Ripple Price Prediction: XRP faces growing downside risks threatening potential return to $3

- Ripple builds on the Dubai regulatory license, partnering with Zand Bank and Mamo to offer blockchain-based payment services.

- Zand Bank believes collaborating with Ripple will enhance its global payment solutions, with an AED-backed stablecoin.

- XRP faces steep downside risks, especially if price break below the 50-day EMA, potentially dropping to $2.00.

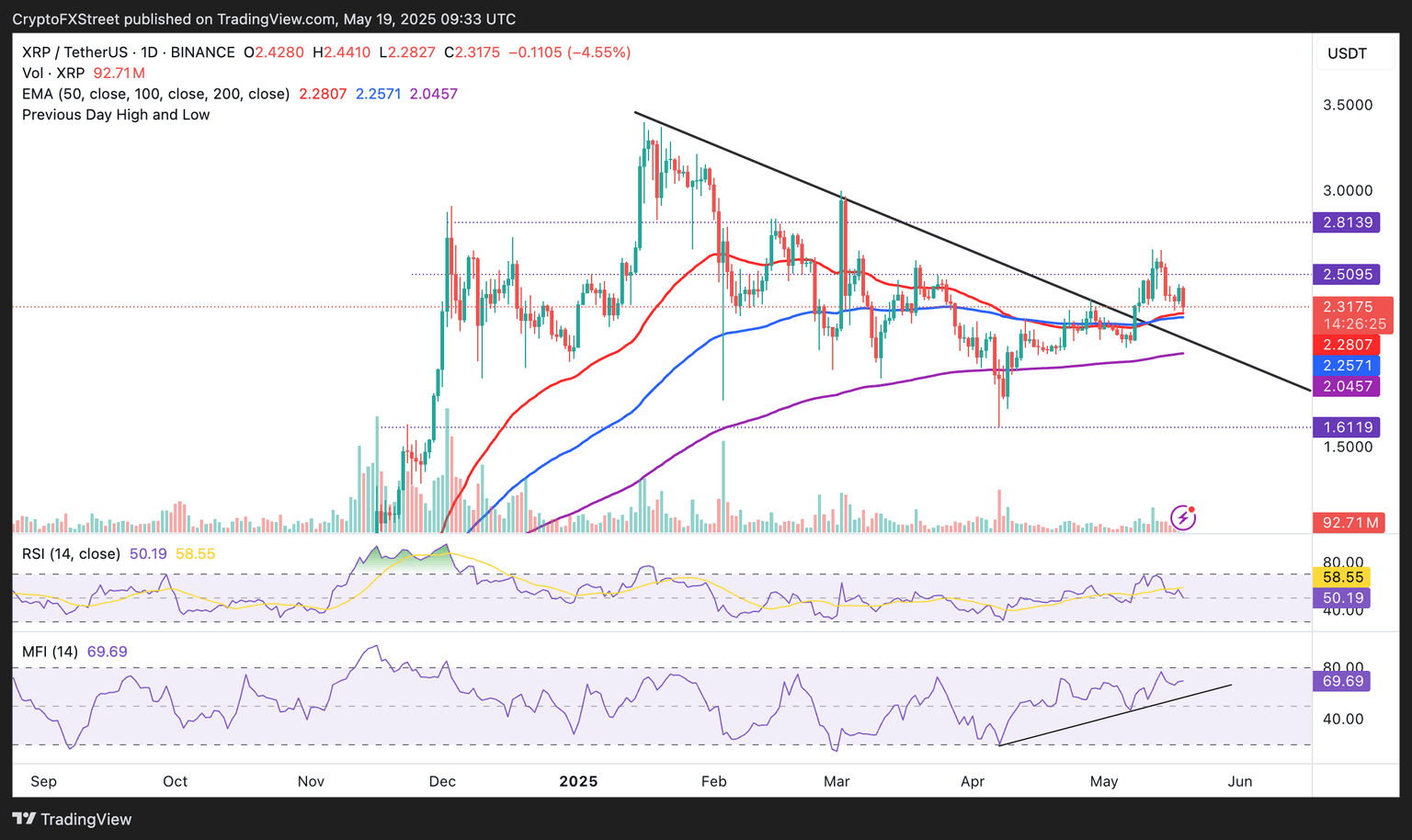

Ripple (XRP) price hovers at around $2.31 on Monday, extending its gradual drawdown from last week’s high of $2.65, as the broader cryptocurrency market swings between gains and losses amid shifting investor sentiment. Protecting XRP's immediate downside is the 50-day Exponential Moving Average (EMA).

A resumption of the uptrend towards $3.00 could gain bullish momentum after Ripple announced a strategic partnership with United Arab Emirates (UAE)-based Zand Bank and Mamo, adding its exposure to the region after securing the Dubai Financial Services Authority (DFSA) license in March.

Ripple Payments expands UAE footprint with two strategic partnerships

Ripple announced on Monday in a press release that it had entered into strategic partnerships with UAE-based Zand Bank and Mamo. The entities will leverage Ripple Payments for blockchain-enabled cross-border transactions.

The announcement comes after Ripple secured its landmark DFSA license.

Zand Bank, the UAE’s first digital bank, and Mamo, a fintech focused on simplifying global payments, will tap Ripple’s infrastructure to enhance their cross-border capabilities.

Ripple said that the DFSA license and the partnerships mark a "major milestone" in its broader goal of managing end-to-end payments on behalf of global customers, settling payments in minutes, and reducing time and friction.

“Securing our DFSA license enables Ripple to better serve the demand for solutions to the inefficiencies of traditional cross-border payments, such as high fees, long settlement times, and lack of transparency, in one of the world’s largest cross-border payments hubs,” said Reece Merrick, Managing Director, Middle East and Africa, at Ripple.

Ripple Payments operates in over 90 payout markets and has processed over $70 million in volume globally. The payment platform has been launched in the United States (US), Dubai, Brazil, Mexico, Australia and Switzerland.

The UAE is a global hub for outbound finance with a market of more than $400 billion for international trade. The region has seen growing demand for efficient payment solutions.

XRP faces downside risks above the 50-day EMA

XRP’s price falls sharply on Monday but holds above support at $2.28, as provided by the 50-day EMA. This follows a drawdown from last week’s high of $2.65, plausibly triggered by potential profit-taking among traders and sentiment in the broader cryptocurrency market, which deteriorated significantly on Monday.

Based on the Relative Strength Index (RSI) indicator’s retreat to the midline of 50 from near-overbought conditions, the path with the least resistance could shift strongly downwards, especially if the RSI slides further toward the oversold region.

Support at the 50-day EMA and the 100-day EMA, slightly below $2.25, is critical for resuming the uptrend, eyeing a return to $3.00. Beyond the two moving averages, declines could accelerate to retest the descending trendline and the 200-day EMA at approximately $2.00.

XRP/USDT daily chart

The uptrend in the Money Flow Index (MFI) implies that more money is flowing into XRP than the outflow volume. In other words, trader interest remains steady despite the recent pullback.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren