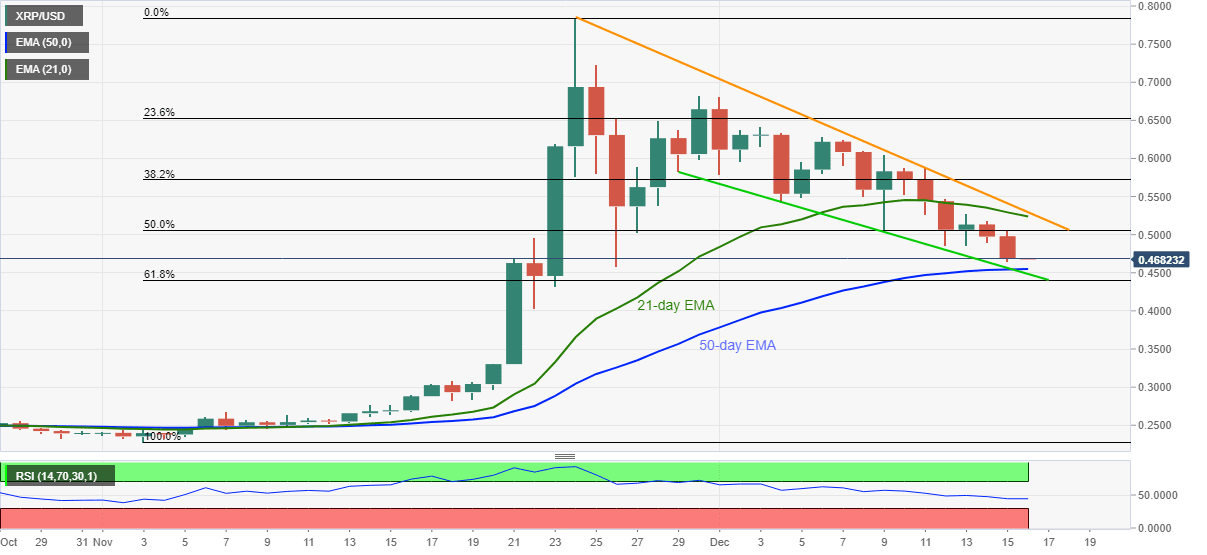

Ripple Price Analysis: XRP bears refresh three week low near 0.4700, eye 50-day EMA

- XRP/USD stays heavy after two-day downside.

- 50-day EMA, 12-day-old support line restricts immediate downside.

- 61.8% Fibonacci retracement adds to the support, bulls need a clear break beyond three-week-long resistance line.

XRP/USD flirts with the lowest since November 26, flashed the previous day, while trading near 0.4700 during early Wednesday. The crypto major refreshed the multi-day low the previous day while extending the downside break of 50% Fibonacci retracement of November’s north-run.

Although receding RSI condition suggests further weakness, a confluence of 50-day EMA and a falling trend line from November 29, around 0.4550/40, will challenge the XRP/USD sellers.

Additionally, 61.8% Fibonacci retracement level of 0.4407 and November 22 low of 0.4035 extra downside filters.

Alternatively, 21-day EMA near 0.5300 will lure the short-term XRP/USD buyers. However, any further upside needs a clear break above the resistance line stretched from November 24, at 0.5410 now.

In a case where the XRP/USD bulls dominate past-0.5410, the 0.6000 threshold can offer an intermediate halt ahead of the monthly peak surrounding 0.6820.

XRP/USD daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.