Ripple Price Forecast: XRP at risk of a 50% drop as critical indicator screams sell

- Ripple price is on the verge of a major breakdown if crucial support level fails to hold.

- A key indicator has presented a sell signal on the 3-day chart.

- The number of whales remains in a downtrend, which indicates they are not interested in XRP.

XRP had a wild run in the past month, experiencing a ton of volatility that started with an initial pump orchestrated by the Reddit group named WallStreetBets. The digital asset remains quite volatile and could be poised for a significant drop.

Ripple price on the verge of a 50% fall

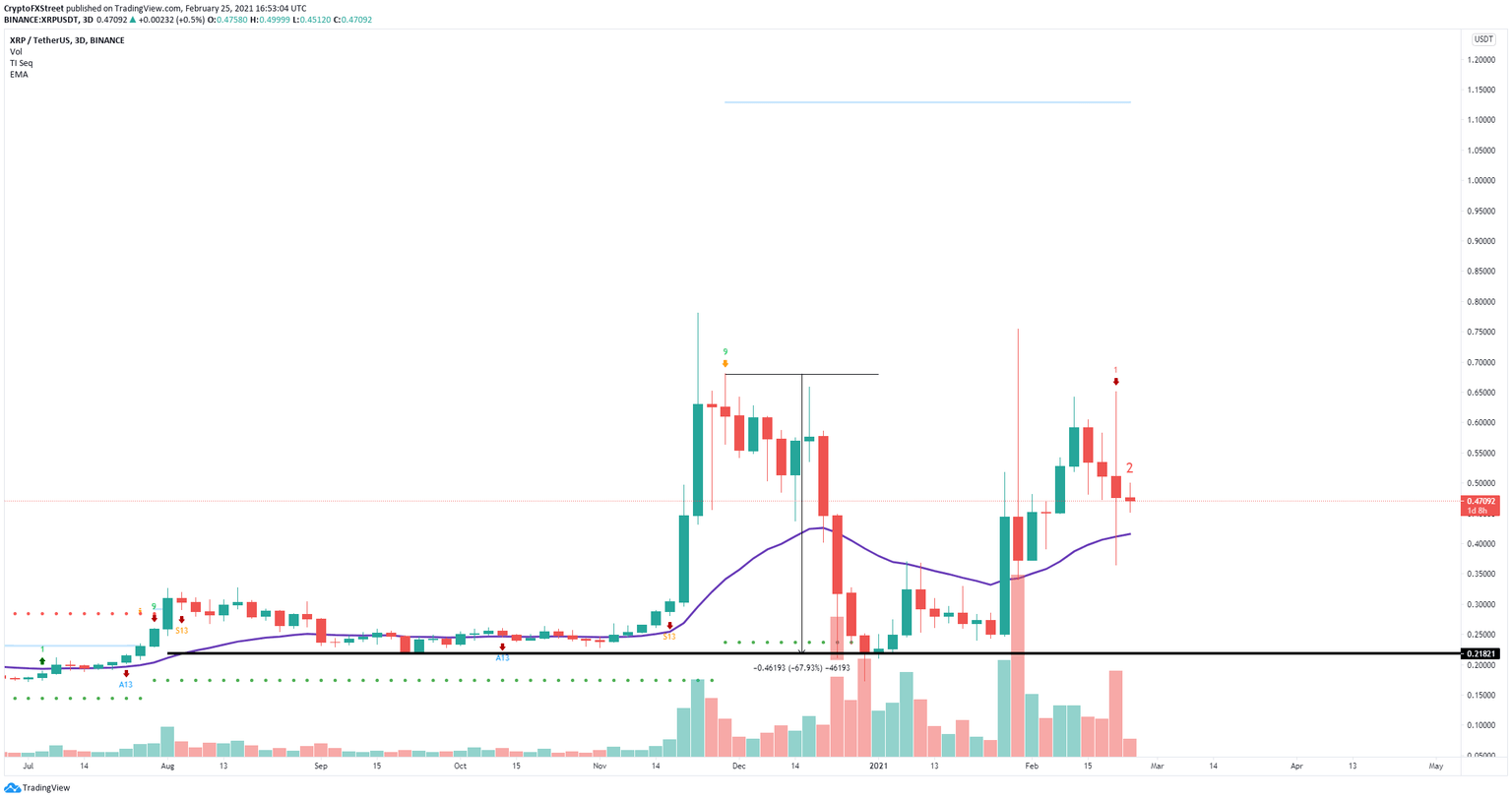

On the 3-day chart, the TD Sequential indicator has presented a sell signal on February 21, which seems to have gotten a significant bearish continuation down to $0.45.

XRP/USD 3-day chart

The last sell signal was presented on November 2020, and Ripple price dropped by more than 70% within the next month. The 26-EMA at $0.415 is acting as a robust support level. If XRP bulls fail to hold this key level, Ripple price can swiftly fall towards $0.218.

XRP Holders Distribution

Additionally, the number of whales holding between 10,000,000 or more XRP coins has decreased in the past three weeks, despite Ripple price falling. It indicates that large holders are not interested in XRP even if the price is lower.

On the other hand, XRP bulls can still invalidate the sell signal by pushing Ripple price above the last high of $0.65. A rebound from the 26-EMA could drive the digital asset towards $0.75.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B17.07.22%2C%252025%2520Feb%2C%25202021%5D-637498687970349624.png&w=1536&q=95)