XRP bulls attempt breakout above $3 as traders reposition

- XRP is poised for a 23% breakout to its record high of $3.66, reflecting positive sentiment in the market.

- XRP futures Open Interest and funding rate rise, indicating growing interest from traders leveraging positions.

- A rejection at $3.00 could delay the potential breakout.

Ripple (XRP) displays bullish potential, trading above $2.96 on Monday as cryptocurrency prices generally recover. A break above the immediate $3.00 hurdle could bolster XRP’s technical structure, increasing the chances of a 23% breakout to its all-time high of $3.66 reached on July 18.

XRP gains bullish momentum as Open Interest and funding rate rebound

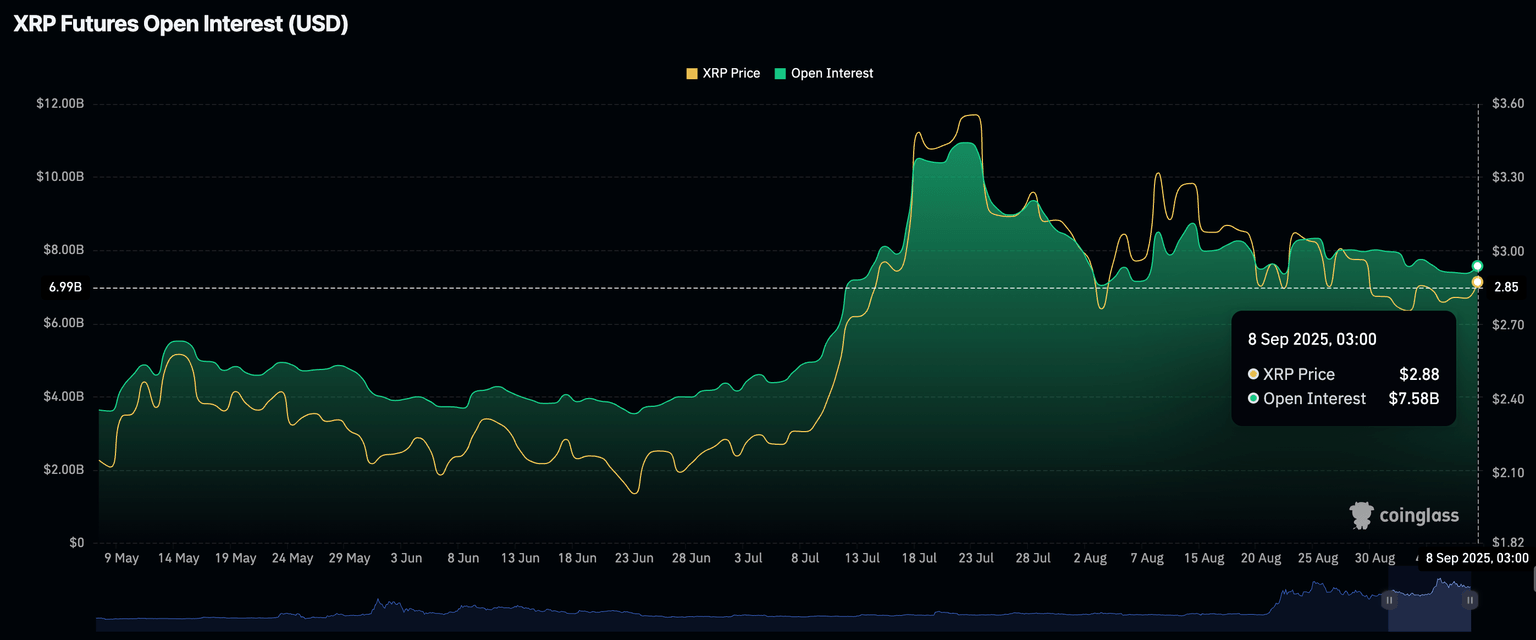

The XRP futures market shows signs of life after several weeks of volatility. This bullish outlook is reflected by the total Open Interest (OI), which averages at $7.58 billion, up from $7.37 billion recorded on Sunday.

OI refers to the notional value of outstanding futures contracts. A steady increase implies that traders are repositioning themselves, following the correction from the all-time high, which has found support at $2.72 as of September 1.

