Ripple Price Prediction: XRP price weathers market-wide volatility near $2.00 support

- XRP comes under immense pressure, falling toward $2.09 as Israel and Iran escalate conflict.

- Ripple and the SEC file a joint motion requesting the release of $125 million held in escrow.

- The SEC would be paid $50 million as a settlement, with the remaining funds returned to Ripple.

Ripple’s (XRP) price is currently trading at around $2.14 at the time of writing on Friday as investors in the crypto market navigate the sudden spike in volatility triggered by geopolitical tensions in the Middle East. The sudden sharp price drop below support at $2.20, caused massive liquidations as the futures contracts Open Interest (OI) plunged.

The decline in the XRP price comes hot on the heels of the conflict between Israel and Iran. Israel launched an attack on Iran, targeting the country’s nuclear facilities, ballistic missile factories and military commanders on Friday, according to a report by Reuters.

Iran immediately responded to the attack, launching drone strikes on Israeli territory, prompting Israel to declare a state of emergency.

Ripple, SEC file joint motion to release $125 million held in escrow

Ripple and the United States (US) Securities and Exchange Commission (SEC) have jointly filed a motion in the US District Court Southern District of New York, requesting Judge Analisa Torres to dissolve the injunction in their ongoing case and move to release $125 million civil penalty held in escrow.

The two parties proposed in the motion that $50 million be paid to the SEC, with the remaining funds returned to Ripple, reflecting the settlement reached in early May. According to the filing, “if the Court issues the requested indicative ruling, the SEC and Ripple will move to the US Court of Appeals for the Second Circuit, for a limited remand to seek relief.”

The Court previously denied a Ripple-SEC joint motion on May 8, citing the failure of the two parties to address whether “exceptional circumstances” warrant a modification of the final Judgement, which had penalized Ripple $125 million for violating securities laws when the company sold XRP directly to institutional investors.

Meanwhile, institutional interest in XRP and related financial products continues to rise, as reported by FXStreet. Publicly listed companies, including VivoEnergy, Trident Digital Tech Holdings, Wellgistics Health, Inc., Webus International Limited, and Hyperscale Data Inc., have recently announced XRP-focused treasury fund strategies.

The cryptocurrency project, Ondo Finance, announced earlier this week the launch of its flagship Ondo Short-Term US Government Treasuries (OUSG) on the XRP Ledger (XRPL).

OUSG bridges the gap between Decentralized Finance (DeFi) and the traditional finance sector, allowing institutional investors on XRPL to seek exposure to short-term US Treasuries.

Technical outlook: XRP holds above critical support

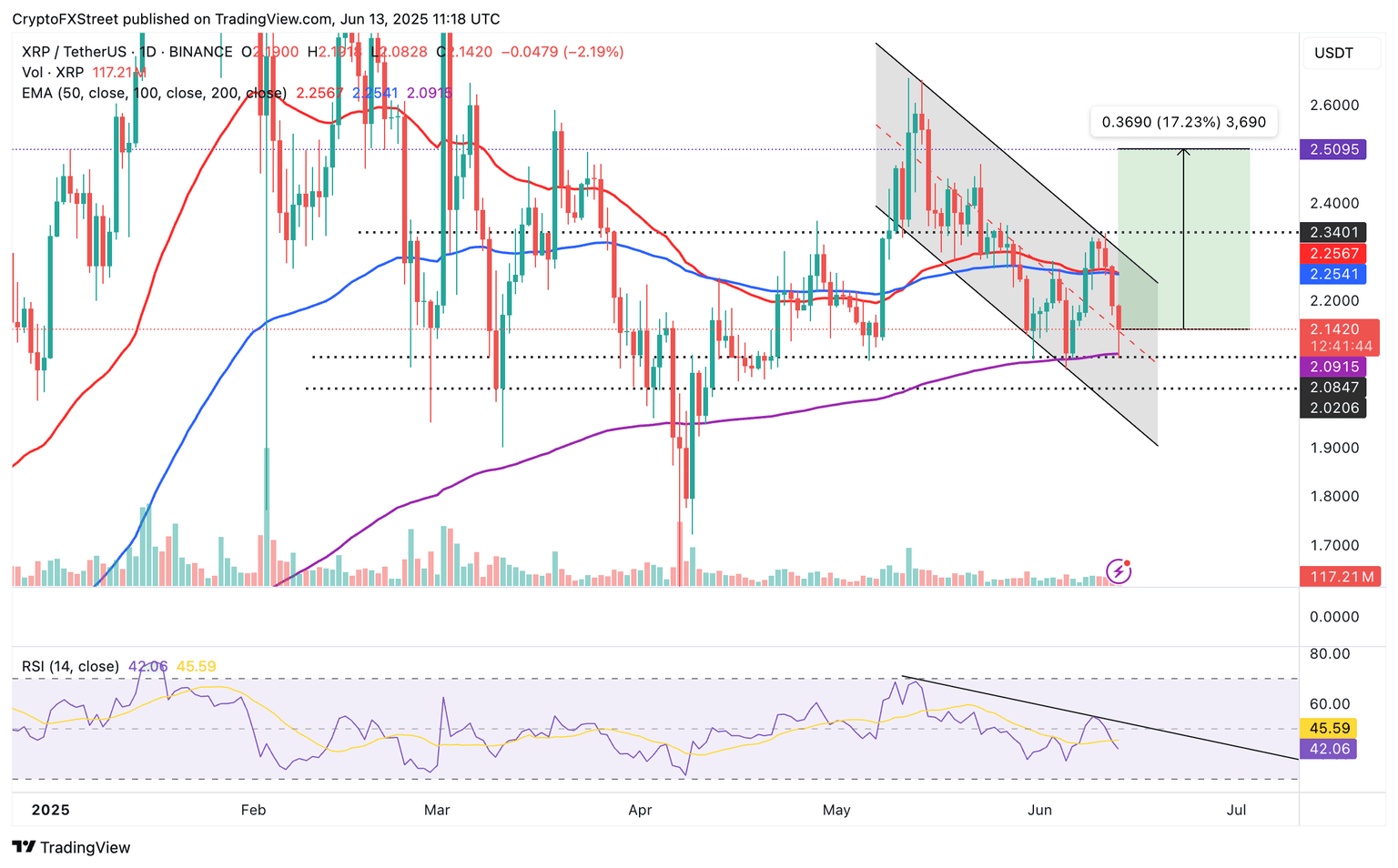

XRP’s price hovers at around $2.14 at the time of writing after a slight recovery from support at around $2.09, reinforced by the 200-day Exponential Moving Average (EMA).

This rebound remains uncertain, especially with the Relative Strength Index (RSI) falling below the 50 midline while remaining below the descending trendline, as shown on the daily chart below.

Key levels of interest likely to be relevant in upcoming sessions and going into the weekend include the descending channel’s middle boundary, currently acting as immediate support, and the 200-day EMA at $2.09, which could prevent losses from extending below the critical $2.00 level.

XRP/USDT daily chart

If the geopolitical situation in the Middle East improves and sentiment in the broader cryptocurrency market shifts, traders may consider buying XRP and contributing to the tailwind. A rebound from the current price level of $2.14 could reinstate the goal of a recovery targeting the hurdle at $2.34 and the seller congestion at $2.50, representing a 17% move from the prevailing market value.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren