Ripple advocates limiting SEC’s role in regulating crypto amid ongoing legal battle

- Ripple has put forward a proposal on its recommendations of how cryptocurrencies should be regulated in the United States.

- The cross-border remittances firm highlighted that the SEC’s approach was hostile and only aims to double down on regulation by enforcement.

- Ripple argues that existing legal frameworks could be tailored better to adjust to the cryptocurrency sector.

While the United States Securities & Exchange Commission (SEC) v. Ripple Labs' case continues to battle out, the blockchain firm has released a paper that calls on regulators and lawmakers to create a framework that oversees that cryptocurrency market.

Ripple proposes three-pronged strategy for crypto sector

Ripple Labs has laid out its vision for a regulatory framework for cryptocurrencies in the United States. The proposed guidelines come amid the cross-border remittances company’s ongoing legal battle with the SEC.

The firm behind cryptocurrency XRP has published a set of guidelines that aims to regulate the blockchain and digital asset industry. Its proposal, “a real approach to cryptocurrency regulation” has been created following discussions with regulators and members of Congress.

According to Ripple CEO Brad Garlinghouse, the guidelines put forward by the firm offer advantages compared to a “regulation-by-enforcement approach.” Stuart Alderoty, the firm’s legal counsel added that the SEC’s approach has been hostile and that they have been “doubling down on regulation by enforcement.”

Ripple’s proposal advocates for a three-pronged approach, including the encouragement of public-private collaboration, adapting existing regulatory frameworks and the creation of digital asset innovation sandboxes.

The cross-border remittances firm highlighted the Eliminate Barriers to Innovation Act of 2021, passed in the House of Representatives in Q2 which encouraged regulators to work with digital asset-based entities and market participants when creating a new policy.

Ripple further argues that existing regulatory frameworks could be tailored better to the cryptocurrency industry. Adapting these existing guidelines could provide greater clarity that innovators are looking for and increase consumer protection.

The blockchain firm further supports SEC Commissioner Hester Peirce’s “safe harbor” proposal, as it would allow developers to launch new products without needing to comply with federal securities laws.

Garlinghouse further stated that Ripple’s proposal is designed to address and remedy the specific challenges that exist in the cryptocurrency industry.

While the company’s headquarters currently remain in San Francisco, the firm has previously hinted that it could be moving from the US to a “more crypto-friendly jurisdiction.”

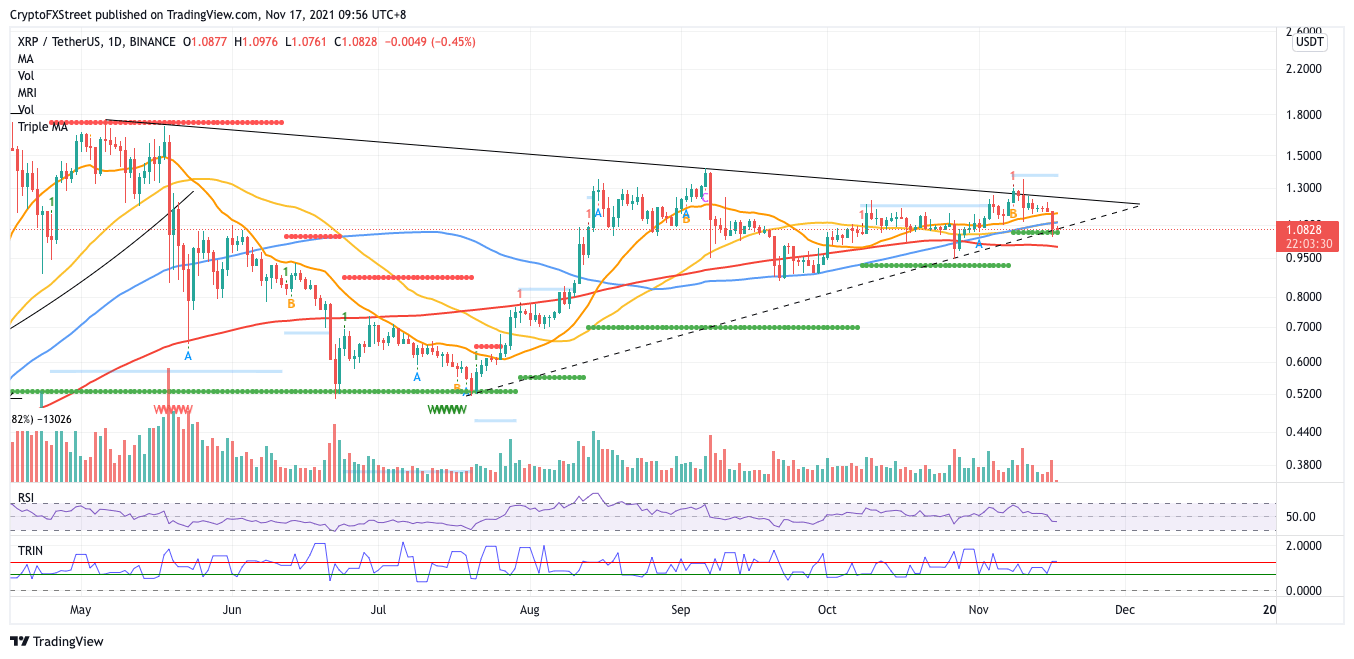

XRP price consolidates but discovers essential foothold

XRP price continues to consolidate within a symmetrical triangle pattern on the daily chart, with little clues to reveal directional intentions. Ripple is approaching the lower boundary of the prevailing chart pattern, an area that seems to hold as steady support amid the token’s retracement.

The first line of defense for XRP price is at $1.07, where the ascending trend line and support line given by the Momentum Reversal Indicator (MRI) meet. Lower targets are not expected as Ripple would be slicing below a multi-month trend line support that formed since Q3 this year.

However, if selling pressure increases, Ripple could drop further toward the 200-day Simple Moving Average (SMA) at $1.00.

XRP/USDT daily chart

Should the bulls gather strength to reverse the period of sluggish performance, XRP price would be confronted with its first obstacle at the 50- and 100-day SMA at $1.11, then at the 21-day SMA at $1.15. Until Ripple is able to break above the topside trend line of the governing technical pattern at $1.23, the token could continue to trend sideways.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.