XRP eyes record high breakout after Ripple and Spanish bank BBVA partnership

- XRP nears breakout to $3.66 record high after reclaiming support $3.00 on Tuesday.

- Ripple partners with Spanish bank BBVA on digital asset custody technology.

- The agreement follows BBVA’s decision to offer crypto-asset trading and custody service for Bitcoin and Ether.

Ripple (XRP) is experiencing a mild intraday uptrend, briefly trading above $3.00 before a slight correction to $2.96 on Tuesday. The uptrend reflects a bullish wave traversing the broader cryptocurrency market, which has seen Bitcoin (BTC) briefly trade above $113,000 while Ethereum (ETH) edges closer to breaching the resistance at $4,400.

Ripple and BBVA collaborate on Bitcoin, Ethereum custody service

Ripple and Spanish Bank BBVA have signed a partnership agreement, which will see the financial institution offer digital asset custody services. BBVA will leverage Ripple Custody, an institutional-grade digital self-custody technology, to offer secure and scalable custody services for tokenized assets, including leading coins such as Bitcoin and Ethereum.

The move comes after the implementation of the European Union’s (EU) Market in Crypto-Assets regulation (MiCA) regulatory framework and rising customer demand for digital asset services.

BBVA recently launched its Bitcoin and Ethereum trading as well as custody services targeting retail customers in Spain. Customers now have direct access to Bitcoin and Ethereum, supported by digital custody services, all within a fully integrated environment.

“We want to make it easier for our retail customers in Spain to invest in crypto-assets, through a simple and easy-to-access digital solution on their cell phone,” Gonzalo Rodríguez, head of retail banking for BBVA Spain, said at the time.

Ripple Custody is gaining momentum as an institutional-grade digital custody technology, ensuring access to crypto and other digital assets while aligning with the strict security, operational, and regulatory requirements in different jurisdictions.

“Ripple’s custody solution allows us to leverage proven and trusted technology that meets the highest security and operational standards, allowing BBVA to directly provide an end-to-end custody service to its customers,” Francisco Maroto, head of digital assets at BBVA, said.

Technical outlook: XRP poised for breakout

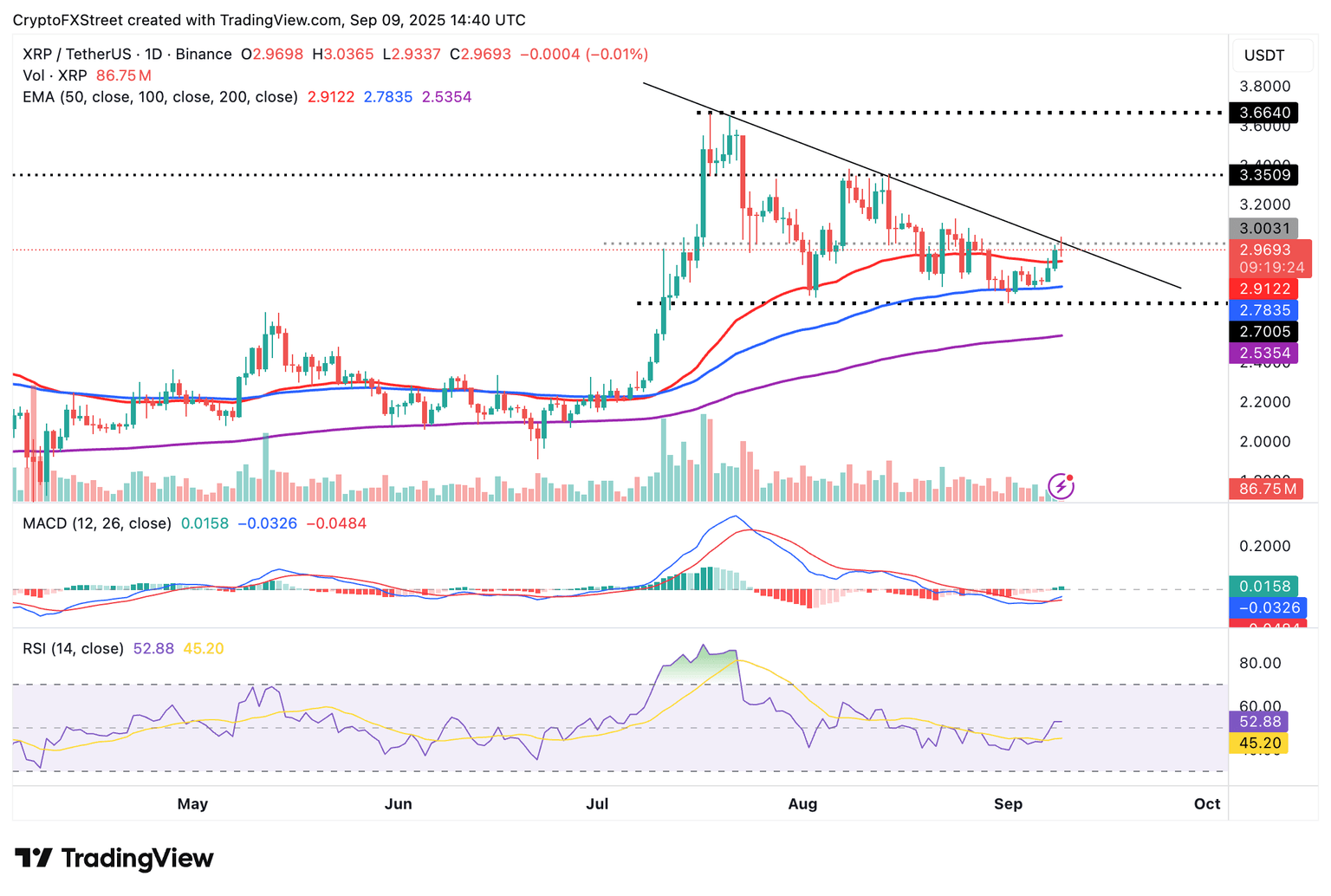

XRP holds above the 50-day Exponential Moving Average (EMA) at $2.91 following a brief move above resistance at $3.00. Its short-term technical structure is bullish, supported by a buy signal from the Moving Average Convergence Divergence (MACD) indicator since Monday.

Traders anticipate a daily close above the descending trendline on the daily chart below, which would affirm XRP’s bullish outlook.

XRP/USDT daily chart

The Relative Strength Index (RSI), which is stabilizing at 52, indicates relatively neutral demand for XRP. A continued move toward overbought territory would mean increasing buying pressure. However, if the RSI drops below the midline, the path of least resistance could shift downward, causing traders to focus on the 100-day EMA support at $2.78 and the 200-day EMA at $2.53.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren