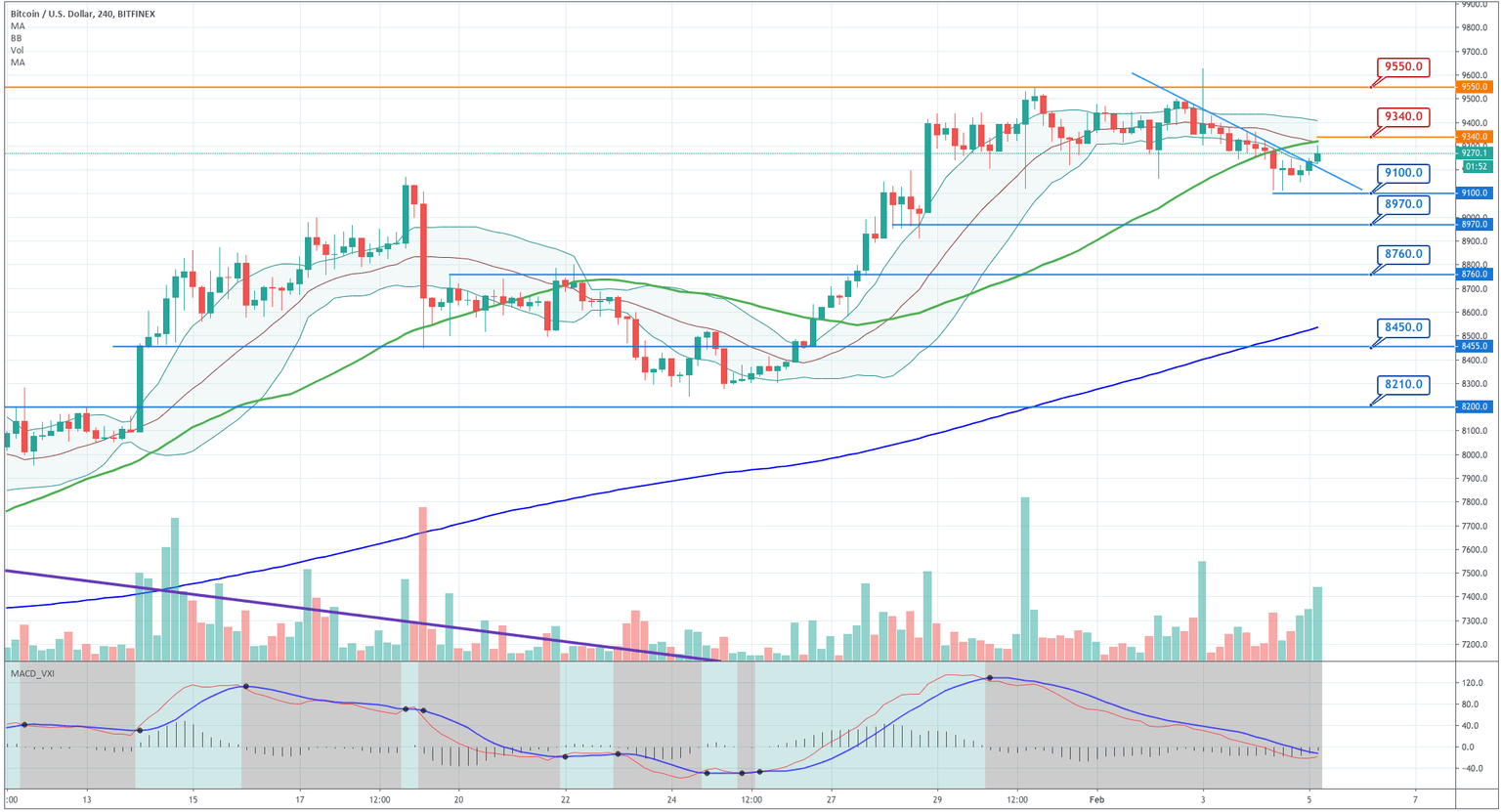

Technical Analysis: Bitcoin

Bitcoin has recovered above its $9,240 level, although it is still moving unconvincing. The MACD is turning up and is ready to make a bullish crossover, but its price still moves in the lower side of the Bollinger bands and below its 50-period SMA. The Key level to observe is $9,100 to the downside and $9,340 to the upside. The good news is the descending trendline has been broken, which might mean the bears don't have the strength to continue pushing it further down.

|

Support |

Pivot Point |

Resistance |

|

9,100 |

9,225 |

9,340 |

|

8,970 |

9,550 | |

|

8,760 |

9,700 |

Ripple

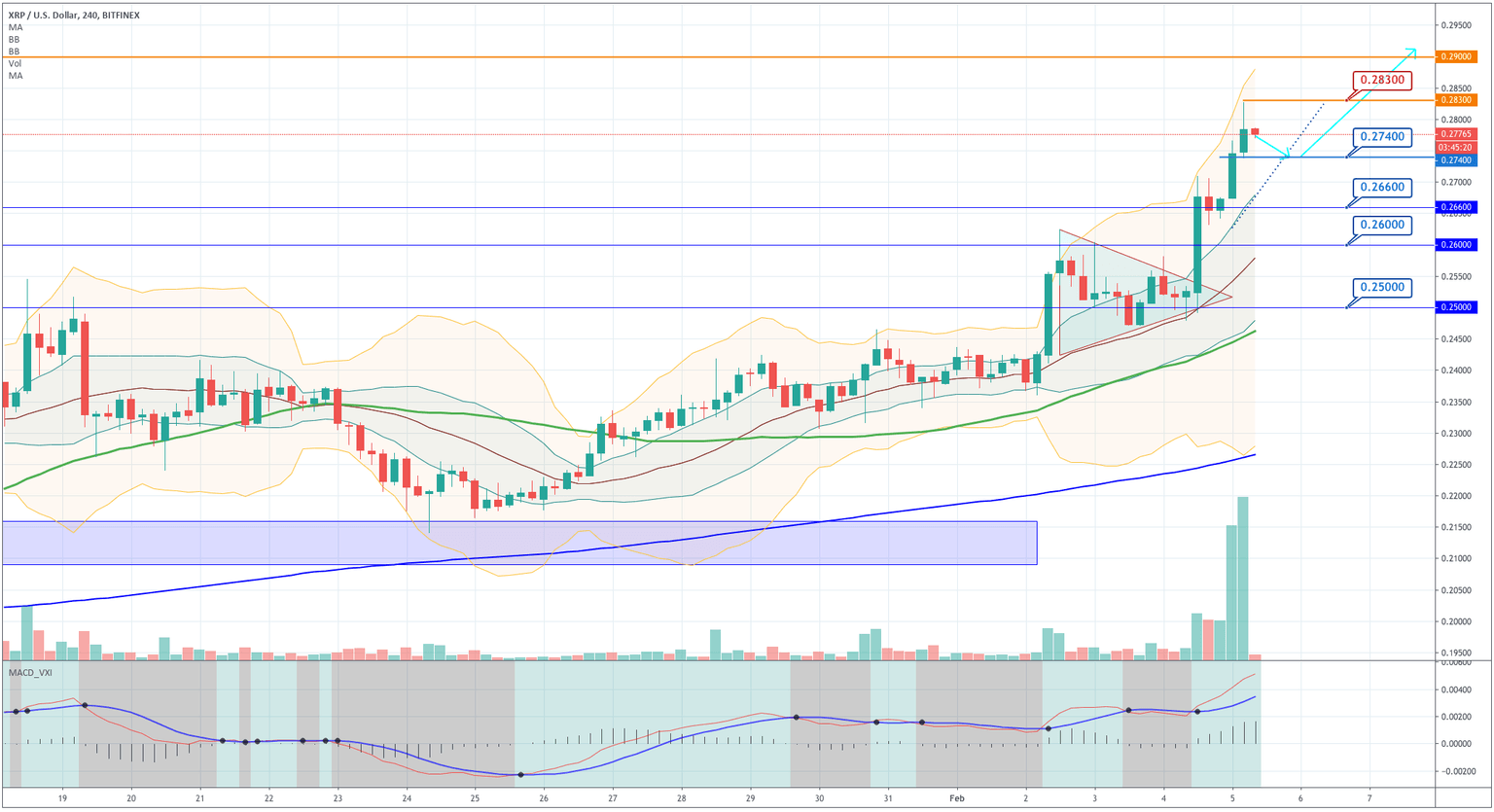

As we guessed yesterday, the triangular pattern was a continuation formation, and the triangle broke sharply to the upside. As we see on the chart, the price moves very close to the +3SD Bollinger line, which shows the strength of XRP's bullish momentum. As we can see, the price stopped its upward advance at $0.283 and is currently retracing. That is fine since it is overbought. So profit-taking and short-term sellers should drive it to the vicinity of the +1 SD. Thus, we expect a consolidation of the price in this area, possibly retracing close to the $0.274 level.

|

Support |

Pivot Point |

Resistance |

|

0.2660 |

0.2660 |

0.2740 |

|

0.2600 |

0.2830 | |

|

0.2550 |

1602.48 |

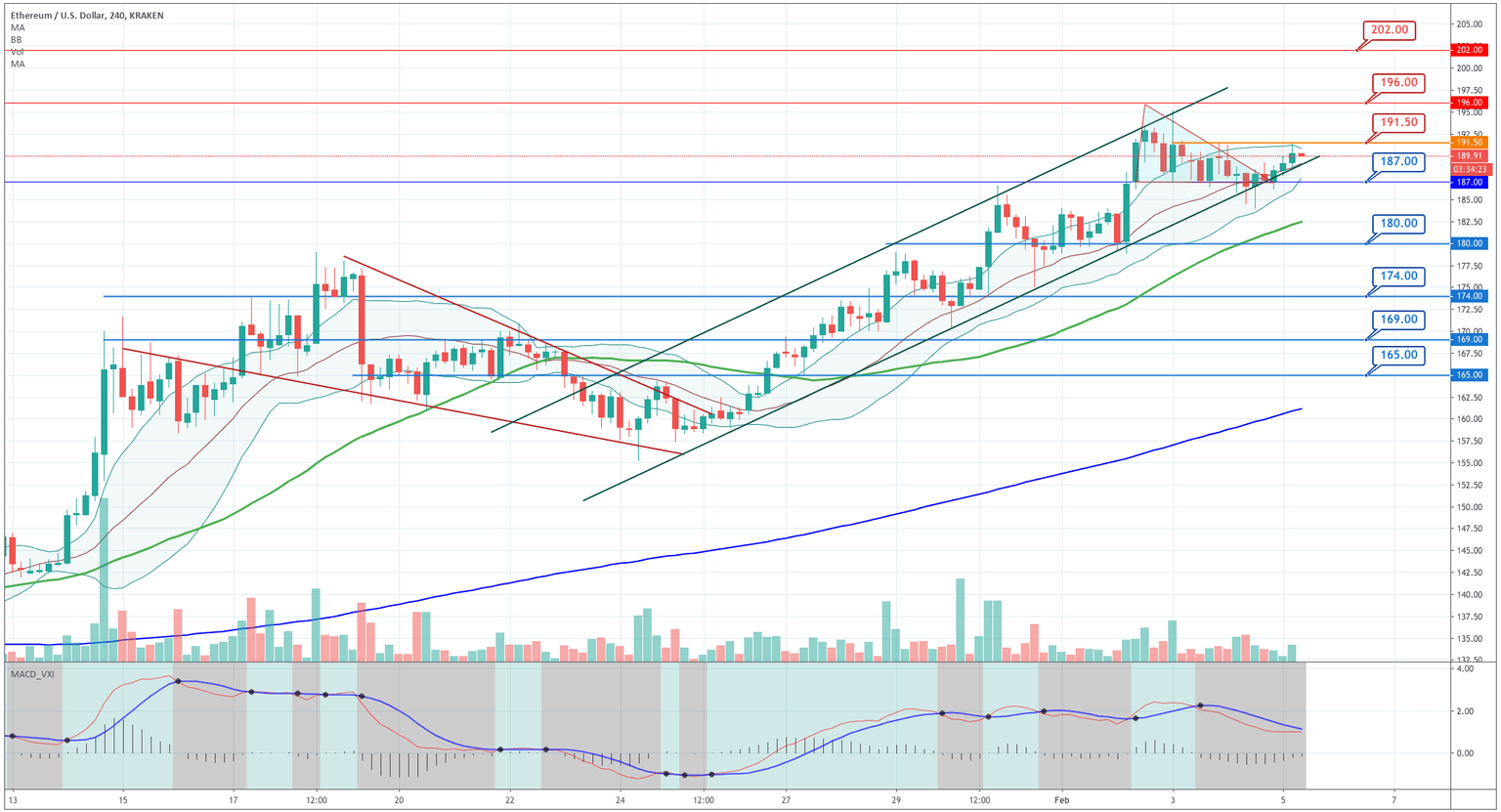

Ethereum

Ethereum also broke the triangular formation to the upside, and the price still follows the lower trendline of its ascending channel. The MACD is turning up and soon to make a bullish crossover. Finally, the price has moved to the upward side of the Bollinger bands and close to its +1SD line. These are all signs of a continuation of the bullish trend. The price is now at $190, and the next resistances to break are $191.5, $196 and $200.

|

Support |

Pivot Point |

Resistance |

|

185.00 |

187.00 |

191.50 |

|

180.00 |

196.00 | |

|

177.00 |

199.00 |

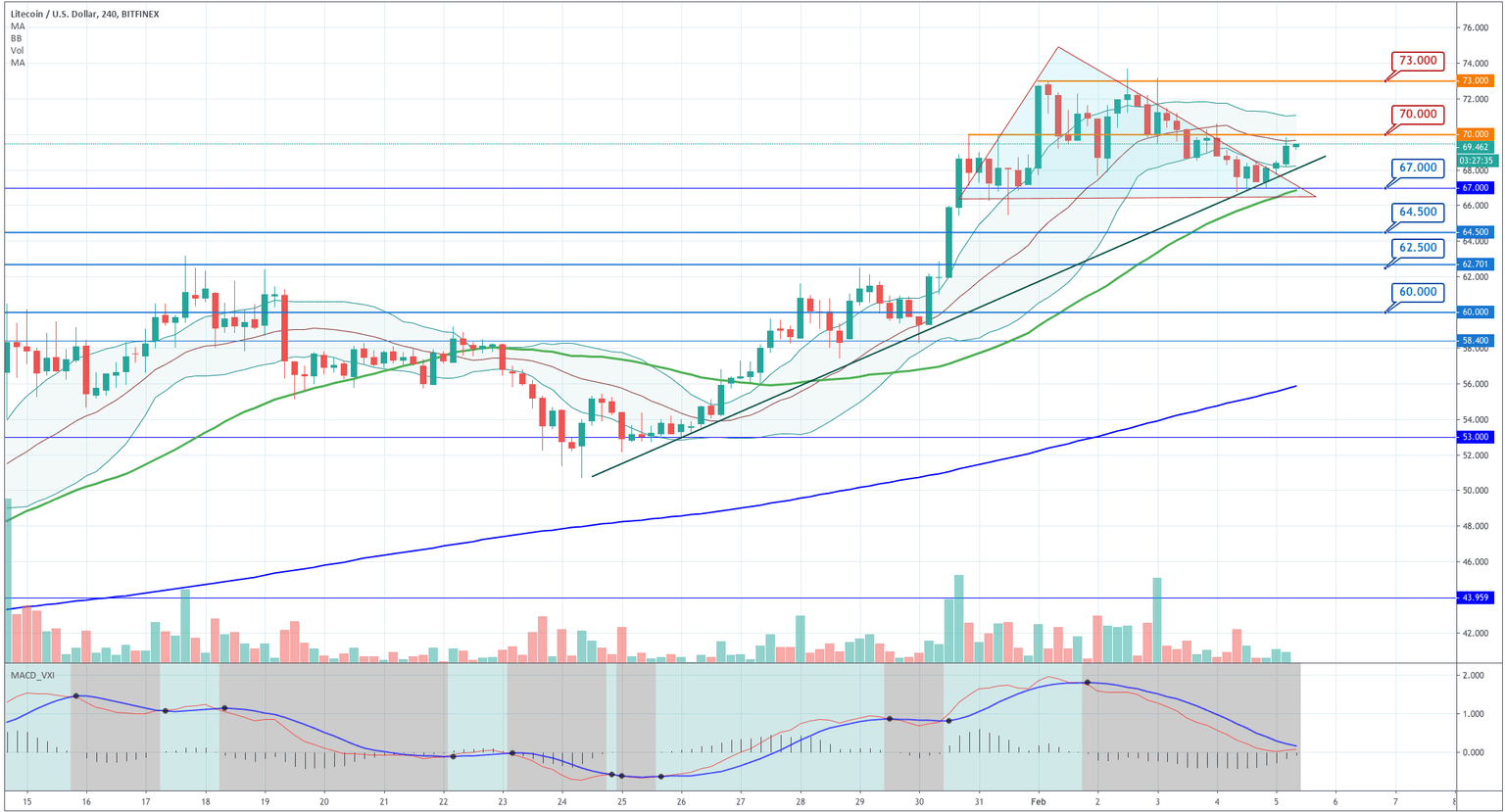

Litecoin

Litecoin also broke its triangular pattern to the upside, its price following the upward trendline. Also, the MACD is very close to making its bullish crossover. The trend is up, but the action is still on the lower side of the Bollinger bands, and the $70 level is to be broken. So, buyersshouldwaitforthis to happen.

|

Support |

Pivot Point |

Resistance |

|

67.00 |

68.40 |

70.00 |

|

64.50 |

73.00 | |

|

62.50 |

75.00 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and