Ripple Price Prediction: XRP/USD bullish levels to watch after BitMex-induced rally

- Ripple is the shining star amid news related to BitMex.

- XRP/USD has smashed several key levels including the 200 SMA.

- Here are the next levels to watch according to the Confluence Detector.

Ripple is ripping higher – and BitMex could be giving it a boost. The large derivatives exchange has announced it would introduce a new XRP Quanto swap, a contract that will be paired against the US dollar and will go live on February 5.

This perpetual contract features high leverage of 50:1 with margins posted to Bitcoin. Short positions will also be allowed, but only with BTC as collateral.

Ripple's XRP is defying dumping by the firm, which has unleashed around $200 worth of XRP from its escrow account of late. The rush into the third cryptocurrency in terms of market capitalization is pushing XRP/USD above $0.27 smashing the all-important 200-day Simple Moving Average.

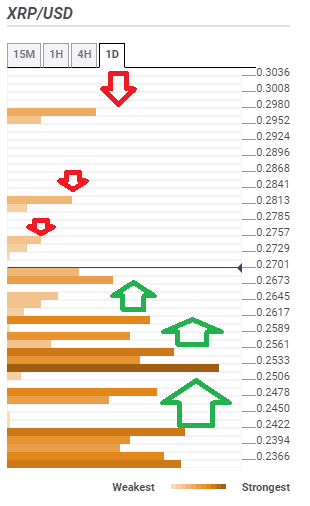

This is what the Crypto Confluence Detector shows in its latest update:

XRP/USD is eyeing $0.2729 as the first soft hurdle. It is where the Pivot Point one-day Resistance 3 awaits the price.

Next, we find $0.2813. The PP one-week R3 awaits Ripple there.

The last topside level is $0.2952, where the mighty PP one-month R2 hits the price.

Looking down, some support awaits at $0.2678, which is also a confluence of pivot points: the daily R2 and the one-month R1.

The next support line is around $0.2617, which is the convergence of the previous daily high, the PP one-day R1, and the Bollinger Band four-hour Upper.

The strongest support cluster is at $0.2520, which is a juncture including the Simple Moving Average 5-4h, the BB 1h-Middle, the PP 1w-R1, the SMA 50-15m, the SMA 10-4h, the Fibonacci 61.8% one-day, and more.

Overall, the path of least resistance for Ripple's XRP is up.

See all the cryptocurrency technical levels.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.