Ripple Price Forecast: XRP is about to breakout to $0.65

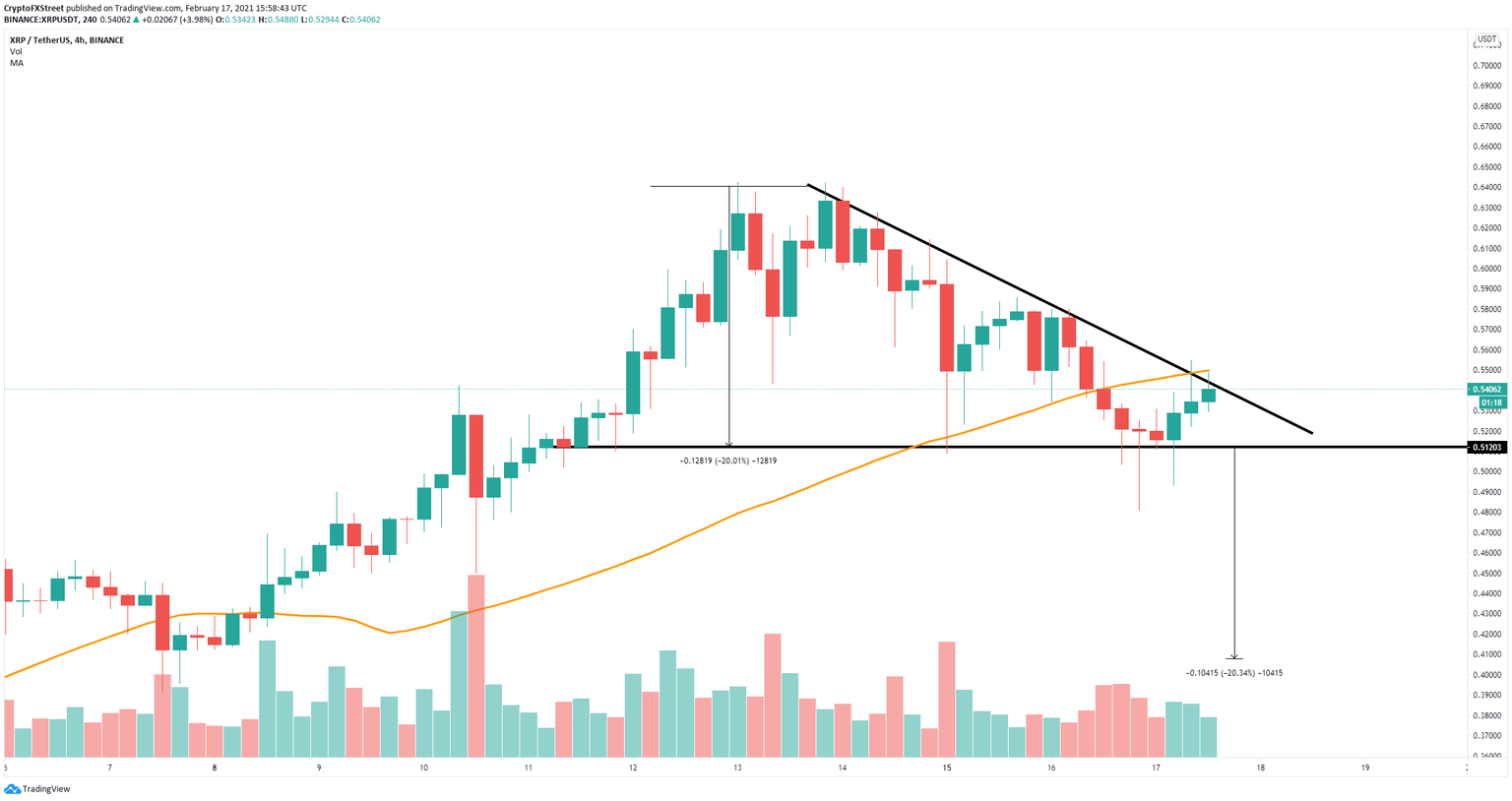

- Ripple price is bounded inside a descending triangle pattern on the 4-hour chart.

- The digital asset is on the verge of a 20% breakout if a key resistance breaks.

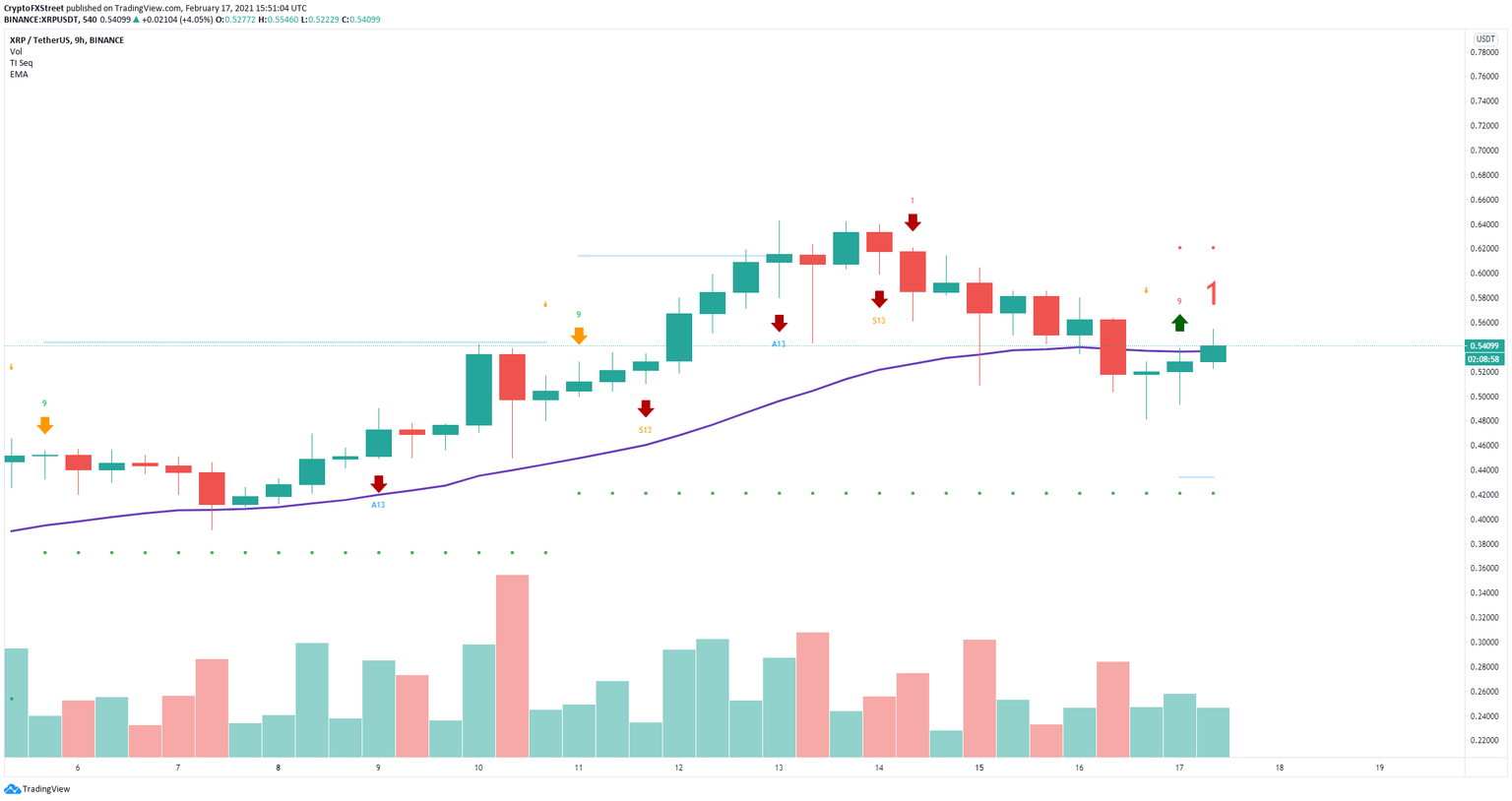

- The TD Sequential indicator has presented a buy signal giving credence to the bulls.

After a significant rebound from its local bottom at $0.30, XRP has managed to hit $0.64 again thanks to an initial pump that started on January 30 from the WallStreetBets community on Reddit. Ripple price is ready for another leg up as technicals scream buy.

Ripple price can explode to $0.65 if this key barrier cracks

On the 4-hour chart, XRP has established a descending triangle pattern with a resistance level located at $0.544. A breakout above this point would push Ripple price up to $0.65, a 20% move determined by the height of the pattern.

XRP/USD 4-hour chart

On the 9-hour chart, the TD Sequential indicator has presented a buy signal on the 9-hour chart and just crossed above the 26-EMA support level. Closing above this point would add even more credence to the bullish outlook above.

XRP/USD 9-hour chart

On the other hand, it seems that whales have taken advantage of the recent increase in prices to sell their XRP holdings. The number of large holders with at least 10,000,000 XRP ($3,000,000) has dropped 10 in the past two weeks.

XRP Holders Distribution

This indicates that some large holders do not believe XRP can continue rising in the near future. A rejection from the key resistance level at $0.544 on the 4-hour chart can quickly send Ripple price down to $0.512.

XRP/USD 4-hour chart

The resistance barrier at $0.544 also coincides with the 50-SMA. Losing the support level of $0.512 will push Ripple price down to $0.40.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B16.56.30%2C%252017%2520Feb%2C%25202021%5D-637491743373002692.png&w=1536&q=95)