‘Revenge of the ETH’ – Is Ethereum’s 9% jump the start of something big?

After being drastically outperformed by Solana (SOL $106) for the past three months, the price of Ether (ETH $2,392) suddenly spiked 8.9% in the last 24 hours, leading to some bullish sentiment returning to Ethereum.

“The revenge of the ETH is starting,” wrote Jordi Alexander, the chief investment officer at Selini Capital, in a Dec. 27 post to X (formerly Twitter).

'The Revenge of The $ETH' is starting.

— Jordi Alexander (@gametheorizing) December 27, 2023

Everything has lined up, it will now run for weeks.

Alts ran; Saylor fired his clip; Eth ETF next up.

The risk/reward on Ether is so compelling here, that I see a liquidity black hole now forming in January.

"Imajin being bearish ETH".. pic.twitter.com/pfy9MJ9Em5

Alexander pointed to a recent rally across several altcoins and Michael Saylor buying another $615 million worth of Bitcoin on Dec. 26 as solid foundations for ETH to make an upside move over the next few weeks.

“The risk/reward on Ether is so compelling here, that I see a liquidity black hole now forming in January,” he added.

Pseudonymous trader Pentoshi added his bullish target for Ether, posting a semi-cryptic chart to X with an approximate price target of $3,485.

$ETH

— Pentoshi euroPeng (@Pentosh1) December 27, 2023

slowly, then all at once. It's building https://t.co/ReE3TGLtBz pic.twitter.com/554SAPk4PC

“Slowly, then all at once,” he added.

The conflict between community members from the Solana and Ethereum ecosystems reached a fever pitch over the last few weeks.

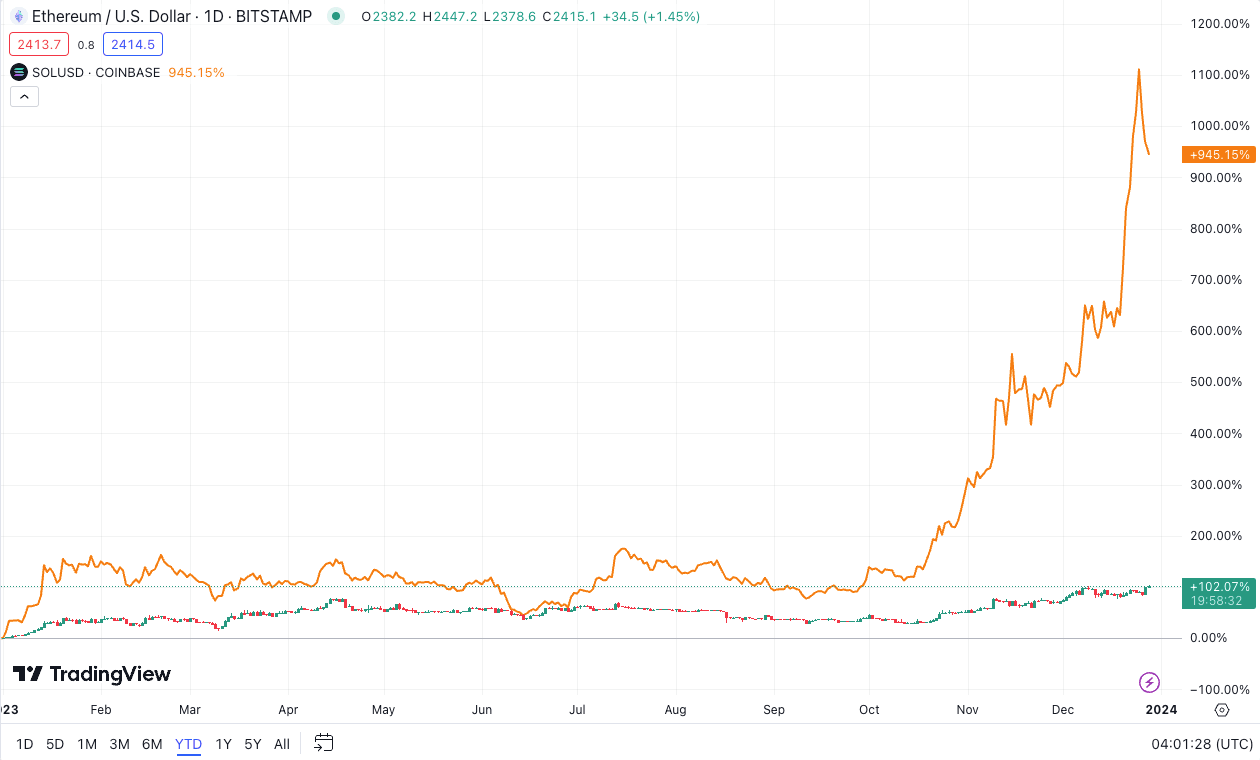

While Ether has gained 102% year-to-date, its price performance has been dwarfed by that of Solana, which has posted a whopping 951% gain since the beginning of this year, per TradingView data.

Ether’s 102% gain was dwarfed by Solana’s staggering 951% year-to-date rally. Source: TradingView

This outsized price performance, along with a tidal wave of relative on-chain activity, led many to assert that the networks’ lower fees and faster settlement times made it the superior blockchain when compared to Ethereum.

On the other hand, Ethereum backers claimed that the networks’ architecture was more suited to larger entities conducting business on-chain and pointed to layer-2 scaling solutions like Optimism and Arbitrum as examples of cheaper fees on ETH.

Respectfully this is false.@arbitrum is just as cheap and fast as Solana in every meaningful way.@0xPolygonLabs is insanely cheap and fast with more mature ecosystem. Plus has the single best vision for scaling in the space with their unified liquidity.@base is cheap and… https://t.co/upwhlHbfxx

— Jesse Eckel (@Jesseeckel) December 24, 2023

At the time of publication, ETH is changing hands for $2,417, up 8.9% in the last 24 hours. Meanwhile, Solana has taken a breather from its recent upward tear, trading at $104 — a loss of 4.2% in the last day.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.