Ripple and SEC clash again as lawsuit becomes even more uncertain

- The US Securities & Exchange Commission (SEC) has accused Ripple of harassment in the lawsuit.

- The SEC also asked the judge in the case to block Ripple and its executives from accessing internal records.

- XRP price plummeted in the last several days, losing 55% of its value.

XRP had a major rally at the beginning of April as investors grew confident in the outcome of the SEC lawsuit. However, the entire cryptocurrency market had a significant crash, and the SEC case outcome is not as straightforward as previously thought.

Ripple gets blocked from accessing various internal records

In the latest events concerning the SEC vs. Ripple lawsuit, the US Securities & Exchange Commission has asked the judge to block Ripple and some of its executives from accessing various internal records because they are not related to the case.

According to the SEC, defendants are harassing them and are trying to derail the focus of the case, stating:

It has become evident through the meet-and-confer process that defendants are seeking to ignore the limitations of this court’s order and to mire the SEC in indefinite discovery disputes and, if successful, document review.

Although XRP investors were spooked out, Ripple and its executives getting blocked from several internal records should not affect the outcome of the lawsuit.

XRP price plummets by 50%,buying opportunity looms

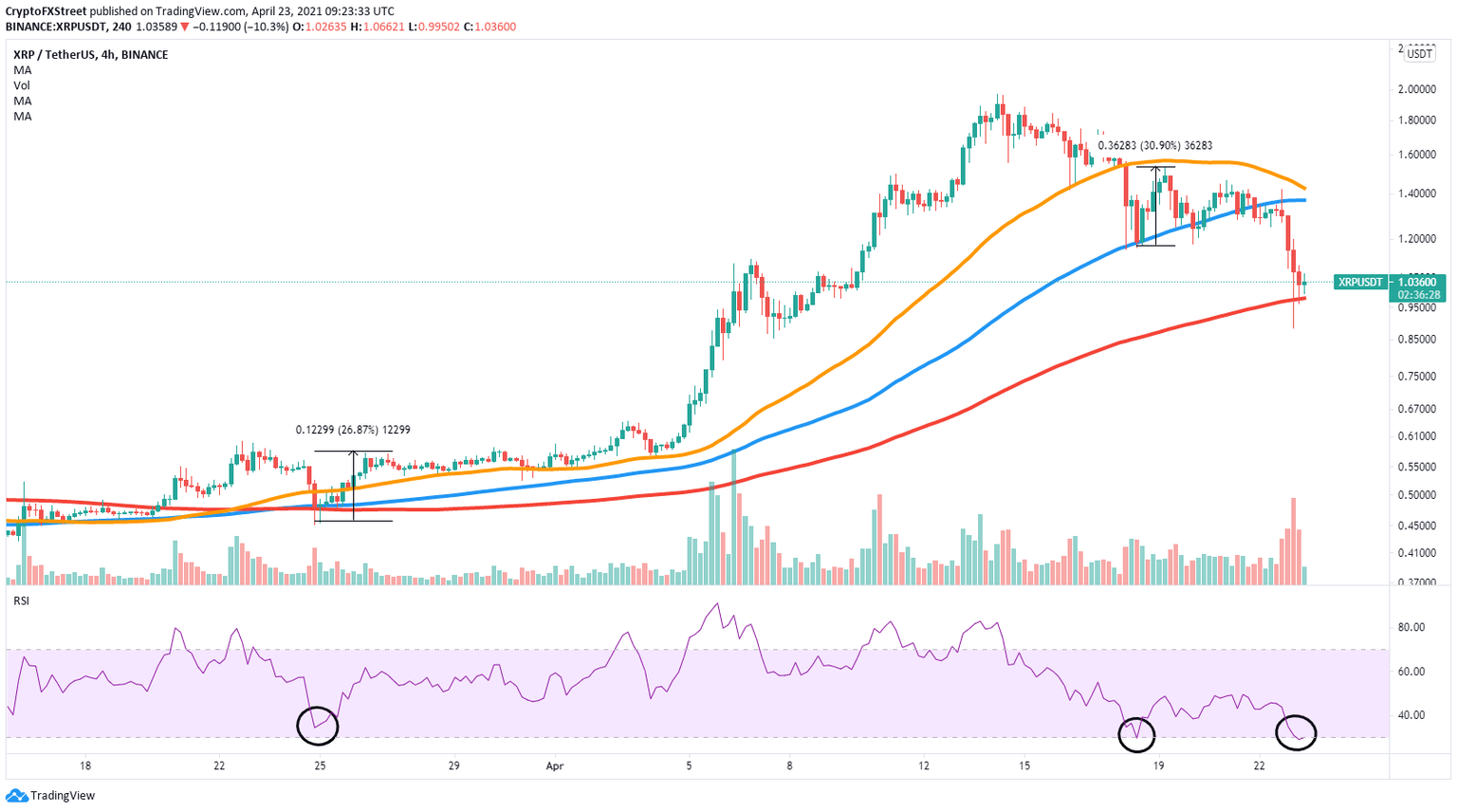

On the Ripple 4-hour chart, the RSI has just reached overextended levels, back below 30, which in the past has proven to be an excellent buying opportunity. The last two times this happened in the last month, XRP price had two 30% rebounds.

XRP/USD 4-hour chart

XRP has also additionally defended the 200 SMA and could be looking for a bounce toward the 50 and the 100 SMA which converge at $1.4.

On the other hand, losing the 200 SMA would be significant as there is almost no support below this point until around $0.60

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.