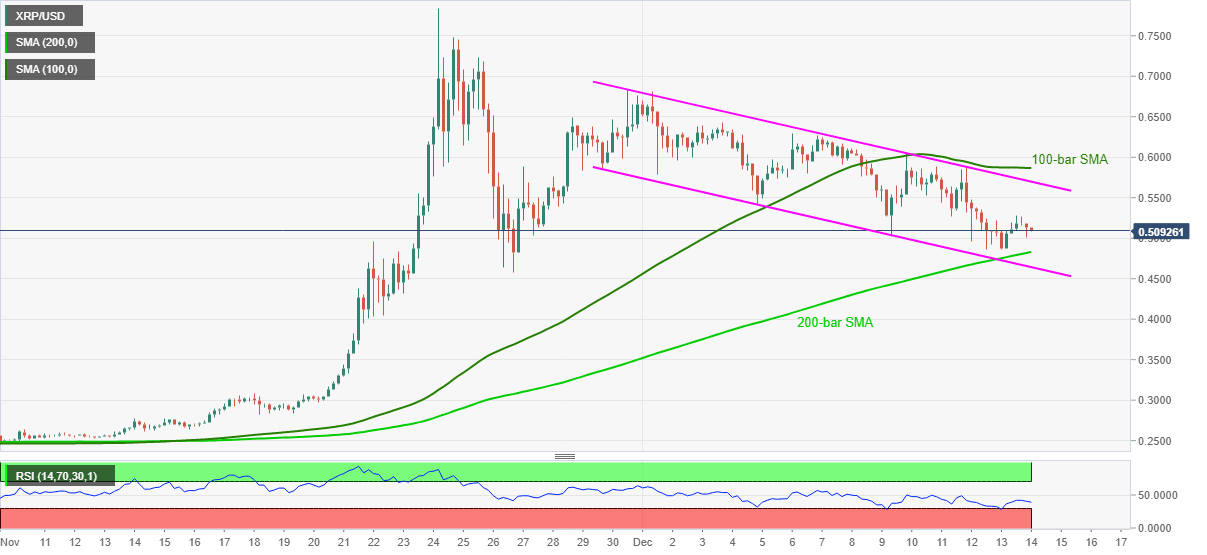

Ripple Price Analysis: XRP bears stay hopeful inside two-week-old falling channel

- XRP/USD extends pullback from 0.5280 inside a bearish chart pattern.

- 200-bar SMA, channel support to test the sellers, 100-bar SMA acts as extra upside barrier.

XRP/USD drops to 0.5092 during the early trading hours of Monday. In doing so, the quote keeps Friday’s downbeat mood inside a descending trend channel formation established since November 29.

With the RSI conditions far from oversold, XRP/USD sellers can keep the reins inside the bearish formation. However, 200-bar SMA and the stated channel’s support, respectively around 0.4830 and 0.4640, will challenge further downside.

In a case where the XRP/USD bears keep dominating past-0.4640, November 26 low around 0.4580 will be the key to watch.

Meanwhile, an upside clearance of the latest top near 0.5280 can recall short-term buyers targeting the channel resistance of 0.5700. Though, any upside break will have to cross the 100-bar SMA level of 0.5865 to convince the XRP/USD bulls.

Overall, the crypto pair is likely to witness further downside but the key supports can offer intermediate bounces to the quote.

XRP/USD four-hour chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.