XRP price approaches technical breakout on institutional adoption boost

- XRP approaches $3.00, increasing alongside the broader crypto market.

- VivoPower has raised $19 million in equity, offered at $6.05 per share, to advance its digital assets treasury strategy.

- VivoPower has operated a dedicated XRP treasury since May.

Ripple (XRP) rises in tandem with the larger cryptocurrency market on Thursday, as investors position themselves in anticipation of a 25-basis-point interest rate cut by the United States (US) Federal Reserve (Fed) in October.

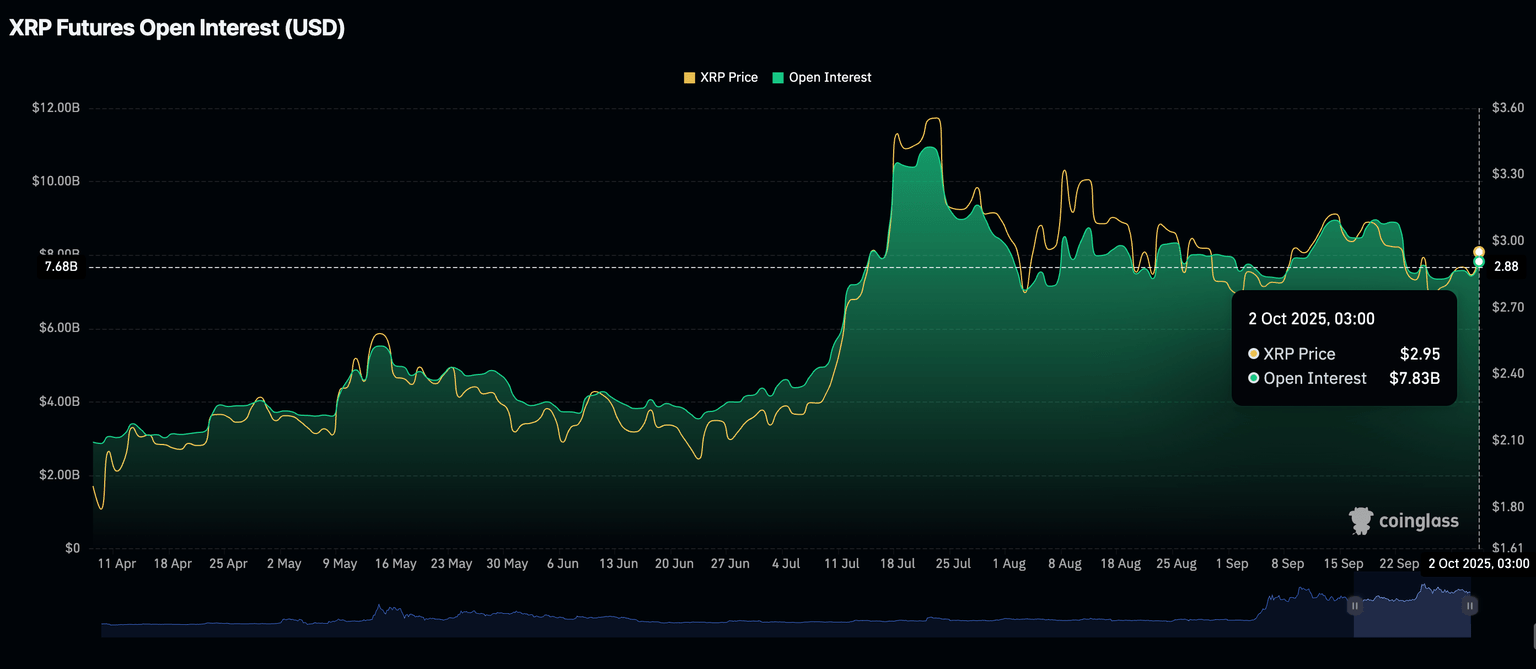

Meanwhile, retail demand for XRP derivatives is also on the rise, with the futures Open Interest (OI) averaging at $7.83 billion, from a monthly low of $7.35 billion on Saturday, according to CoinGlass.

OI represents the notional value of outstanding futures contracts; hence, a persistent increase means demand for futures is gaining traction as traders pile into long positions. Higher OI also implies increased engagement and conviction in XRP’s ability to sustain the uptrend in the short term.

XRP Futures Open Interest | Source: CoinGlass

VivoPower announces $19 million equity raise for digital reserve strategy

VivoPower, the company that debuted its first digital asset treasury strategy in May, valued at $121 million, has announced the completion of an additional $19 million equity raise.

According to the press release on Thursday, the equity raise valued shares at $6.05. The proceeds of the equity raised will be channelled into advancing ViVoPower’s XRP reserve strategy, as well as retiring its debt.

In addition to the digital treasury, ViVoPower emphasized its commitment to contributing to the utility and growth of the XRP Ledger (XRPL) through Decentralized Finance (DeFi) initiatives and blockchain-as-a-service applications (BaaS).

“The Company’s new direction centers on the acquisition, management, and long-term holding of XRP digital assets as part of a diversified digital treasury strategy,” VivoPower stated in the release.

Technical outlook: XRP bulls eye breakout above $3.00

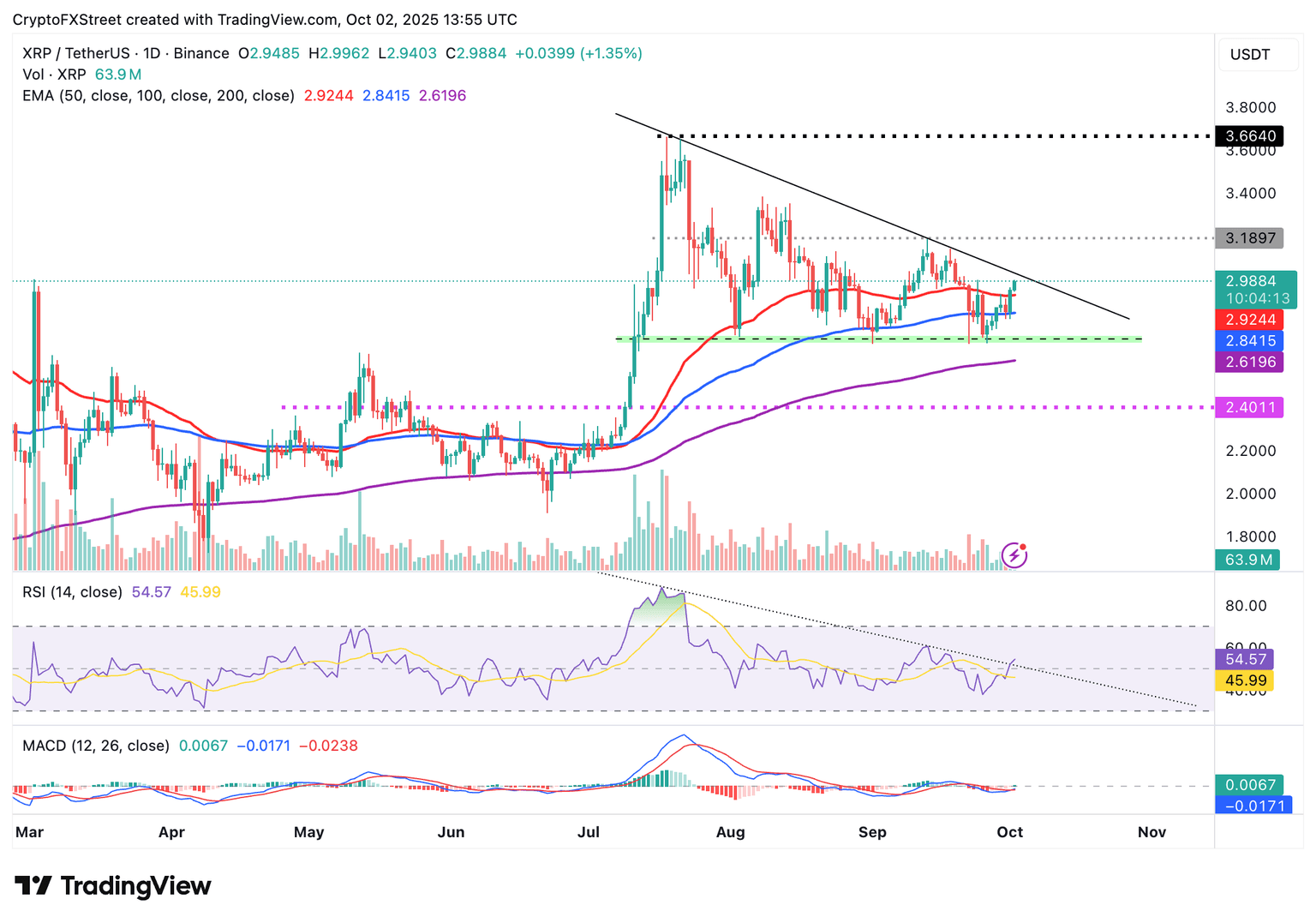

XRP holds above the 50-day Exponential Moving Average (EMA), currently at $2.92. This upside represents marginal intraday gains of slightly more than 1% on Thursday.

Technical indicators, including the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicator, support XRP’s bullish outlook, which could drive the price above $3.00 if risk-on sentiment persists.

The RSI highlights a notable increase to 54, indicating that selling pressure is easing, while the MACD indicator maintains a buy signal triggered on Wednesday, encouraging investors to seek exposure.

XRP/USDT daily chart

Since XRP has been in a general downtrend since mid-July, when it reached an all-time high of $3.66, a break above the descending trendline on the daily chart could mark a bullish turning point.

Still, traders should remain optimistically bullish, as the uptrend could stall due to the previous supply around $3.18. If investors book early profits, contributing to selling pressure, attention could shift to the 50-day EMA at $2.98 and the 100-day EMA at $2.84.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren