Ripple Price Prediction: XRP struggles with uptrend to $0.75, as co-founder Jed McCaleb offloads 38 million coins

- Ripple's rejection from $0.65 is yet to find formidable support.

- Jed McCaleb continues to sell his XRP holdings, adding to the overhead pressure.

- XRP will resume the uptrend if the 50 SMA and the ascending channel's lower edge support hold firmly.

Ripple has sustained a consistent uptrend for over two weeks. It had become apparent that the cross-border cryptocurrency will quickly rise above the yearly high at $0.75. However, a correction came into the picture at $0.65, leading to the ongoing declines.

Ripple's co-founder Jed McCaleb sells millions of coins

The co-founder of XRP and former Ripple executive Jed McCaleb is reported to have recently sold at least 38 million coins, worth roughly $22 million. Over the last few weeks, McCaleb's wallet, referred to as 'Tacostand,' has made several sales. According to Leonidas Hadjiloizou, an analyst following the wallet's activities, the most recent sale was the largest.

The analyst believes that if the sales continue at the same 38 million per day, McCaleb will run out of his holdings by May. Hadjiloizou wrote on Twitter:

Jed will be selling 38,345,406.53 XRP per day this week. This amounts to roughly 268 million XRP or $166M at current prices in 1 week. At this rate, his 2.896 billion XRP would run out by May. At half that rate (19M per day), he would run out by mid-July. At 10M per day by the end of the year.

Ripple eyes breakdown below ascending channel

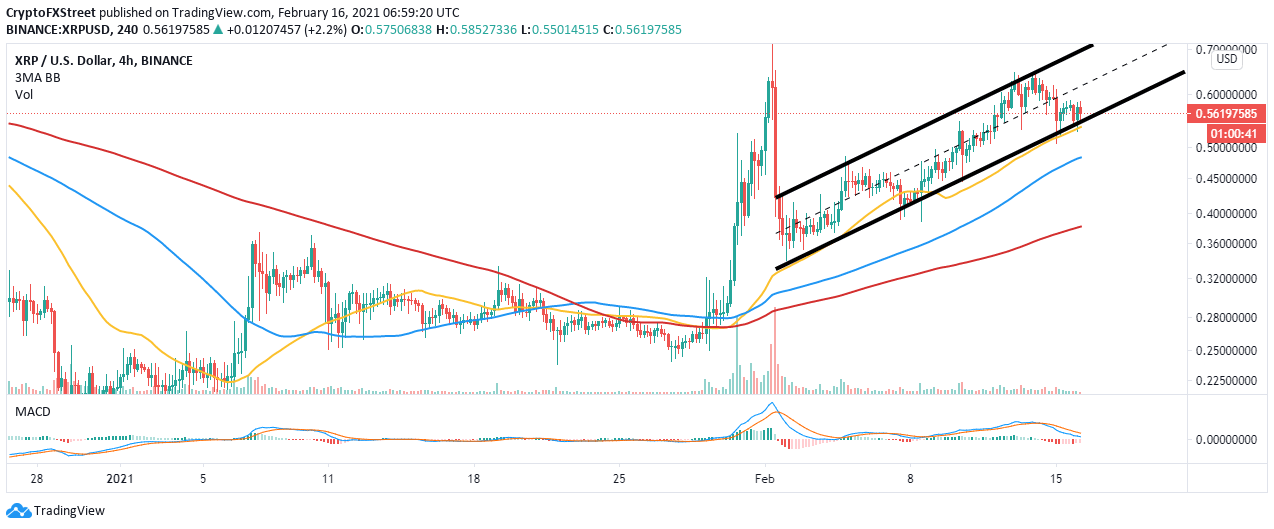

XRP is exchanging hands at $0.56 while holding in the lower band of the ascending parallel channel. Closing the day below the middle boundary added weight to the breakdown. Moreover, if the lower edge gives in to the selling pressure, overhead pressure will mount, pushing Ripple downhill.

The Moving Average Convergence Divergence (MACD) continues to validate the correction as it nears the midline. The MACD line (blue) increases the deviation from the signal line, which shows that bears have control over the price.

XRP/USD 4-hour chart

Looking at the other side of the picture

If XRP holds above the ascending channel's lower boundary support, declines to $0.4 will be averted. Notably, the 50 Simple Moving Average (SMA) is in line to provide support, perhaps strong enough to stop the ongoing breakdown. XRP bulls must focus on stepping above $0.6 to get the price out of the woods and focus on higher price levels.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren