XRP price momentum steady as risk-on sentiment surges

- XRP regains bullish momentum, targeting a breakout to $3.66 record high.

- The XRP Ledger stablecoin market cap has increased by 46% over the past week to $166 million.

- Crypto payment network Mesh adds support for Ripple's RLUSD

Ripple (XRP) extends gains for the second day in a row, trading at around $3.25 on Wednesday. XRP mirrors positive market sentiment across the cryptocurrency cycle market after the United States (US) July inflation came in below expectations, ramping up bets for the first interest rate cut this year in September.

If interest in XRP rises as reflected by the performance of the derivatives market this week, speculative demand could extend price recovery toward the record high of $3.66 reached on July 18.

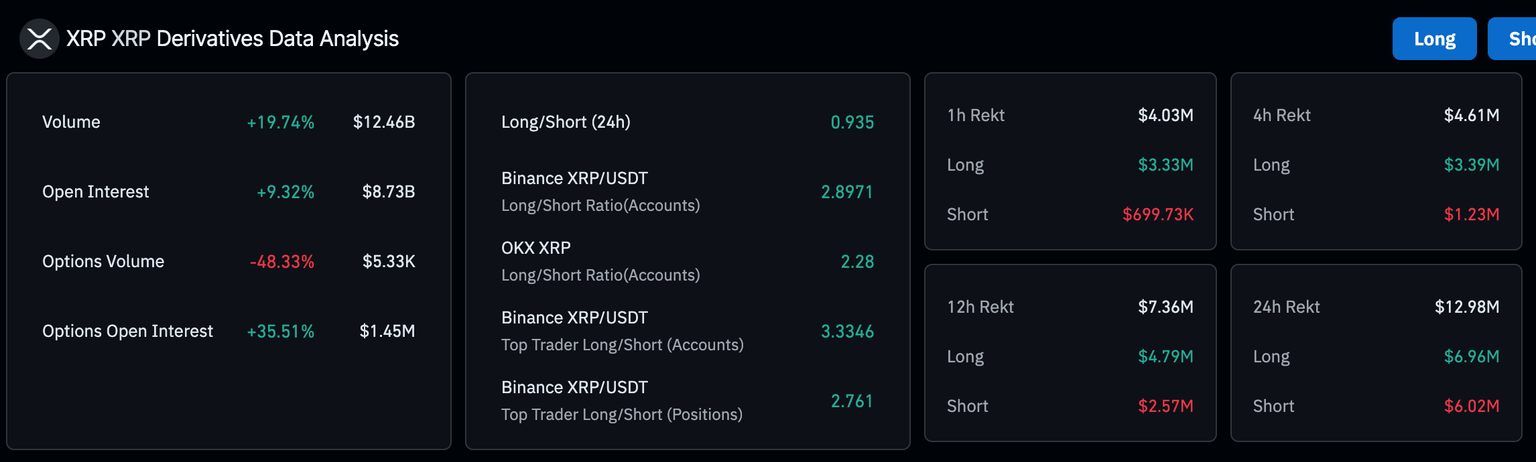

CoinGlass data highlights a 9% increase in the derivatives market Open Interest (OI), averaging at $8 billion on Wednesday. Additionally, a 20% increase in the volume to $12.5 million suggests heightened trading activity.

XRP derivatives market data | Source| CoinGlass

XRP Ledger Stablecoin market surges, Mesh adds support for RLUSD

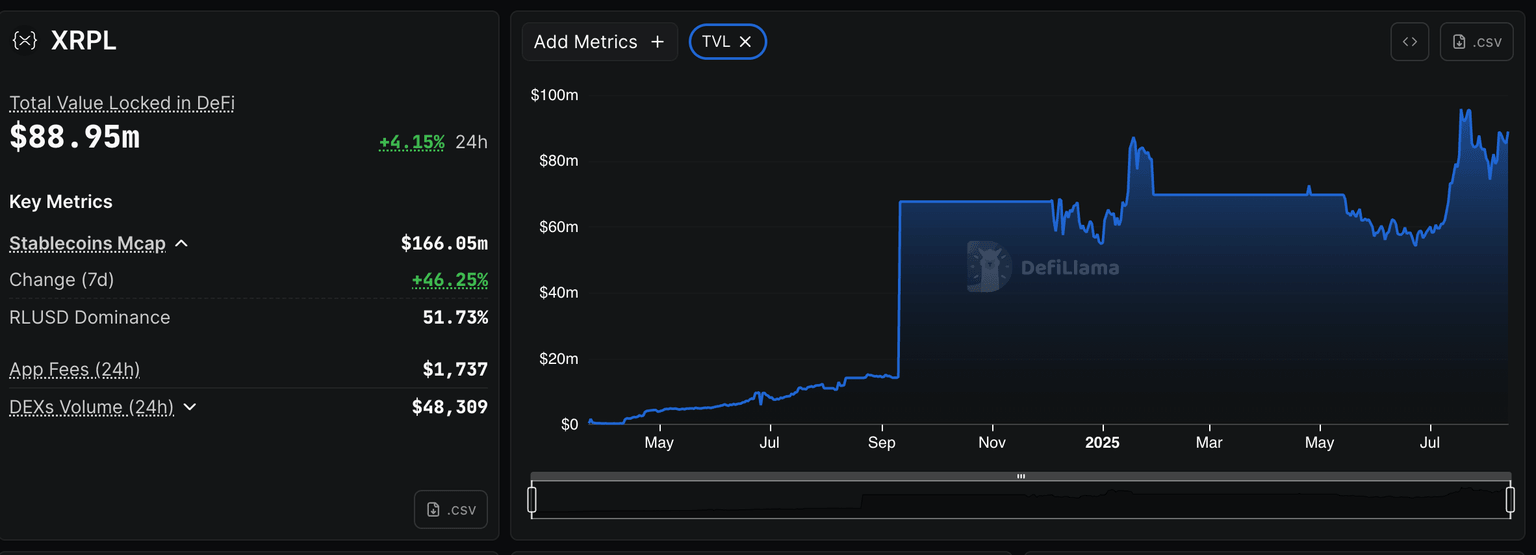

The stablecoin market capitalization on the XRP Ledger (XRPL) has surged over 46% in the past week, averaging $166 million, according to DefiLlama. Ripple USD (RLUSD) is the largest stablecoin on the protocol with 52% dominance.

The total value locked (TVL), which represents the sum of the value of all coins held in smart contracts linked to all the protocols on XRPL, is up 4% in the last 24 hours to $89 million. Should this trend continue, interest in XRP will rise, thus accelerating the tailwind on the token.

XRPL DeFi stats | Source: DefiLlama

Meanwhile, Mesh, a payment network supporting over 50 tokens has announced support for RLUSD. Merchants on the platform are now able to acceptation payment in the US Dollar (USD)-pegged stablecoin while users have the option of paying with RLUSD.

“With Mesh now supporting RLUSD, users can easily deposit, transfer, and pay using the stablecoin, and merchants can accept it at checkout. Since it’s fully backed 1:1 to the U.S. dollar, RLUSD can be relied on by both users and merchants alike for stable, non-volatile payments,” Mesh said in a blog post.

Technical outlook: XRP consolidates ahead of breakout

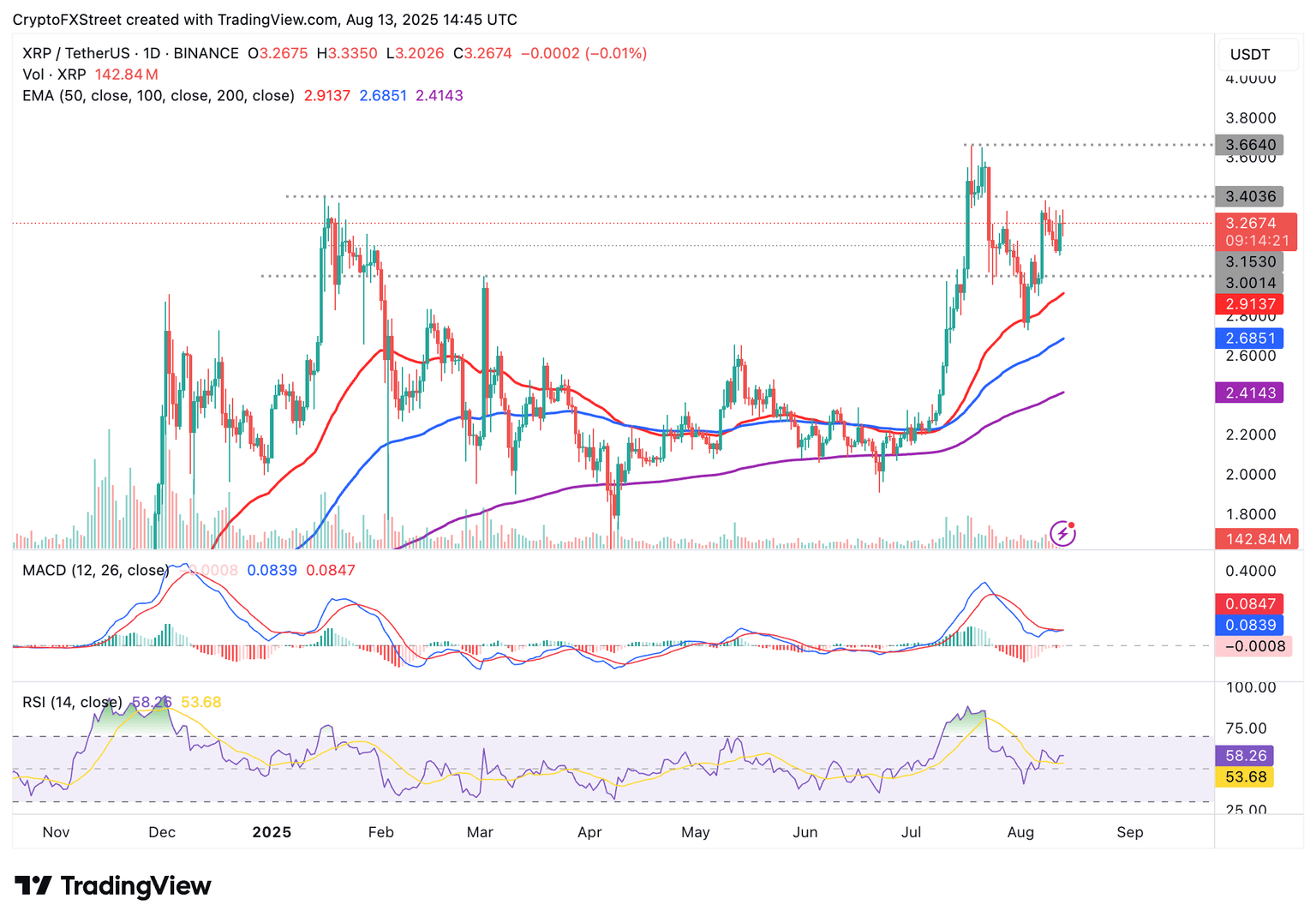

XRP is consolidating near its weekly high as bulls tighten their grip in the broader cryptocurrency market. Trading at $3.26 at the time of writing, XRP shows signs of stability ahead of an anticipated breakout above the short-term hurdle at $3.40, which was tested on Friday, and the record high of $3.66.

The Moving Average Convergence Divergence (MACD) confirms the XRP price's sideways movement, holding slightly above the zero line. Traders should watch for a potential buy signal that would manifest with the blue MACD line crossing above the red signal line.

XRP/USDT daily chart

The Relative Strength Index (RSI) upholds the XRP bullish bias, holding above the midline. Still, traders must be cautious because if the RSI declines below the midline, the path of least resistance will flip downward, increasing the chances of XRP sliding in search of liquidity toward the $3.00 level and the next support at $2.91 provided by the 50-day Exponential Moving Average (EMA).

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren