XRP bulls target 10% move amid falling exchange inflows

- XRP rebounds above key $2.40 support in tandem with other crypto majors on Thursday.

- XRP inflows into the Binance exchange decline significantly amid potential bear exhaustion.

- Traders start piling into long positions as the XRP futures Open Interest weighted funding rate steadies.

Ripple (XRP) rises above $2.40 at the time of writing on Thursday, following two consecutive days of declines. The token briefly corrected, with the intraday candle wick reaching $2.35 earlier in the day, as a bearish wave spread across the cryptocurrency market.

If retail interest steadies in upcoming sessions, the uptrend could extend toward short-term resistance at $2.62 and later the psychological $3.00 level.

XRP shows signs of stability as selling pressure eases

XRP inflows into the Binance exchange increased in October, peaking at approximately 362 million tokens last Saturday. The surge coincided with the largest deleveraging event in the history of the industry and the subsequent flash crash in the XRP price to $1.25.

Traders often transfer assets to exchanges with the intention of trading or selling. Hence, the surge in inflows likely contributed to selling pressure. However, with inflows reducing this week, as shown in the chart below, a potential shift in sentiment could pave the way for a sustained recovery in the XRP price.

-1760625147622-1760625147623.png&w=1536&q=95)

XRP Ledger Exchange Inflows - Binance | Source: CryptoQuant

Meanwhile, the XRP derivatives market has stabilized, with the futures Open Interest (OI) weighted funding rate flipping positive. According to CoinGlass data, the OI funding rate averages 0.0015% on Thursday, following a historical dip to -0.2045% on Saturday.

If an uptrend develops above the mean line in the coming days, as traders increase their exposure to XRP longs, it will suggest improved sentiment and boost the short-term bullish outlook.

XRP OI-Weighted Funding Rate | Source: CoinGlass

Technical outlook: Can XRP bolster its recovery?

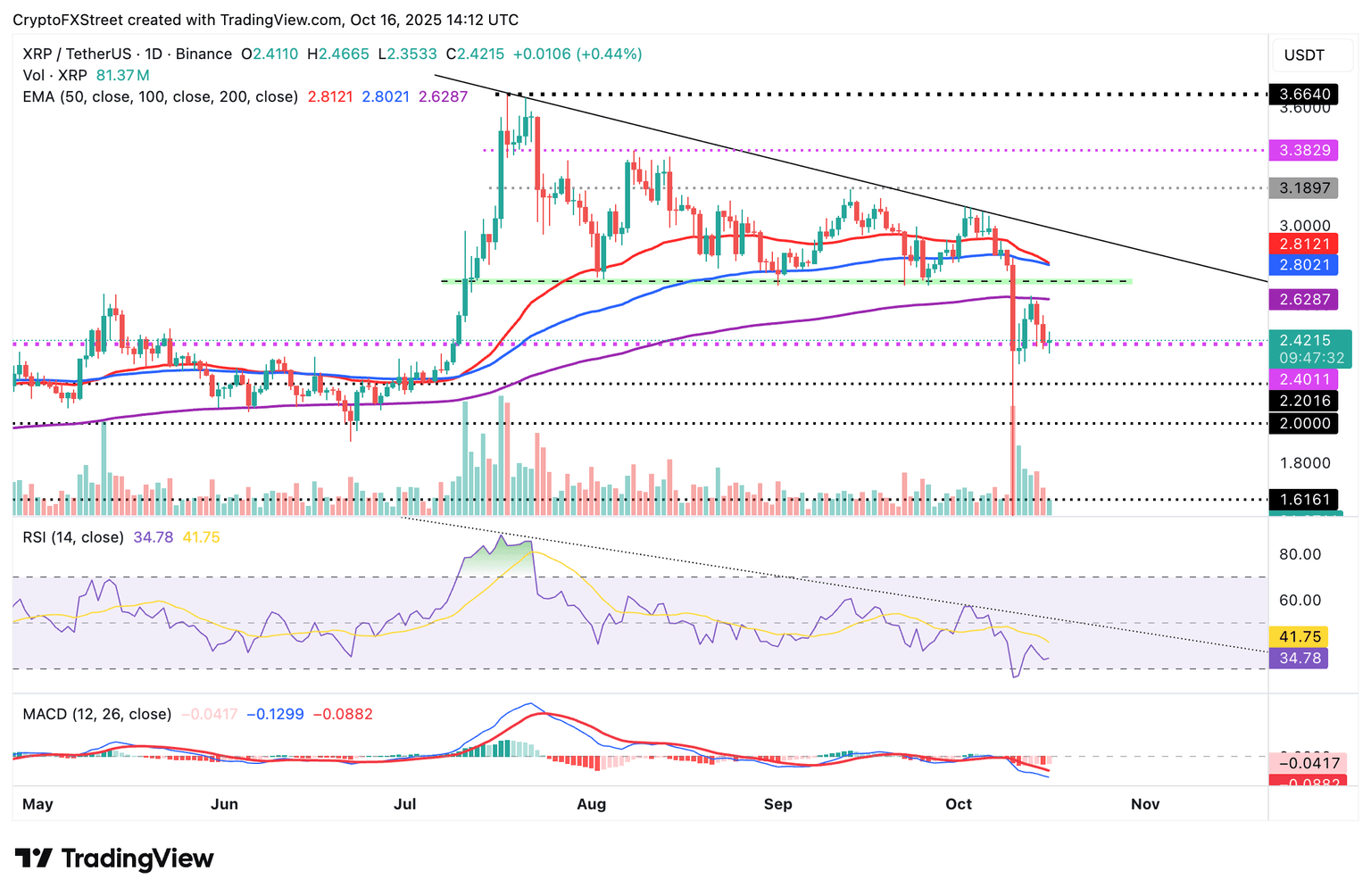

XRP is trading above a short-term support established at $2.40, as cryptocurrencies post marginal gains on Thursday. This subtle uptick reflects the increase in retail demand along with the drop in exchange inflows.

If bulls tighten their grip, traders could anticipate a breakout above the 200-day Exponential Moving Average (EMA) at $2.62 on the daily chart and increase the odds of the price of XRP rising toward the $3.00 level.

XRP/USDT daily chart

Still, with the Moving Average Convergence Divergence (MACD) indicator maintaining a sell signal on the same daily chart, triggered on Thursday, downside risks remain.

The downward-trending Relative Strength Index (RSI) at 33 suggests the bearish momentum is increasing. Hence, the short-term support at $2.40 must hold to prevent the down leg from stretching to sweep more liquidity at $2.22, a level tested in early June.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren