XRP edges higher on stable retail demand, risk-on sentiment

- XRP bulls move to pare losses following an intraday sweep to $2.40.

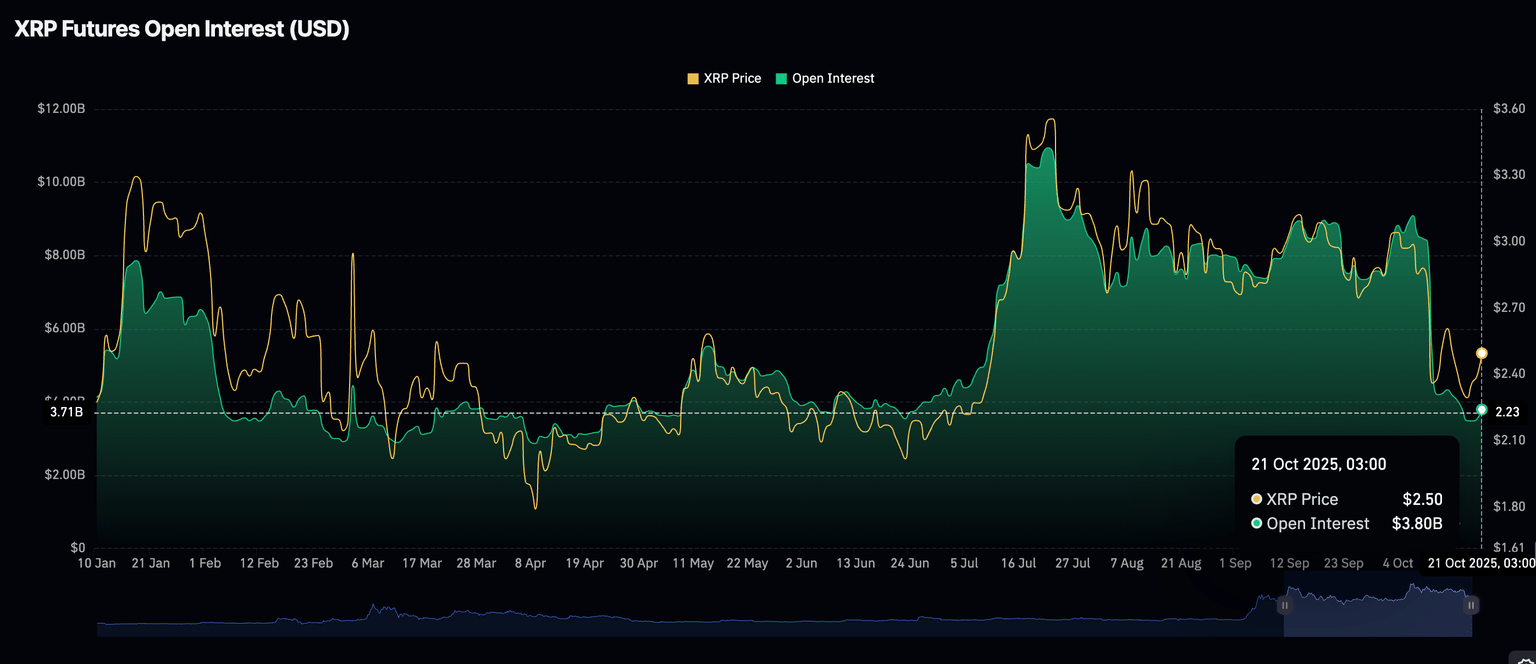

- Retail interest increases with the XRP futures Open Interest averaging $3.8 billion.

- The MACD indicator hints at a buy signal on the daily chart.

Ripple (XRP) rises alongside crypto majors such as Bitcoin (BTC) and Ethereum (ETH), trading above $2.50 on Tuesday. The recovery comes after XRP extended its down leg to $2.40 earlier in the day, reflecting intense volatility across the cryptocurrency market.

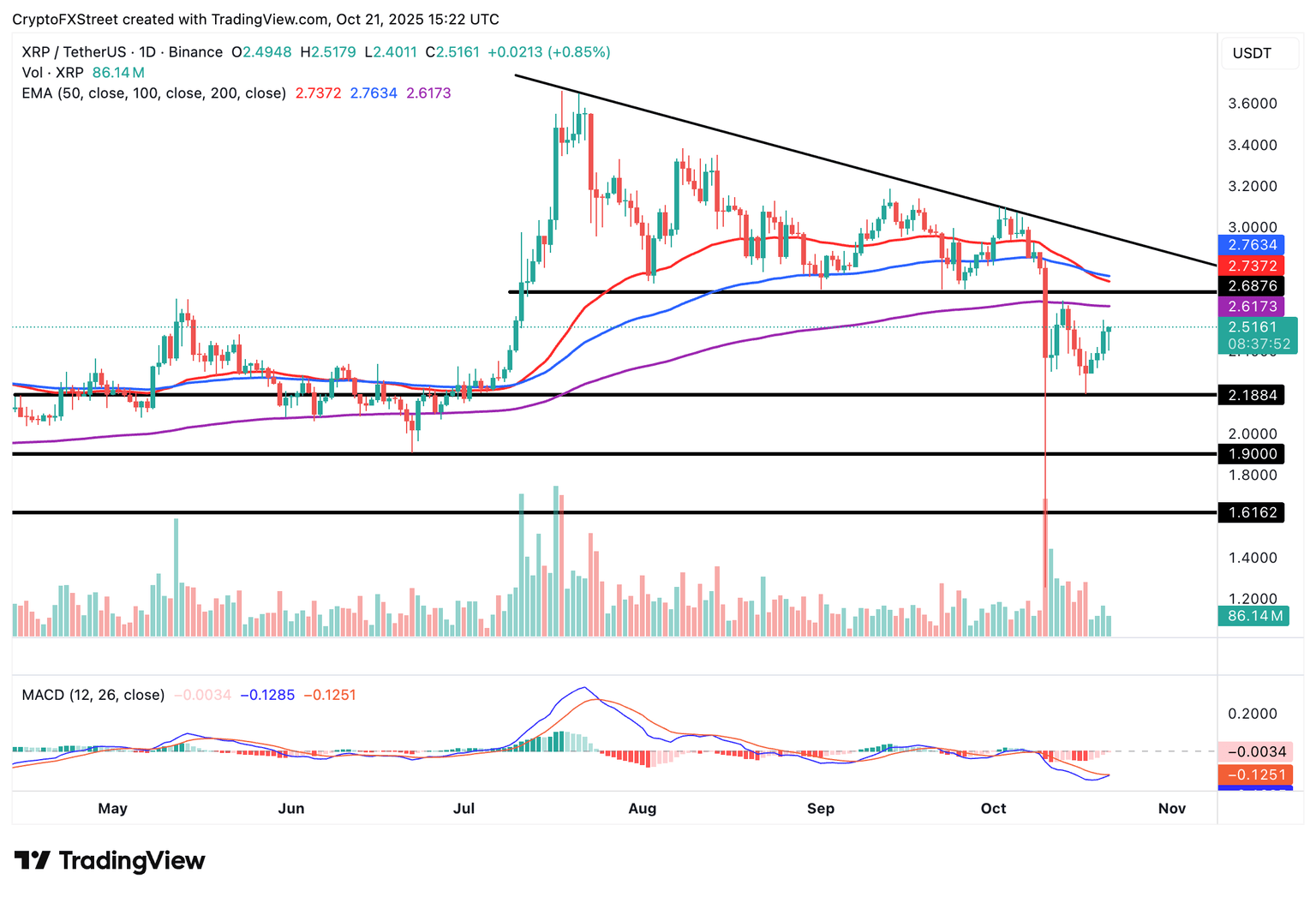

Traders will be watching out for a daily close above $2.50 to ascertain XRP’s recovery potential. Key short-term milestones include a sustained breakout above the resistance range between $2.61 and $2.70.

Retail demand stabilizes as XRP rebounds

The XRP derivatives market is stabilizing, as evidenced by the futures Open Interest (OI) recovering to $3.8 billion from approximately $3.5 billion on Sunday. Although minor, the uptick reflects a potential shift in sentiment from bearish to bullish.

The XRP OI peaked at $10.94 billion days after the price reached a historical high of $3.66 on July 18, underscoring the impact of steady retail demand. Therefore, there is a need for a steady uptrend in OI to bolster bullish momentum this week.

XRP Futures Open Interest | Source: CoinGlass

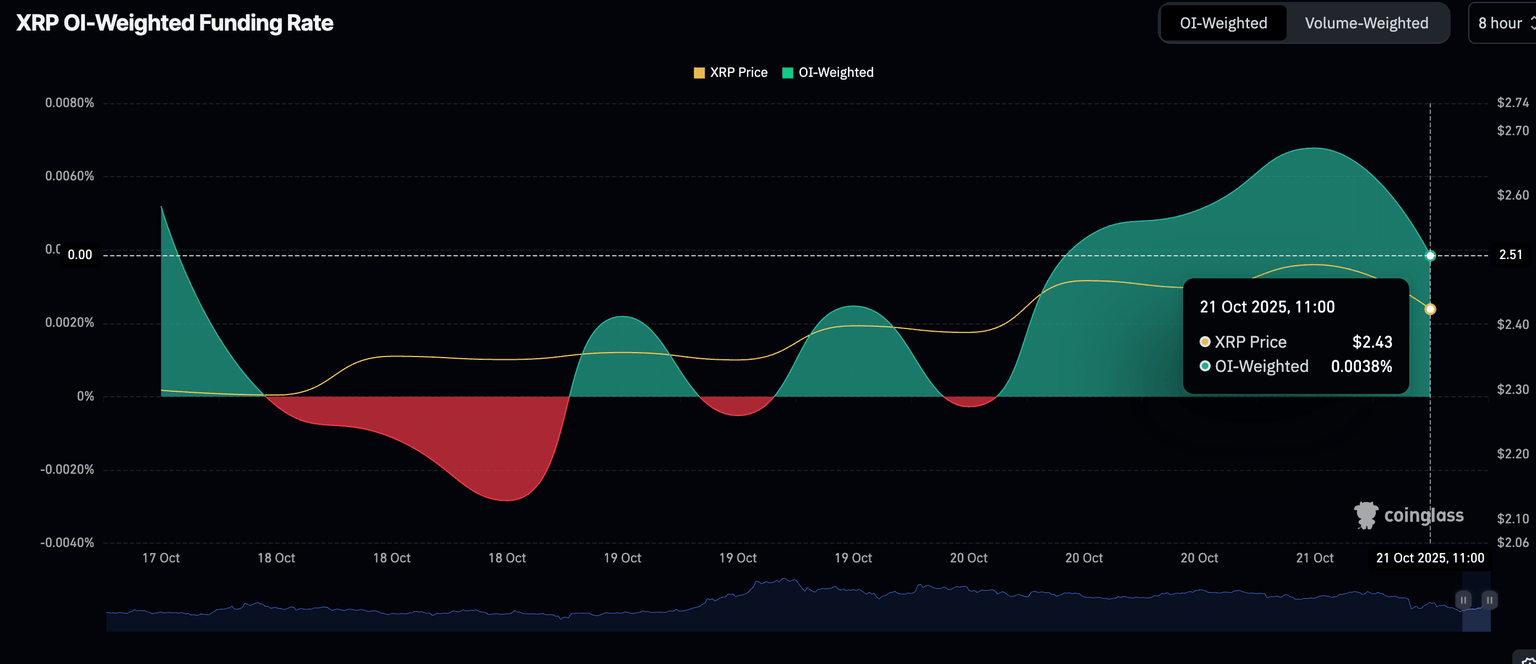

A sharp drawdown in the OI weighted funding rate to 0.0038% from 0.0068% on Monday suggests that traders are increasingly piling into short positions, citing negative sentiment surrounding XRP.

Still, the situation is not at extreme levels, considering the OI weighted funding rate remains positive on Tuesday. The next sessions could provide insight into the direction retail interest may take. A reversal would imply that sentiment is positively shifting to support a sustainable recovery in the price of XRP.

XRP OI weighted funding rate | Source: CoinGlass

Technical outlook: XRP bulls regain control

XRP is trading above the pivotal $2.50 level, supported by a sudden turnaround in risk appetite on Tuesday. From the daily chart, this optic marks the fourth consecutive day of recovery following Friday’s sell-off to $2.18.

Should the Moving Average Convergence Divergence (MACD) indicator on the daily chart confirm a buy signal, with the blue MACD line crossing above the red signal line, interest in XRP will surge, increasing the odds of a prolonged uptrend.

XRP/USDT daily chart

The 200-day Exponential Moving Average (EMA) at $2.61 represents the first key resistance likely to encourage early profit booking. Therefore, sustaining an uptrend above this level and the subsequent seller congestion at $2.70 would reinforce the bullish outlook.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren