Ripple Price Analysis: XRP bullish potential to $1.0 remains intact despite recent pullback

- XRP/USD extends U-turn from two-week high to refresh intraday low.

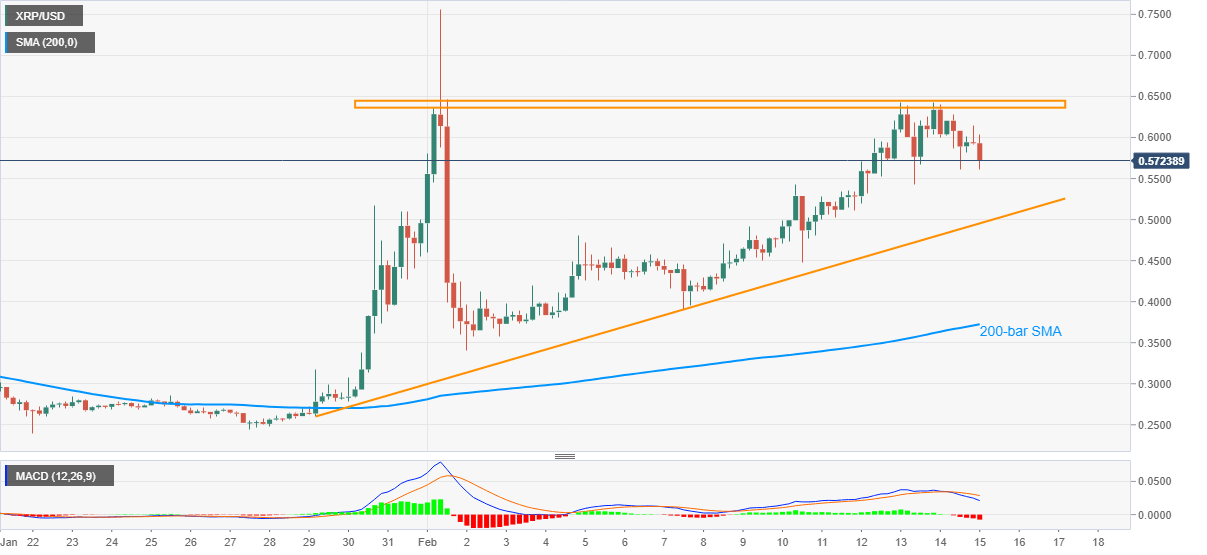

- Sustained trading beyond 200-bar SMA keeps buyers hopeful.

- Short-term sellers may try to confirm short-term ascending triangle amid bearish MACD.

XRP/USD stands on a slippery ground while refreshing the intraday low to $0.5620, down around 5.0% intraday, during early Monday. In doing so, the altcoin extends pullback from the highest levels since February 01 while also respecting multiple tops marked during the last two weeks.

Considering the bearish MACD signals and the cryptocurrency pair’s failures to cross the immediate hurdle, XRP/USD is likely witnessing short-term downside pressure towards an ascending trend line from January 29, at $0.4953 now.

Though, a clear downside break of $0.4953 will confirm the bearish technical pattern, ascending triangle breakdown, while directing ripple sellers toward the 200-bar SMA level of $0.3725.

It should, however, be noted that the XRP/USD bulls may remain optimistic unless the quote keeps the monthly run-up beyond the key SMA. As a result, any clear break below $0.3725 will be detrimental for the bullish trend.

Alternatively, fresh buying can wait for a clear break above $0.6360 wherein December 2020 peak of $0.6577 and late-November 2020 high near $0.6830 will entertain the XRP/USD bulls.

In a case where XRP/USD remains firm above 0.6830, the latest high of $0.7565 and the year 2020 peak surrounding $0.7850 can offer intermediate halts before the $1.0 psychological magnet.

XRP/USD four-hour chart

Trend: Further pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.