Arab Chain, an analyst highlighted via CryptoQuant, stated that “the stabilization of OI after the peak, along with the price’s decline from its highs, indicates a repositioning phase. Leveraged positions remain in the market, but at a lower level than during the July or August peak.”

XRP Futures Open Interest | Source: CoinGlass

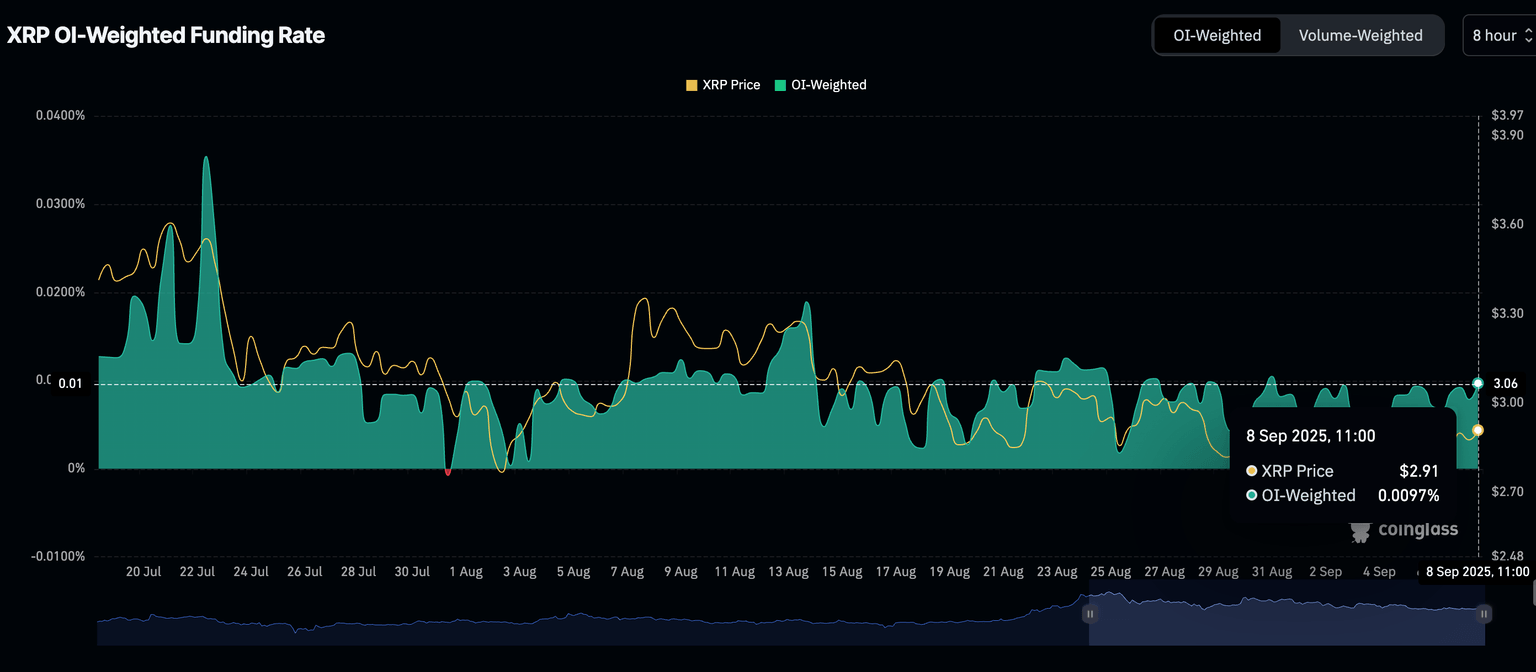

The steady increase in the futures funding rate to 0.0083% at the time of writing from 0.0047% on September 2 supports the bullish outlook for XRP derivatives. A steady increase in this metric suggests that more traders are leveraging long positions in XRP, thereby bolstering bullish market sentiment.

XRP Futures Funding Rate| Source: CoinGlass

Technical Outlook: Assessing XRP’s bullish structure

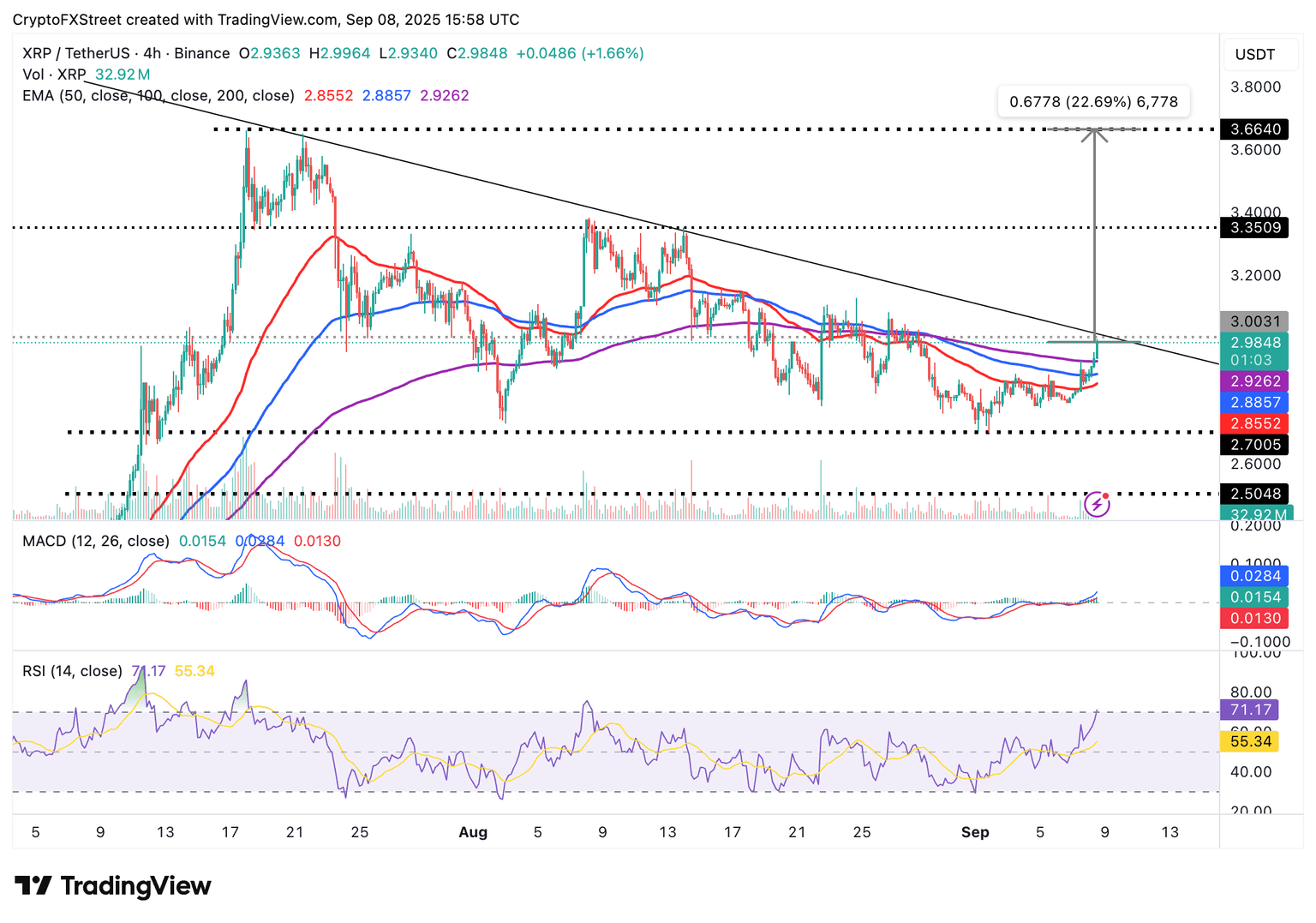

XRP holds above key moving averages on the 4-hour chart, including the 200-period EMA at $2.92, the 100-period EMA at $2.88 and the 50-period EMA at $2.85, signaling positive market sentiment.

A buy signal from the Moving Average Convergence Divergence (MACD) indicator, which has been in place since Sunday, supports a potential bullish outcome. This could propel XRP to a 23% breakout above its current level and reach its record high of $3.66.

XRP/USDT 4-hour chart

Traders will look for a short-term break above the $3.00 pivotal level to validate XRP’s bullish potential. However, with the Relative Strength (RSI) showing signs of retreating from overbought territory, a rejection is on the cards, which may delay the move to $3.66.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren